Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

The Federal Reserve maintained its policy interest rate range of 4.25%-4.50%, with the intent of bringing inflation closer to its 2% target.

The committee slightly downgraded its economic outlook for 2025, projecting slower economic growth and modestly higher inflation due largely to tariff policy uncertainty.

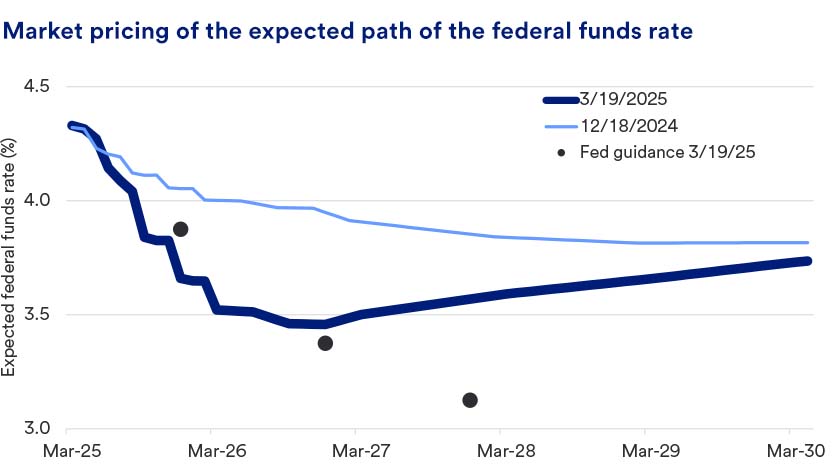

The Fed’s median projections call for 0.50% of rate cuts in 2025, which generally aligns with bond market pricing.

The Federal Reserve (Fed) held its target federal funds interest rate in a range of 4.25%-4.50% following its regularly scheduled two-day meeting, a widely anticipated outcome. The Fed has held rates steady since previously cutting rates by a total of 1% in 2024’s second half. The updated official statement said, “Uncertainty around the economic outlook has increased,” which Fed Chair Jerome Powell later qualified as relating to tariff policy uncertainty. The Fed’s projections indicate a somewhat downgraded economic outlook for the next few years but maintained expectations for two additional rate cuts this year. The Fed continues to believe policy rates should remain somewhat restrictive for now to dampen inflation.

Many investors are worried about potential tariffs’ impact on both inflation and economic growth prospects. These concerns translate into gloomier economic forecasts and consumer and business surveys but have yet to show in economic data. During Powell’s press conference, he highlighted that the Fed’s higher inflation projection derives from tariff uncertainty, but longer-term inflation expectations remain well-anchored.

Aggressive policy tightening in the form of rate hikes between early 2022 to mid-2023 helped drive the Core Personal Consumption Expenditures Price Index (Core PCE), the Fed’s preferred inflation gauge, from a peak above 5.5% year-over-year in 2022 to 2.6% in January.

The Fed announced it will slow the pace of reduction in its $6.4 trillion bond holdings next month. The bond holdings peaked at $8.5 trillion in 2022, and the Fed has allowed them to run off, or mature without replacement, up to $25 billion per month of Treasuries and $35 billion per month of mortgage bonds. On April 1, this pace will fall to $5 billion per month in Treasuries, while remaining at $35 billion per month in mortgage bonds. Slower or no balance sheet runoff improves market liquidity, which refers to the amount of money readily available to buy goods, services and financial assets in an economy. Strong liquidity can also provide a cushion against unforeseen financial market shocks, and liquidity measures remain constructive for now.

Stock prices rose Wednesday, with most gains coming after the Fed’s communication began. Large stocks, represented by the S&P 500, rose 1.08% while small stocks rose 1.57%. Treasury bond yields fell for most maturities. Ten-year Treasury bond yields dropped 0.04% to 4.25%, while two-year Treasury yields dropped 0.06% to 3.98%.

Monetary policy, defined as central bank target interest rates, remains restrictive in most geographies around the globe. However, policy has been easing overall, with central bank rate cuts exceeding hikes starting in the fourth quarter of 2023 and continuing through the current quarter. Several other major central banks in addition to the Fed have already or are expected to cut rates this year, including the Bank of England, European Central Bank, Bank of Canada and the Reserve Bank of Australia.

We retain a positive outlook for diversified portfolios due to solid corporate profits, constructive economic growth trajectories and our expectation for further global monetary condition easing. We remain cognizant of deteriorating surveys from consumers and businesses with respect to inflation and growth prospects. However, we favor awaiting evidence that a potentially gloomier outlook has translated to weaker economic activity. We have previously noted the weak historical relationship between surveys and future economic activity, as Powell noted during the press conference today. In aggregate, consumer activity remains near normal historical levels, though driven disproportionately by wealthier cohorts. Moderating medium-term inflation trends remain clear but are vulnerable to potential tariff implementation. We will keep you informed of our views as new data becomes available and as we update our assessment of market conditions.

As always, we value your trust and are here to help in any way we can.

This information represents the opinion of U.S. Bank. The views are subject to change at any time based on market or other conditions and are current as of the date indicated on the materials. This is not intended to be a forecast of future events or guarantee of future results. It is not intended to provide specific advice or to be construed as an offering of securities or recommendation to invest. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Not a representation or solicitation or an offer to sell/buy any security. Investors should consult with their investment professional for advice concerning their particular situation. The factual information provided has been obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. U.S. Bank is not affiliated or associated with any organizations mentioned.

Based on our strategic approach to creating diversified portfolios, guidelines are in place concerning the construction of portfolios and how investments should be allocated to specific asset classes based on client goals, objectives and tolerance for risk. Not all recommended asset classes will be suitable for every portfolio. Diversification and asset allocation do not guarantee returns or protect against losses.

Past performance is no guarantee of future results. All performance data, while obtained from sources deemed to be reliable, are not guaranteed for accuracy. Indexes shown are unmanaged and are not available for direct investment. The S&P 500 Index consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. The Consumer Price Index is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. It is one of the most frequently used statistics for identifying periods of inflation or deflation. The Personal Consumption Expenditures (PCE) Price Index is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. It is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

Equity securities are subject to stock market fluctuations that occur in response to economic and business developments. International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments. Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility. Investing in fixed income securities are subject to various risks, including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Investment in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. Investments in high yield bonds offer the potential for high current income and attractive total return but involve certain risks. Changes in economic conditions or other circumstances may adversely affect a bond issuer's ability to make principal and interest payments. The municipal bond market is volatile and can be significantly affected by adverse tax, legislative or political changes and the financial condition of the issues of municipal securities. Interest rate increases can cause the price of a bond to decrease. Income on municipal bonds is free from federal taxes but may be subject to the federal alternative minimum tax (AMT), state and local taxes. There are special risks associated with investments in real assets such as commodities and real estate securities. For commodities, risks may include market price fluctuations, regulatory changes, interest rate changes, credit risk, economic changes and the impact of adverse political or financial factors. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates and risks related to renting properties (such as rental defaults).

U.S. Bank and its representatives do not provide tax or legal advice. Your tax and financial situation is unique. You should consult your tax and/or legal advisor for advice and information concerning your particular situation.

Persistently elevated inflation continues to vex consumers and policymakers alike.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.