Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

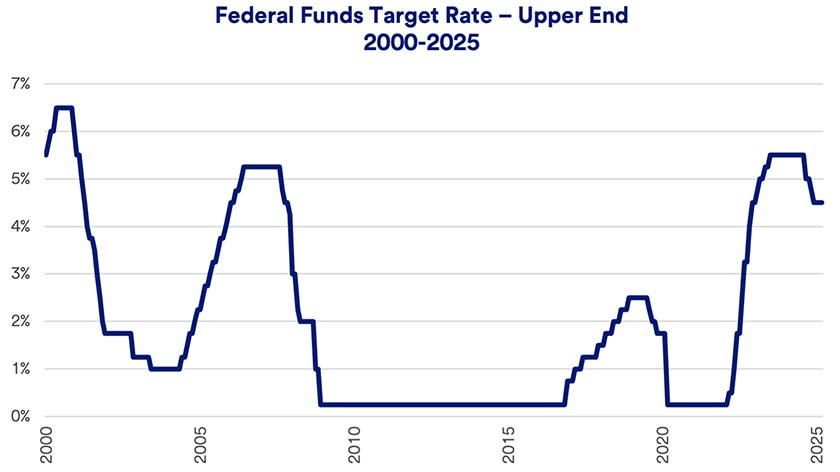

At its March 2025 meeting, the Federal Reserve (Fed) held interest rates steady at 4.25% to 4.50%.

The FOMC still projects two interest rate cuts later this year.

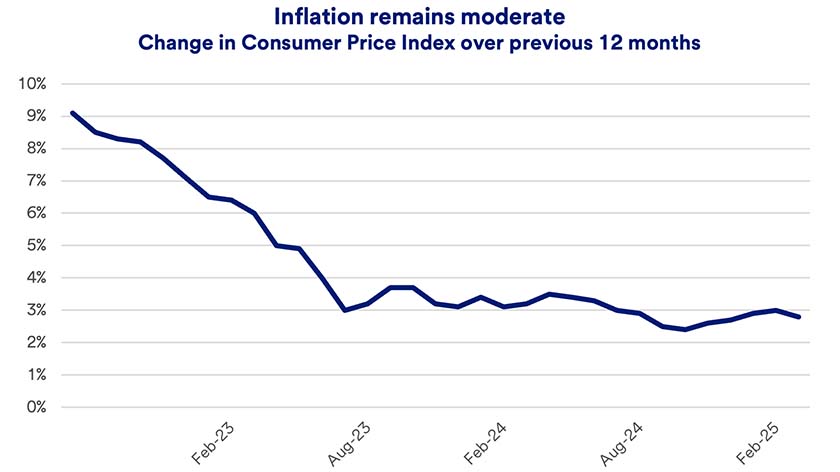

The Fed raised its inflation expectations while lowering economic growth projections.

While acknowledging growing economic risks, the Federal Reserve (Fed) is holding the line on the federal funds target rate it controls. At its March 2025 meeting, Federal Open Market Committee (FOMC) members, as expected, maintained its target interest rate range of 4.25% to 4.50%. The Fed last cut rates in December 2024. FOMC members still project two potential 2025 rate cuts.

The federal funds target rate is the rate banks charge each other for overnight lending. It also tends to influence consumer rates such as home mortgages and automobile loans. The Fed’s interest rate policy decision comes in an environment of increasing economic uncertainty. Investors are assessing potential economic implications as President Donald Trump pursues new policy initiatives, including stepped-up tariffs with major U.S. trading partners. In its statement following March’s FOMC meeting, the Fed stated, “Uncertainty around the economic outlook has increased.”1

FOMC members issued a Summary of Economic Projections and their expectations about where significant measures of the economy will stand by year’s end. Among the most notable projections2 were:

While these changes aren’t dramatic, they raise concerns about current and future trends. Inflation risks are always a key Fed consideration. In comments following the March 19 meeting, Fed Chair Jerome Powell said, “Some near-term measures of inflation expectations have recently moved up…consumers and businesses are mentioning tariffs as a driving factor.”3 President Trump has already raised tariffs on some foreign goods the U.S. imports, with more tariffs potentially on the horizon.

Powell noted that Trump administration policies on trade, immigration, fiscal policy, and deregulation “will matter for the economy and the path of monetary policy.” But the Fed wasn’t yet ready to act. Said Powell, “We think that the right thing to do is wait here for greater clarity about what the economy is doing.”3

Investors may have to wait until the Fed’s next two meetings, in May and June 2025, to see more definitive action. “The Fed is in a wait-and-see mode, waiting on the data,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “It started cutting rates last year based on rising unemployment and slower inflation. Until we get major data changes like that, they’ll remain extremely cautious about cutting interest rates further.”

