Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

The U.S. economy grew 2.8% last year.

Fourth quarter growth was slightly less at 2.4%.

Federal Reserve revises downward 2025 GDP forecast.

The latest U.S. government review of fourth quarter 2024 Gross Domestic Product (GDP) shows that the economy grew at a 2.4% annualized rate. This represents a slight uptick from initial fourth quarter 2024 GDP readings. The U.S. economy grew by 2.8% in 2024 overall, nearly replicating 2023’s 2.9% growth rate.1

The latest data is a look back at economic activity that already transpired. In 2025, economic conditions may be shifting due in part to President Donald Trump's pursuit of economic policy changes. Most notably, Trump implemented significant tariff increases with markets prepared for even more tariff announcements. Already in place are an additional 20% tariff on Chinese goods, 25% tariffs on steel and aluminum imports from all countries, and as of late March, a new 25% tariff on imported automobiles and some imported car parts. The ultimate economic impact is unclear, but it’s added a degree of uncertainty for businesses and consumers alike.

Notable new data points raising concerns are recent consumer surveys showing declining sentiment. For the second consecutive month, the University of Michigan’s Consumer Sentiment Index in March showed a 10% sentiment decline from the previous month. Sentiment is 27.1% lower than a year earlier.2 There’s a lack of clarity about the full impact of Trump’s tariff moves, but they have altered the economic environment, particularly related to international trade.

The Conference Board’s March Consumer Confidence Index found a 7.2% confidence drop from February’s. The Board’s Consumer Expectations Index, reflecting the short-term outlook for income, business, and labor market conditions, dropped to a 12-year low.3

“Consumer confidence surveys are unreliable signals of future economic performance,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “A better correlation is found in jobless claims and real wage growth.” To this point, both initial weekly jobless claims and annual wage gains remain relatively stable, sending no major warning signs. “Despite how consumers respond to surveys, if they have jobs, they still tend to spend money,” says Haworth.

Healthy consumer spending is the key to ongoing U.S. economic growth. According to the U.S. Bureau of Economic Analysis, personal consumption expenditures generated close to 3% of the economy’s fourth quarter expansion, one of strongest quarters of consumer activity in recent times. Net exports and government spending made modest contributions, while private investment significantly detracted from fourth quarter growth.1

“A soft landing is still likely,” says Beth Ann Bovino, chief economist for U.S. Bank, referring to the description of a slower economy that avoids a recession.

A key question now is whether consumers can maintain spending levels to the extent necessary to keep the economy growing. Eric Freedman, chief investment officer for U.S. Bank Asset Management, expresses a note of caution. “Data is beginning to show that lower income and some middle-income consumers are feeling pressure. The combination of higher interest rates and higher costs are starting to weigh in.” Freedman says if interest rates remain elevated, consumers will feel more pressure.

Early 2025 consumer spending data shows possible slowing. January retail sales fell, with only a modest February recovery. Haworth sees some unusual factors at play. “Weather and wildfire issues likely contributed to slower retail activity. Those seem like temporary factors.” Nevertheless, Haworth says the economic growth rate is likely slowing. One “real-time” measure of GDP growth is the Atlanta Federal Reserve Bank’s “GDP Now” forecast. It currently shows a first quarter annualized GDP decline of more than 1%. However, Haworth points out that Wall Street consensus forecasts are closer to 2%.4

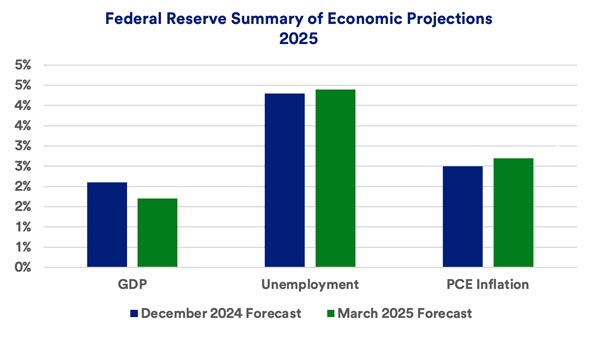

In its first two 2025 policymaking meetings, the Federal Reserve (Fed) stood firm on the federal funds target rate, leaving it within a range of 4.25% to 4.50%. That’s down 1% from its pre-September 2024 fed funds rate peak. However, market expectations are for only two Fed rate cuts in 2025. After its March meeting, the policymaking Federal Open Market Committee (FOMC) members adjusted down 2025 economic projections. Those forecasts reduced economic growth expectations and increased unemployment and inflation projections (based on Personal Consumption Expenditures).5

