Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

Former President Donald Trump defeated Vice President Kamala Harris and will become the nation’s 47th President.

Trump has proposed measures with potentially significant economic ramifications, though many details are not yet clearly defined.

Equity markets initially responded positively to the result, while bond retreated.

A long and often divisive Presidential election season ended with a victory for Republican former President Donald Trump over Democratic Vice President Kamala Harris. President-elect Trump has proposed several specific economic policies that could represent a notable change from current and past policies. However, details have yet to be spelled out, and it is too early to determine the potential capital market impact that could result.

Along with Trump’s victory, Republicans regained control of the U.S. Senate. With several races still in flux, it is not clear the size of the Republican majority. Control of the House, which was narrowly in Republican hands prior to the election, is still uncertain, though Republicans may be on a path to retaining control. This would provide Trump with the support of both houses of Congress, likely enabling fewer obstacles in passing his legislative priorities, like what President Joe Biden enjoyed in the first two years of his current term.

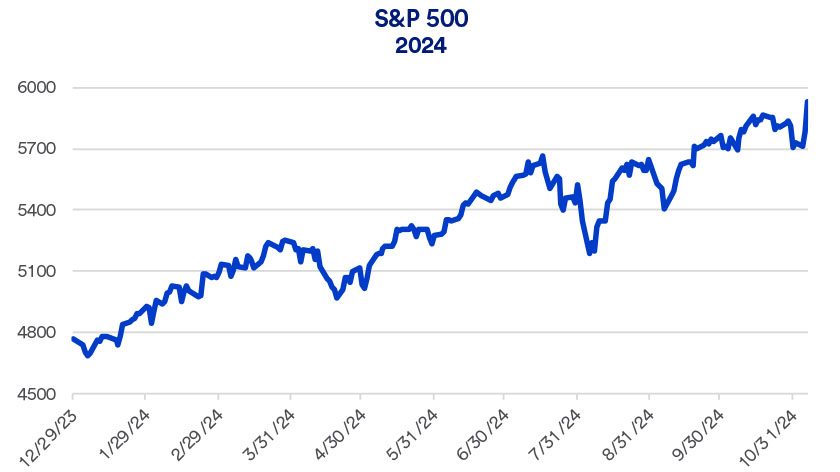

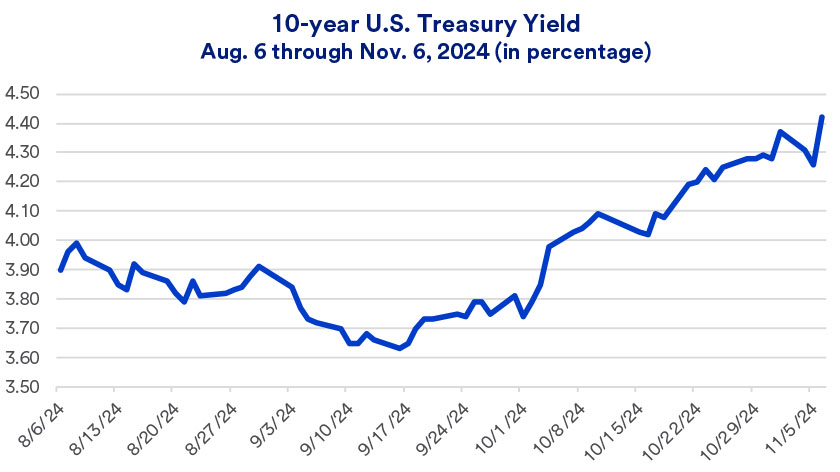

The day following the election, the U.S. stock market generated dramatic gains, with the Dow Jones Industrial Average, S&P 500 and NASDAQ Composite Indexes reaching new record highs. At the same time, fixed income markets lost ground, with the yield on 10-year U.S. Treasury securities rising significantly on the first, post-election trading day.

Stocks continued what has been a second consecutive year of strong gains. In apparent response to the election outcome, small company stocks and Energy and Financial sectors performed particularly well. This is what Rob Haworth, senior investment strategy director for U.S. Bank Asset Management, anticipated. “Our expectation has been that much of the election outcome’s impact will be seen at the sector level, with certain industries benefiting from new policies, while others may face more headwinds.”

Bonds, which gained ground as interest rates fell between April and September, have experienced changing fortunes since mid-September, when the Federal Reserve (Fed), for the first time since 2020, cut short-term interest rates. Signs of continued economic strength tempered investor bond demand, driving yields higher in the weeks since the Fed’s rate cut.

While the 2024 campaign and election results may dominate headlines, the investment environment, for the most part, is driven by other factors. “For now, the market is more focused on third quarter corporate earnings,” according to Haworth. Based on the latest economic data, consumer spending remains strong. This, combined with modest business investment spending, serve as the foundation for a favorable earnings environment. The U.S. economy continues to grow, expanding in the third quarter at an annualized rate of 2.8%, nearly matching the second quarter’s 3.0% increase.1 Markets are also keeping a close eye on Fed monetary policy, anticipating 0.25% rate cuts in both November and December. That would bring the federal funds target rate (the rate charged by banks for overnight lending to each other) 1% lower than where it stood prior to September 2024.