Along with interest rate actions, another Fed monetary policy tool is its balance sheet of financial assets. During recent challenging economic periods, the Fed tried to boost economic activity by purchasing fixed income assets, such as U.S. government bonds and mortgage-backed securities. The Fed’s market participation helped moderate interest rates. The balance sheet of assets grew to just under $9 trillion in 2022. Since that time, the Fed has reduced its balance sheet, now down to less than $6.8 trillion.4

Notably after its March meeting, the FOMC announced plans to slow the decline in its securities holdings. Beginning in April, it will start reducing Treasury securities holdings by just $5 billion per month, rather than the previous $25 billion per month. The Fed will continue monthly $35 billion reductions in its mortgage-backed securities holdings, a policy that’s been in place for some time.

“The Fed started cutting rates last year based on rising unemployment and slower inflation. Until we get major data changes like that, they’ll remain extremely cautious about cutting interest rates further.”

Rob Haworth, senior investment strategist, U.S. Bank Asset Management

In 2024’s summer and fall months, the Fed’s focus shifted from an emphasis on tempering inflation to one of maintaining labor market health. While inflation is down considerably from a 9.1% 2022 peak, in 2024, the rate of decline leveled off.5 Inflation is not an immediate concern, though the Fed’s radar appears to be zeroed in on the potential that tariffs could push prices higher.

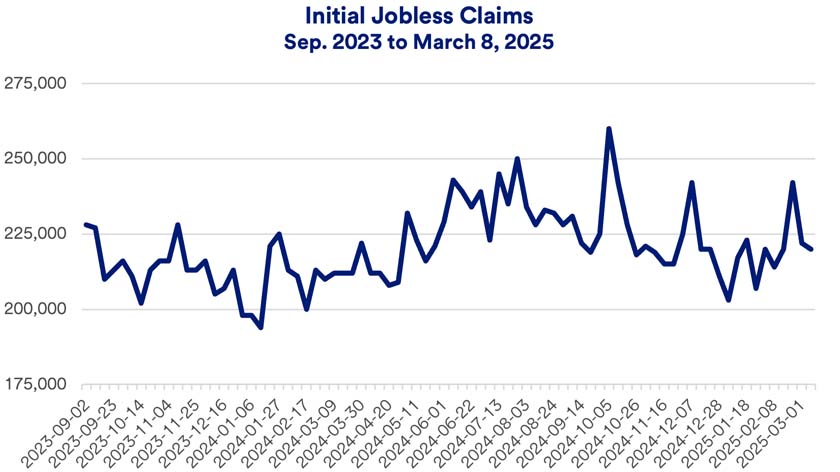

In recent months, the labor market appeared to stabilize. The nation’s unemployment rate stands at 4.1%.5 Markets pay close attention to the weekly initial jobless claims report, considered a real-time source of labor market trends. The most recent data shows initial jobless claims remaining in a comfortable range.6 “Concern would grow if weekly initial claims exceed 300,000,” says Haworth.

With the spotlight on Trump administration policy shifts and their potential economic ramifications, the Fed, in its “wait-and-see” mode, is not driving the market today as it was before. Still, Fed actions and projections remain a critical market focus. So far in 2025, equity markets are experiencing heightened volatility, apparently in reaction to White House policy announcements.

At the same time, bond markets are performing better than U.S. stocks. 10-year U.S. Treasury note yields are significantly lower than in recent months. However, they remain elevated by recent historical standards.

The policymaking FOMC next meets in mid-May 2025. Markets expect the Fed to hold the line on rates at that meeting, with a higher likelihood of a rate cut at its June 2025 meeting.7

As the Fed continues to address monetary policy, be sure to consult with your financial professional and review portfolio positioning. Explore whether changes might be appropriate given your goals, time horizon and feelings toward risk in today’s evolving interest rate environment.

Monetary policy is controlled by a nation’s central bank, which in the United States, is the Federal Reserve (Fed). The Fed’s management of monetary policy can have a significant impact on the shape of the nation’s economy. Congress’ mandate for the Fed is to maintain price stability (manage inflation); promote maximum sustainable employment (low unemployment); and provide for moderate, long-term interest rates. Fed monetary policy influences the cost of many forms of consumer debt such as mortgages, credit cards and automobile loans.

The Fed is the nation’s central bank, and perhaps the most influential financial institution in the world. The central governing board of the Federal Reserve reports to Congress, with the chair of the Federal Reserve appointed by the President. There are also 12 regional federal reserve banks that are set up like private corporations.

The Federal Reserve’s Federal Open Market Committee (FOMC) sets a target interest rate policy for the federal funds rate. This is the rate at which commercial banks borrow and lend excess reserves to other banks on an overnight basis. The fed funds rate is raised or lowered usually to help impact underlying economic conditions. For example, in 2022, as inflation surged, the FOMC began raising interest rates to make borrowing more expensive and slow economic activity. That strategy was designed to ease pricing pressures and reduce the inflation rate. In periods when the economy is slow or in a recession, the Fed tends to lower rates to try to stimulate economic activity and help the economy expand again.

As interest rates change, learn what the ripple effects across capital markets may mean for investors.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.