Exclusive relationship with state department of insurance

Get in touch

Jason Folken

Insurance Specialty Group – National Sales

jason.folken@usbank.com

866-681-5052

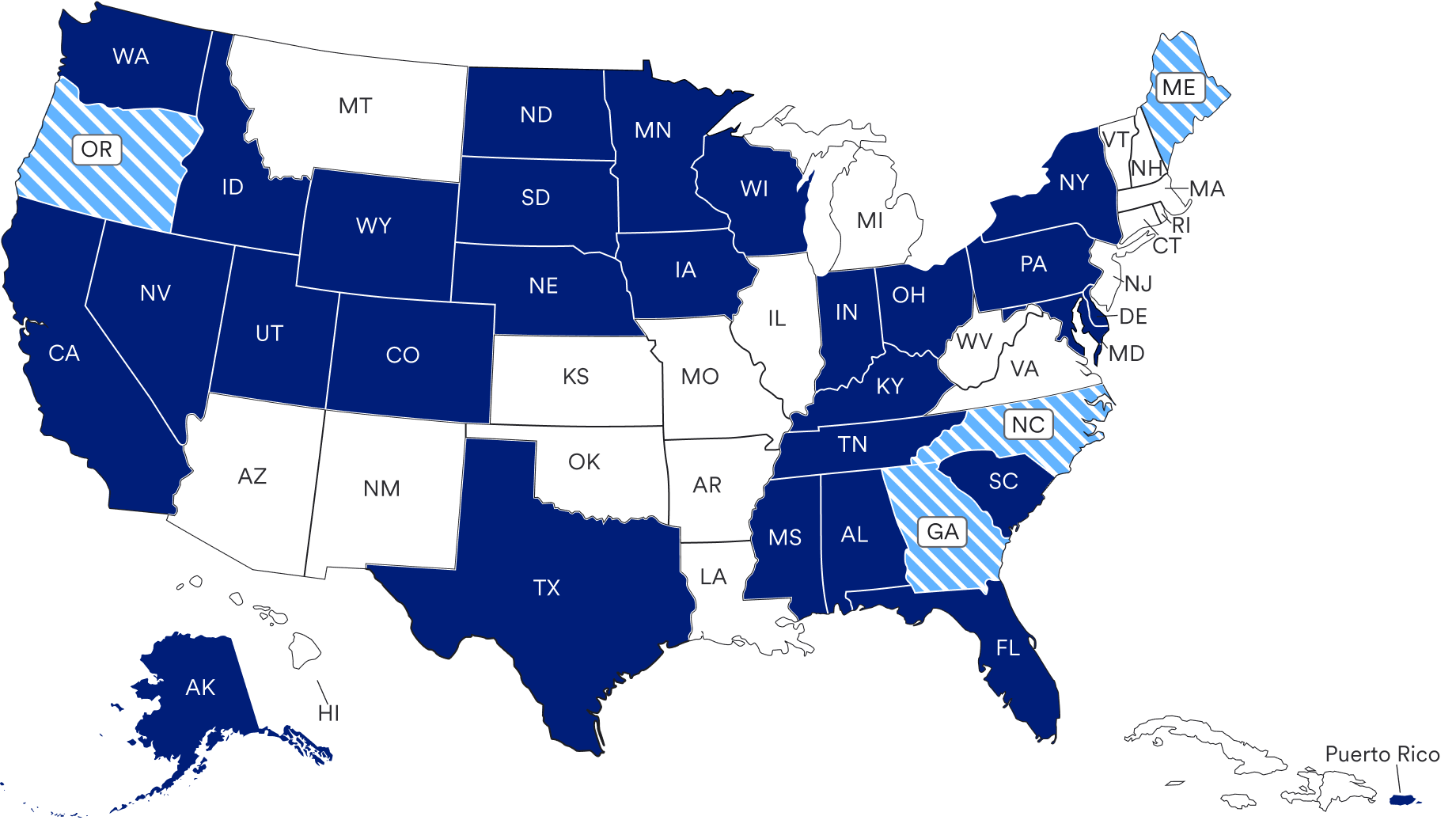

33 approved states and districts

We have an exclusive relationship with the departments of insurance in Alabama, Alaska, California, Colorado, Delaware, Florida, Idaho, Indiana, Iowa, Kentucky, Maryland, Minnesota, Mississippi, Nebraska, North Dakota, Nevada, New York, Ohio, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Washington, Wisconsin, Wyoming and Puerto Rico.

We are eligible and approved by the departments of insurance in Georgia, Maine, North Carolina and Oregon.

We do not conduct business in states not listed above.

Advantages of reinsurance trusts

- Reduce costs

- Trust account is established once, eliminating annual renewal risk

- Trust remains an asset of the grantor, improving balance sheet position

- Make credit previously held in lines of credit available

- Qualify for Schedule F credit

Why do insurers choose U.S. Bank for reinsurance trusts?

Insurance custody services

- Dedicated team for reinsurance trust accounts

- Custody, income collection and corporate actions

- Straight-through processing (STP) and SWIFT

- Partnership with Clearwater Analytics for reporting

Proven approach

- Focus on automation and consolidation

- Operational excellence in security processing

- Largest statutory deposit network in 33 states

- Sixth-largest custodian combined with the strength and stability of U.S. Bank

Additional related services

- ADP proxy

- SWIFT messaging

- Worldwide securities settlement

- Risk and compliance monitoring

- State deposit tracking and reporting

- Securities processing and settlements

- NAIC and GAAP-compliant processing

- Xcitek online corporate actions notification and processing

Discuss reinsurance trusts with the experts.

Learn more about reinsurance and how a trust might benefit you by reaching out to the U.S. Bank team.

Start of disclosure content