Tax policy is likely to be a key focus of the new administration. Most provisions of the Tax Cut & Jobs Act (TCJA), are set to expire at the end of 2025. When passed in 2017, the package represented the first Trump administration’s most prominent domestic policy initiative. If the provisions are extended, keeping tax rates lower, as former President Trump proposes, along with other prospective tax cuts his campaign put forward, lower tax collections could ignite new federal budget deficit concerns, also potentially driving bond yields higher. To this point, the Trump campaign hasn’t specified how to address deficit concerns, although it has raised the possibility of additional tariffs on imported goods as a method of boosting revenues (more on tariffs below).2

Trump recently proposed cutting the corporate tax rate to 20%, and as low as 15% for companies manufacturing products in the U.S.3 He also stated support for eliminating taxes on tips for service and hospitality workers.4 Trump also supports tax deductible automobile loans, an end to taxes on Social Security benefits, and other tax breaks.3

Tariffs, particularly those placed on Chinese goods, have emerged as a significant policy matter. During his term as President, Trump implemented tariffs, and President Biden continued most of them and recently added more tariffs, reflecting a move away from previous free trade policies. Trump has discussed the possibility of implementing far more sweeping tariffs, but details remain sketchy.

An old saying goes that “elections have consequences.” But how do those results influence capital markets? And what are the potential ramifications for you as an investor? To better address this question, U.S. Bank investment strategists studied market data from the past 75 years and identified patterns that repeated themselves during election cycles.

The analysis points to minimal impact on financial market performance in the medium to long term based on potential election outcomes. The data also shows that market returns are typically more dependent on economic and inflation trends rather than election results.

How have election outcomes affected market performance in the past and how might potential scenarios play out in the 2024 presidential election?

U.S. Bank investment strategists reviewed market data going back to 1948. Using average 3-month returns following each election outcome—and comparing those with the average 3-month return during the full analysis history—strategists calculated the statistical significance of the relationship between political control and market performance using a calculation called a t-statistic, or t-test.

A t-test determines whether one group of variables (in this case, the political composition of the White House and Congress) has a measurable effect on another variable (in this case, average three-month S&P 500* returns during the control period).

The analysis also looked at the exact periods of time when parties took control of different branches of government (rather than starting from election dates themselves), although this analysis resulted in similar outputs and conclusions.

Results of the analysis contradict conventional wisdom that a Republican or Democratic “sweep” of the presidency and Congress is most likely to cause market disruption. In fact, historically there has not been a statistically significant relationship between single-party control of both the White House and Congress and market performance.

Rather, the data uncovered three divided-government outcomes with a statistically significant relationship to market performance.

Two scenarios corresponded to positive absolute returns in excess of long-term average returns:

One scenario corresponded to positive absolute returns modestly below long-term average:

While investors may closely monitor election results for their potential effect on stock market performance, it’s important to recognize that other factors that may have greater impact on their portfolios. The historical data suggests that economic and inflation trends, more so than election outcomes, tend to have a stronger, more consistent relationship with market returns.

The historical data suggests that economic and inflation trends, more so than election outcomes, tend to have a stronger, more consistent relationship with market returns.

In general, rising economic growth and falling inflation have been associated with returns that are considered above long-term averages, while falling growth and rising inflation have corresponded to positive but below average market returns. For investors, staying focused on these patterns is probably more insightful than potential election outcomes when it comes to forecasting market performance.

When looking at midterm election data (elections held in between presidential elections), U.S. Bank investment strategists found that the S&P 500 consistently outperformed in the year after midterms compared with non-midterm years. Just like presidential elections, which party controls Congress generally was not a factor in projecting overall equity market performance.

These equity and bond market trends were consistent over time unless there was a dramatic disruption. Read more about how midterm elections affect the stock market.

While the analysis doesn’t point to elections having a meaningful medium-to-long-term market impact, they could affect individual sectors and industries. Different election outcomes have the potential to affect proposed policies, regulations, or global conflicts.

The following are policy issues to monitor throughout the presidential nomination and election process:

In any election, there’s also the potential for delays in verifying an election victor, particularly in closely contested races. At the presidential level, this occurred in both the 2000 election (settled with a Supreme Court verdict) and 2020 election (when the result was challenged by one candidate). In these instances, ensuing delays could lead to more uncertain election outcomes, in which case riskier asset classes might decline until clarity emerges.

As is the case outside of election season, investors are well served to focus most on factors such as economic growth, interest rates, inflation and corporate earnings when making portfolio decisions. Having a well-established plan designed around your needs and financial objectives can help you maintain a consistent strategy that avoids emotional reaction to events like election outcomes.

Talk with your wealth management professional to explore how best to position your portfolio, consistent with your long-term plan.

Stay up to date on the latest market news and activity.

*The Standard & Poor’s 500 (S&P 500) is a well-known, broad capitalization weighted index of U.S. stocks. The index has one of the longest histories amongst U.S. indexes.

Historically, there does not seem to be a clear connection between the outcome of a Presidential election and capital market performance in the medium- to long-term. Two scenarios corresponded to positive absolute returns in excess of long-term average returns – Democratic control of the White House and full Republican control of Congress; or Democratic control of the White House and split control of the Senate and House. One scenario corresponded to positive absolute returns modestly below long-term averages – Republican control of the White House and full Democratic control of Congress.

There doesn’t seem to be a direct link between the occurrence of an election year and market outcomes. The stock market, as measured by the S&P 500, was down in three of the 16 presidential election years since 1960. It experienced negative returns in seven of the 16 non-presidential election years. Typically, other factors such as the state of the economy, interest rates, inflation and corporate profits have a greater bearing on broad stock market performance.

It’s important for investors to avoid anticipating election outcomes, the potential impact of those projected outcomes, or actual election results. Investors should discuss their current portfolio positioning with their financial professional, and determine, by assessing all factors, including changes in personal circumstances and economic and market developments, whether any changes are appropriate.

Investors are increasingly focused on how the administration’s policy changes are impacting markets and the economy.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.