Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

Trump administration efforts to halt the Russia-Ukraine war opened the door to negotiations, but with limited progress.

The Israel-Hamas cease fire appears to have ended.

Increasingly, the U.S. seems to be assuming a more unilateral posture on the world stage.

In early 2025, the more than three-year-old Russia-Ukraine war has returned to the headlines, due in large part to the Trump administration's efforts to help broker a cease-fire agreement. U.S. officials have met separately with representatives of Ukraine and Russia to lay out terms. The two sides have agreed on limited cease-fire terms affecting energy resources and Black Sea shipping. However, fighting continues, and the path to a peaceful resolution remains unclear.

The world’s other prominent hotspot, the Middle East, has seen a cease-fire agreement between Israel and Hamas break down. Israel has again begun military operations in Gaza, while Hamas continues holding a number of Israeli hostages captured in October 2023. The two sides appear to be far from a settlement.

While both conflicts remain on the global radar, neither seems to be having a significant capital markets impact, according to Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “In the current environment, issues like tariffs are much more the market’s focus than military conflicts.”

With Russia and several Middle Eastern countries among the world’s largest oil producers, investors often are concerned about how conflicts potentially impact oil prices. The start of the Russia-Ukraine war, highlighted by Western countries confronting Russia with economic sanctions, led to a temporary uptick in oil prices, exceeding $100/barrel. In recent months, prices have remained in a trading range between $65 and $90/barrel.1

“Oil prices this year have not created many concerns,” says Haworth. He notes that more issues may arise if Middle East tensions flare up. The U.S. and Britain are carrying out airstrikes in Yemen, seeking to hit Houthi rebel targets. Iran reportedly backs Houthis and their efforts to disrupt Red Sea shipping lanes. “There’s a question of how much pressure we put on Iran and whether that could impact oil markets,” says Haworth.

In the meantime, global oil production appears to be on the upswing. The Organization of Petroleum Exporting Countries-plus (OPEC+) previously cut supplies to force oil prices higher. The cartel reportedly plans to boost production in April and again in May. “OPEC countries are concerned about clawing back market share they lost when they cut production,” says Haworth.

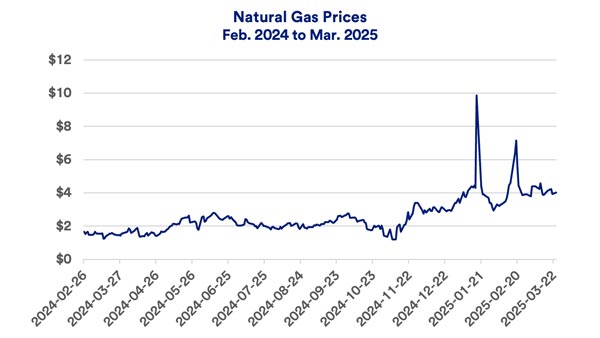

Natural gas is another global energy consideration. “In contrast to oil markets, natural gas prices are up, driven in part by exacerbated European-Russian tensions,” says Haworth. Before the war, Europe was heavily reliant on Russian natural gas. “Higher natural gas prices could be a more persistent concern for Europe’s economy,” Haworth notes. “While easing Russian-Ukrainian tensions might be helpful, it’s doubtful there would be an immediate return to normalcy in terms of Europe again becoming dependent on Russian natural gas.”

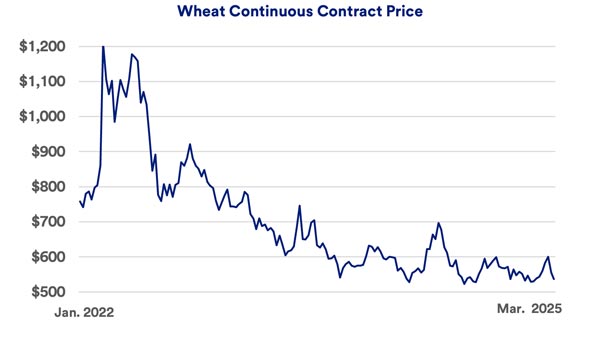

Both Russia and Ukraine are major global suppliers of wheat and other agricultural products. This contributed to a temporary spike in agricultural commodity prices in the early weeks following Russia’s invasion of Ukraine in February 2022. Wheat prices, for example, have trended lower in recent months.3

Haworth notes that given the duration of the Russia-Ukraine conflict, commodity markets have generally adjusted to changing conditions. “The only durable negative impact has been on German chemical companies, which are suffering due to the lack of cheap natural gas.”

