Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

In March, 10-year Treasury bond yields flattened out after declining more than 0.50% earlier this year.

Yields today remain above last year’s lows.

Declining 10-year Treasury yields could reflect softening growth expectations for the economy.

10-year Treasury yields are relatively flat today after declining earlier this year. In March, 10-year Treasury yields generally moved in a narrow range between 4.16% and 4.34%. They remain well above 2024’s lowest 3.63%.1

“Given the current 10-year Treasury yield, bond markets seem to be priced for an environment with 2% Gross Domestic Product growth and 2%-plus inflation,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “If we see 10-year yields move significantly lower, the question is whether it reflects declining inflation or slowing growth expectations.” Haworth notes that based on recent survey data, consumers anticipate higher inflation, so falling inflation is not likely to help reduce bond yields. A recent University of Michigan survey shows consumers anticipate inflation, currently at 2.8%,2 jumping to 4.9% over the coming year.3

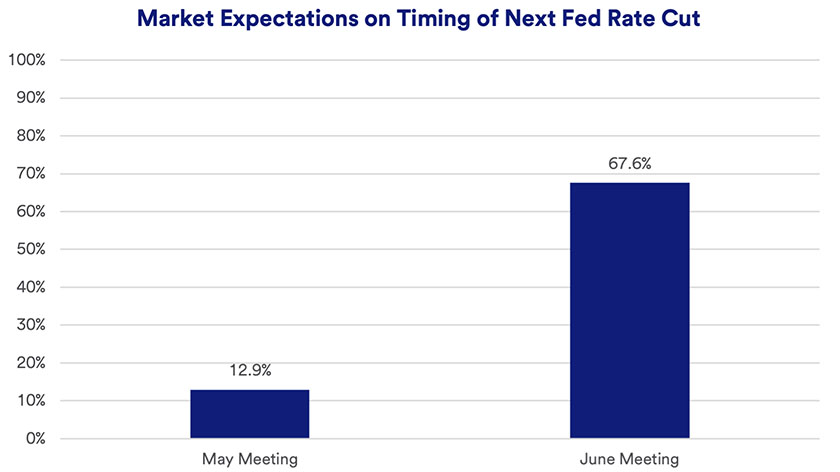

At its March meeting, the policymaking Federal Open Market Committee (FOMC) chose to maintain the short-term federal funds target rate in a range of 4.25% to 4.50%. In late 2025, the Fed cut rates three times but has held the line since December. Markets don’t anticipate another Fed rate cut before June 2025.4

In March, the FOMC decided to trim its reduction of U.S. Treasury security holdings. For months, the Fed reduced those positions by $25 billion per month. Beginning in April, it will only reduce Treasury holdings by $5 billion monthly. “With the Fed tempering quantitative tightening, it may put a little less pressure on Treasuries, but the Fed is maintaining a lot of pressure on mortgage rates.” The Fed continues monthly $35 billion reductions in its mortgage-backed securities holdings, which total more than $2 trillion.

Congressional actions may also affect fixed income markets. In early 2025, the federal government reached its debt ceiling limit, meaning no new debt is being issued. Instead, the Treasury Department is pursuing “extraordinary measures” to maintain government operations. This includes spending down much of the $800 million the Treasury holds in general account funds. “This likely contributed to the recent interest rate decline,” says Haworth. “The Treasury can’t issue debt due to the debt ceiling, and they are adding liquidity to the market, leading investors to put more money to work in Treasuries.” That created a more favorable supply-demand balance, reducing bond yields.

In the coming months, Congress must address the debt ceiling issue. Once Congressional action again suspends the debt ceiling, new Treasury debt can be issued, boosting supply. “The effect could be to reverse the whole process, and the temporary circumstances helping bond yields decline would no longer exist,” says Haworth. However, bond yield trends are driven by a variety of market forces.

Early 2025’s decline in long-term yields occurred as short-term rates remained relatively stable. This comes in the wake of the Federal Reserve’s (Fed’s) most recent interest rate stance, holding the line on the short-term fed funds rate. In recent weeks, the 3-month Treasury yield held near 4.35%. In early March, the 10-year Treasury yield dropped to 4.22%. As a result, the yield curve again modestly inverted, but not as dramatically as was the case from late 2022 until late 2024. Today’s yield curve, the yield generated by Treasury bills from 3-month maturities to 30-year maturities, is virtually flat.1 “This reflects that for the time being, the Fed’s interest rate moves lag the market’s earlier expectations,” says Haworth.

“Given the current 10-year Treasury yield, the bond market seems to be priced for an environment with 2% Gross Domestic Product growth and 2%-plus inflation. If we see 10-year yields move significantly lower, the question is whether it reflects declining inflation expectations or declining growth expectations.”

Rob Haworth, senior investment strategy director, U.S. Bank Asset Management

How should investors approach fixed income markets today? Investors may wish to modestly underweight their fixed income position within portfolios that mix stocks, bonds and real assets. “This isn’t specifically an indication of bond market weakness but reflects our expectations that economic conditions should support continued earnings growth, creating more attractive forward opportunities in equities,” says Haworth.

Nevertheless, Haworth says that within their bond portfolios, investors should explore the potential of more complex credits. For example, investors in high tax brackets may benefit by extending durations slightly longer and including an allocation to high-yield municipal bonds as a way to supplement their investment grade municipal bond portfolio. Some non-taxable investors should consider diversifying into structured credits, non-government agency issued residential mortgage-backed securities, commercial mortgage-backed securities and collateralized loan obligations. “Yield spreads between these types of credits and U.S. Treasuries remain relatively wide and their fundamentals look good,” says Haworth. For certain eligible investors, insurance-linked securities may offer a way to capture differentiated cash flow with low correlation to other portfolio factors.

Talk to your wealth professional for more information about how to position your fixed income investments as part of a diversified portfolio.

The bond market is often reflective of other key factors that affect the economy. If the economy grows rapidly and inflation is rising, bond yields tend to follow suit. Bond yields also tend to rise if the Federal Reserve, the nation’s central bank, raises the short-term interest rate it controls, the federal funds target rate. Inflation in the U.S. began surging in 2021, and by early 2022, the Federal Reserve began raising rates. As a result, yields across the bond market also rose. In contrast, if the economy is slowing or maintaining modest growth with low inflation, bond yields tend to decline or remain low. This was the situation for an extended period prior to 2022. In mid-2024, bond yields began to decline again, and, in September 2024, the Fed began what was expected to be a series of rate cuts. Since the Fed’s initial rate cut, long-term bond yields moved higher, likely reflecting the market’s recognition of the strong U.S. economy.

Bond prices move in inverse fashion to interest rates, reflecting an important bond investing consideration known as interest rate risk. If bond yields decline, the value of bonds already on the market move higher. If bond yields rise, existing bonds lose value. The change in bond values only relates to a bond’s price on the open market, meaning if the bond is sold before maturity, the seller will obtain a higher or lower price for the bond compared to its face value, depending on current interest rates. Bondholders will generally be repaid the face value of a bond if it is held to maturity, regardless of the interest rate environment.

There are advantages to purchasing bonds after interest rates have risen. Along with generating a larger income stream, such bonds may be subject to less interest rate risk, as there may be a reduced chance of rates moving significantly higher from current levels. However, even when interest rates are low, bonds can still be appropriate for inclusion in a well-diversified portfolio.

As interest rates change, learn what the ripple effects across capital markets may mean for investors.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.