Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

As the new tariffs era comes into sharper focus, China’s economy appears to face headwinds across a range of issues including trade with the U.S. and sluggish economic growth.

China’s government is implementing new stimulus plans to promote domestic consumer demand as an economic growth driver.

In 2024’s second half, Chinese stocks rallied but have since retreated from peak levels.

As global trade tensions rise, China finds its economy facing more potential headwinds on top of existing challenges. As one of America’s largest trading partners, China is now caught up in expanded tariff orders President Donald Trump handed down in February and March. Most Chinese goods exported to the U.S. are now subject to 20% tariffs that weren’t in effect before Trump returned to the White House in January.

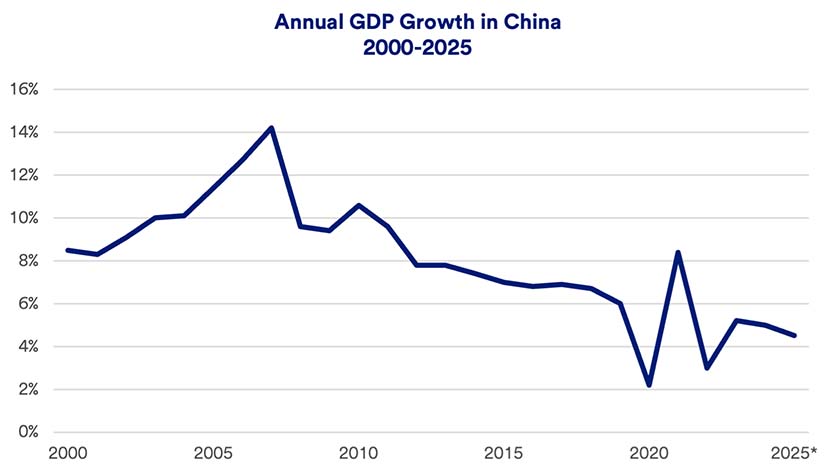

Higher tariffs for goods shipped to America aren’t the only economic challenge facing the country. While in 2024 China managed to generate 5% Gross Domestic Product (GDP) growth, significant domestic issues have kept China’s growth rate more subdued than in the past.

China continues to struggle with meeting its domestic consumer spending goals, and economic growth remains below peak levels.

“China is trying to spur more consumer-led growth rather than investment-led growth, but with limited success so far,” says Rob Haworth, senior investment strategy director for U.S. Bank Asset Management. “While China isn’t downplaying the importance of its export activity, expanding internal demand is their bigger challenge.”

China’s government is now implementing a range of stimulus measures, including one that provides consumers with partial rebates for specific purchases. This move is designed to boost retail activity. China’s retail sales took a step back last year, growing only at half the pace of the prior year’s sales. 1 Stimulus plans are also designed to, at least in part, offset some of the potential slowdown in export activity should trade wars persist.

“Another challenge for China is its real estate market overhang,” says Haworth. “China has yet to enact meaningful policies to take surplus housing out of the hands of speculators, who found themselves over-extended in real estate.” Housing demand has dampened and in 2024 and early 2025, Chinese housing prices continued to slide.2

President Trump campaigned heavily on imposing new tariffs on goods America imports from overseas, with a primary emphasis on China, though he also targeted other countries such as Canada and Mexico. While some proposed tariffs were delayed, Trump went ahead with expanded tariffs on Chinese imports.

If China’s trade activity with the U.S. slows, Haworth believes they’ll try to expand trade with Europe, where the economy is showing more favorable signs.

To counter new U.S. levies, in March 2025, China added tariffs to U.S.-produced farm commodities. This includes a 15% tariff on chicken, wheat and corn, and a 10% tariff on soybeans, pork, beef and fruit.3

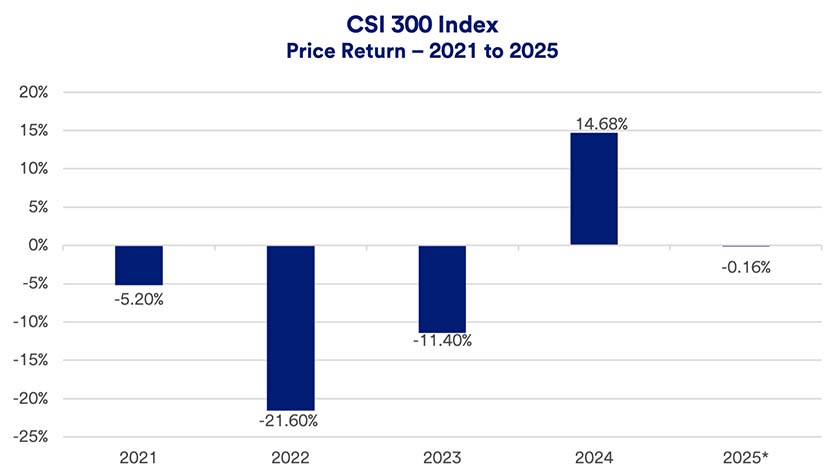

In 2024, China’s equity markets snapped a three-year losing streak. Stocks were headed lower early in the year, but managed to bounce back. Momentum faded recently and the CSI 300 Index, a key measure of Chinese stock performance, is essentially flat year-to-date.3 “Markets are still working off some of the fervor that resulted from a modest government economic stimulus program implemented in early fall of 2024,” says Haworth. “That gave the market an immediate, positive jolt, but equities have slowly trended lower since October last year.”

“China is trying to spur more consumer-led growth rather than investment-led growth, but with limited success so far."

Rob Haworth, senior investment strategy director, U.S. Bank Asset Management

In January 2025’s early weeks, the CSI 300 Index is still 32% below its February 2021 peak.4

Despite its recent challenges, China remains the world’s second largest economy (after the United States). However, the rapid growth that characterized recent decades has given way to more muted GDP expansion.2

Notably, China’s per capita GDP (a basic measure of income per person) is far below that of most developed nations, indicating the country’s growth has a long way to go. China’s per capita GDP is $13,870, compared to the U.S. per capita GDP of $89,680.5

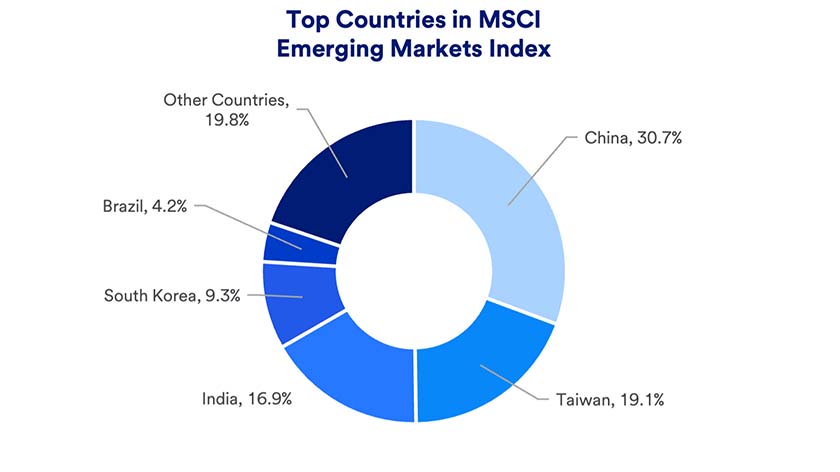

Although it is the world’s second largest economy (after the United States), investors still classify China as an emerging market. Within that category, it is by far the largest single country contributing to the MSCI Emerging Markets Index, representing more than one-quarter of the Index.4 “Any investor who puts money to work in a broad, emerging market index likely owns a significant position in Chinese stocks,” says Haworth.

In 2024, the MSCI Emerging Markets Index generated a total return of 7.50%, outpacing the MSCI EAFE developed markets index, but significantly underperforming U.S. markets. By comparison, the S&P 500 earned a 25.02% total return. In 2025, the situation is reversed. Through March 10, the MSCI Emerging Markets Index is up 3.81% on a total return basis, compared to the S&P 500’s -4.30% total return.6

“Part of the recent Chinese market comeback can be attributed to its own artificial intelligence (AI) innovations,” says Haworth. “The AI platform DeepSeek and another created by the technology firm Alibaba could have a positive impact on China’s economy.”

International stocks should be part of a well-diversified portfolio. “We believe global stocks represent a reasonable opportunity, as they offer more attractive valuations than U.S. stocks,” says Haworth.

Haworth says an emerging market index, where Chinese stocks play a prominent role, may be an effective way to incorporate into your portfolio a position in China’s market.

Any changes to your investment strategy should be consistent with your goals, time horizon and risk appetite. Talk with your U.S. Bank wealth professional to review your current financial plan and determine whether there is an opportunity to incorporate emerging market stocks – with exposure to China – into your broader, well-diversified portfolio.

Note: The MSCI Emerging Markets Index captures large and mid-cap equity performance across twenty-four emerging market countries. Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility. International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments.

Economies across the globe have become increasingly interdependent. For example, many U.S. companies source products from China. During the height of the COVID-19 pandemic, this created supply chain constraints as portions of China’s economy were virtually shut down. That had a negative impact on business activity for some U.S. companies dependent on Chinese suppliers. An additional way events in China can affect the U.S. and other world markets is that China represents the second largest economy in the world and the largest emerging market in terms of stock valuation. If China experiences economic challenges or market volatility, it can have an impact on the global economy, which may be reflected in the U.S. stock market. Recent trade tensions between China and the U.S., resulting in both sides implementing tariffs, are an additional consideration.

China has grown to have the second largest economy in the world, second only to that of the United States. Some forecasters predict that in the coming decades, China will grow to have the largest economy based on its Gross Domestic Product (GDP). China’s population is close to three times that of the United States, but the standard of living is much lower in China. One way this is measured is by GDP per capita – in other words, the size of the economy divided by the number of people residing in the country. In 2025, China’s per capita GDP was $13,870 compared to $89,680 for the U.S., based on International Monetary Fund data.

When constructing a well-diversified portfolio to meet long-term financial objectives, international stocks can play an important role. “As we look at all of the risks in the market today, it makes sense to consider allocating a portion of equity assets into non-U.S. stocks, including emerging market stocks,” says Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management. China is the largest of the emerging markets. For a portion of a portfolio including China, Haworth favors emerging market funds that represent a broad index of stocks. “The emerging markets index provides significant exposure to Chinese stocks, since they make up more than one-quarter of the MSCI Emerging Market Index,”6 says Haworth. “But it also provides exposure to other markets that help diversify investors away from potential risks arising from investing exclusively in Chinese markets.”

With the market and economy in flux, how should investors position their portfolios to capitalize on potential opportunities, while guarding against risks?

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.