“In the current environment, issues like tariffs are much more the market’s focus than military conflicts."

Rob Haworth, senior investment strategy director, U.S. Bank Asset Management

Europe is likely to feel more impact than is the case domestically. “In the U.S., we’re a bit more insulated from the economic fallout from the conflicts compared to other parts of the world,” says Tom Hainlin, national investment strategist for U.S. Bank Asset Management.

A sudden trade war, prompted by President Trump’s implementation of a new set of tariffs on major trading partners, is another factor potentially affecting commodity prices. “The impact may be most felt on our grain trade,” says Haworth. The Trump administration has implemented 25% tariffs on steel and aluminum imports. Other tariff plans are in the works, with more details pending.

The investment landscape appeared to change as President Trump assumed office and began implementing significant changes affecting many existing policies and government operations. Increasing global tensions tied to trade tensions and ongoing geopolitical conflicts contributed to investor uncertainty about near-term economic impacts. As a result, markets started the year exhibiting increased volatility. The full impact of these changes is difficult to predict. “Capital markets won’t deal in guesses about what may come,” says Haworth. “They’ll wait for something more concrete.”

Nevertheless, investors may wish to consider an overweight position in equities, including representation from global markets. In 2025’s first quarter, global markets outperformed U.S. markets, reversing the previous two years’ performance trends.

Be sure to talk to your financial professional about what steps may be most appropriate for your circumstances.

The most prominent conflicts in the world today are found in two geographic regions. One is Eastern Europe, where Russia and Ukraine have been involved in a war for more than three years following Russia’s invasion of Ukraine. Recent comments and actions by the Trump administration may have altered the landscape of the current battle, as parties for both sides debate ways of pausing or ending the military engagement. The second, more recent conflict, followed a surprise October 2023 attack by Hamas against Israel. In short order, Israel responded with massive bombardments and by sending ground troops into the Gaza Strip. The war’s reach has extended into Lebanon, as Israel seeks to attack a Hezbollah stronghold, and Hezbollah has responded with rocket attacks into Israel. In January 2025, a cease-fire was implemented, though the future direction of the conflict remains uncertain.

To this point, the economic impact of these conflicts were mostly regional in nature. In the immediate aftermath of Russia’s invasion of Ukraine in early 2022, oil prices soared. That reflected efforts by western nations to place economic sanctions on Russia, which is a major oil supplier. However, that price spike was short-lived. Oil prices rose at the start of the Israeli-Hamas conflict, but haven’t spiked to previous levels, and recently dropped below $70/barrel.1 However, changes in the geopolitical landscape may be underway as the Trump administration approaches both the Russia-Ukraine and Israel-Hamas conflicts differently than did the Biden administration. In addition, President Trump has implemented significant new tariffs, reversing decades of generally free global trade, another factor that has the world economy on edge.

Stocks suffered through a bear market in 2022, though much of that was attributed to a changing economic environment. Most notably, the decision by the Federal Reserve to raise short-term interest rates beginning in early 2022 altered the investment landscape. Since late 2022, stocks recovered considerable ground. “The risk of an Israel-Iran conflict does raise greater concerns that Middle East military action could become more widespread,” says Rob Haworth, senior investment strategy director at U.S. Bank Asset Management. However, Haworth notes that the global conflicts currently aren’t having a significant impact on investor sentiment.

Investors are increasingly focused on how the administration’s policy changes are impacting markets and the economy.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.