The Fed remains focused on bringing inflation closer to its 2% target while balancing that with a healthy labor market. Inflation for the 12 months ending in February 2025 stands at 2.8%, with February’s unemployment rate at 4.1%.6 “A soft landing is still likely,” says Beth Ann Bovino, chief economist for U.S. Bank, describing a slower economy that avoids a recession.

“Trade wars and falling consumer expectations signal both recession fears and inflation fears,” says Bovino. “It’s still not ugly, but the shocks are starting to add up.”

Haworth sees little likelihood that an inflation spurt would force the Fed to raise interest rates before cutting rates again. “Even with 2024’s rate cuts, the Fed today is still in a restrictive monetary stance and likely believes that it is already sufficiently positioned to fight inflation,” says Haworth. “The labor market is likely the Fed’s primary focus today.”

Throughout 2024, the economy’s ongoing strength helped corporations meet or exceed earnings expectations. For the second consecutive year, the S&P 500 generated total returns topping 25%.6 Haworth says the earnings outlook remains favorable. “There appears to be a sufficient level of economic growth to keep the market buoyant, although likely with a degree of volatility.”

In the current environment, investors may wish to consider a modest overweight in equities, including global stocks, and a modest underweight in fixed income, with a neutral position in real assets. Haworth says this reflects an economic environment that, in the near term, appears to put equities in a position to outperform fixed income.

Consider reviewing your current portfolio with your wealth management professional to determine if it’s consistent with your long-term goals and positioned to meet your needs in today’s market and economic environment.

Note: Diversification and asset allocation do not guarantee returns or protect against losses. The Standard & Poor’s 500 Index (S&P 500) consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. The S&P 500 is an unmanaged index of stocks. It is not possible to invest directly in the index. Past performance is no guarantee of future results.

A recession is a significant and prolonged downturn in economy activity. Some define a recession as two consecutive quarters of declining Gross Domestic Product (GDP) growth. However, more complex formulas are often used. The accepted arbiter of a recession, the National Bureau of Economic Research (NBER), considers a variety of measures to determine a recession’s timing and length. These may include nonfarm payrolls, industrial production and retail sales, along with key measures such as GDP. Quite often, the NBER makes a final recession determination months after it begins.

The most recent recession was an unusual one, related to the start of the COVID-19 pandemic. It lasted only from February through April 2020, one of the shortest recessions on record. But it also was one of the most severe. According to the U.S. Bureau of Economic Analysis, the U.S. economy declined at an annualized rate of 5.5% in 2020’s first quarter and declined again by 28.1% (annualized) in the second quarter. However, it quickly rebounded, growing by a 35.2% annualized rate in the third quarter. This was an unusual circumstance related to the partial closing of many businesses and schools and the sudden layoff of workers in response to the onset of the pandemic, followed by a rapid reopening for most businesses. The previous recession occurred more than a decade earlier, the so-called Great Recession of 2007-2009. This recession was tied to the financial crisis that rocked the global economy for an extended period.

While it is difficult to predict a recession in advance, the current state of the economy makes the possibility of a recession in the near term appear remote. “It seems likely the economy may avoid a recession in the near term, though we can expect that real Gross Domestic Product (GDP) growth will remain modest over time,” says Matt Schoeppner, senior economist at U.S. Bank. In 2024’s first quarter, the economy grew at an annualized rate of 1.6%, but improved significantly in the second quarter, growing at a 3.0% annualized rate, followed up with 3.1% annualized third quarter GDP growth and 2.3% fourth quarter 2024 annualized growth.1

Persistently elevated inflation continues to vex consumers and policymakers alike.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.