Digital tools

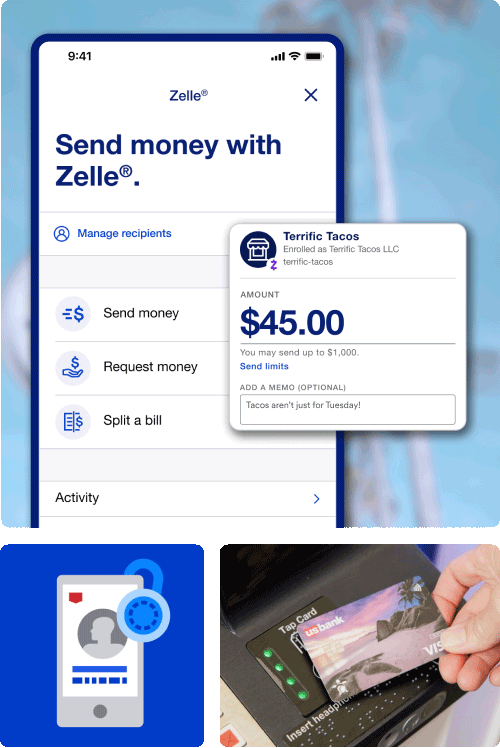

Bank on the go with the U.S. Bank Mobile App and online banking. Transfer funds between accounts with ease. Use bill pay, track spending, send money with Zelle®, set savings goals and more.

Easily access and manage funds, track everyday expenses, set up direct deposit and more.

Store funds toward your short- and long-term goals while earning interest.

Earn interest on funds you won’t need for a self-selected period of time.

![]()

Our experienced bankers are available online or in-person to answer questions or help you with your account.

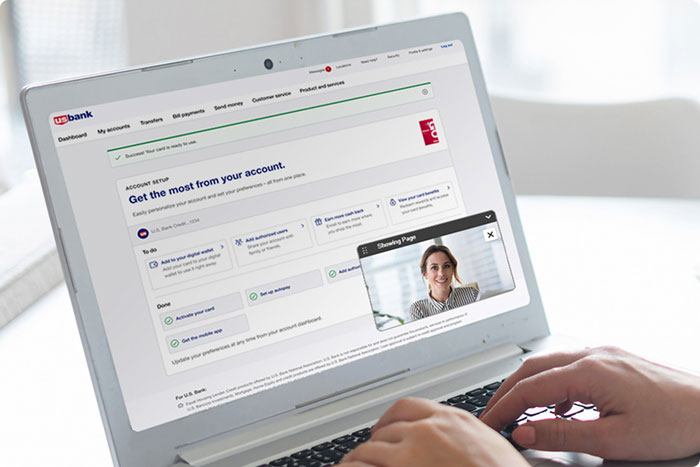

Start a cobrowse session from anywhere for immediate assistance. With cobrowse, a banker can securely see your screen and help you set up your account, manage your money and much more. It’s just one click to start a cobrowse session, and one click to end the session whenever you like.

With resources and exclusive benefits, we’re committed to helping military veterans achieve their financial goals.

Open a bank account as a young adult under 24 for benefits tailored to you, along with tools and services to help you organize your finances.

Whether you need account support or you're unsure of your next move, our goals coaches can help. You’ll meet with your coach online or in person and discuss your goals, financial or not – best of all, it’s on us.

You can open a bank account online or in a branch if you’re 18 years or older and a legal U.S. resident. You’ll need:

With a bank account, you can:

Accessing your account online is safe and secure. Our industry-leading encryption and security features are always on to protect you and your information.

A minor must open an account with an adult.

If you want to open a Bank Smartly Checking® account with a minor (aged 13 through 17), you can open the account online or in a branch, as long as you’re both present. If opening the account online, you’ll need the teen’s Social Security number, income (if any) and a few other details.

If the minor is under the age of 13, or if you’d like to open any other type of account with a minor aside from the above, you’ll need to make an appointment and go to a branch together.

You can apply for an individual account if you’re 18 years or older and a legal U.S. resident. You’ll need to provide your Social Security number and a valid, government-issued photo ID.

A checking account is typically used for day-to-day spending and paying your bills. You can easily access your money with a debit card, ATM or check. A savings account is meant to help you grow your money or set aside funds for a big purchase. It’s often beneficial to have both as part of your financial plan.

Our do-it-yourself automated setup makes it easy and takes just a few minutes in the Mobile App or online banking. You can do this for paychecks, Social Security benefits and more. (For other federal benefits, visit godirect.gov.) Your direct deposit update is seamless, secure and verified in real time.

Whether you’re opening a new account or want to add a beneficiary to an existing one, we’ll need to know the type of account (checking, savings, CD) and some personal information about your beneficiary. You’ll also need to provide written confirmation of your request via signature.

Head to a U.S. Bank branch or call 800-USBANKS (872-2657) to get started. We accept relay calls.

You can find your account number and routing number through any of the following: