Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

Following two consecutive years of strong stock market gains, investors wonder if the upward trend will continue in 2025.

10-year U.S. Treasury yields recently settled near 4.50%.

While stocks appear well positioned for further gains, it remains to be seen how a variety of Trump administration proposals might impact capital markets and the economy.

With key equity indices near all-time highs, investors wonder if a third consecutive year of stock market gains is in the cards. In both 2023 and 2024, the S&P 500 gained over 25% on a total return basis. While stocks are up again so far in 2025, the S&P 500 has dropped below its record high. 1 In the meantime, long-term interest rates, which rose steadily from mid-September to mid-January, are down from recent peaks.

On balance, the investment outlook is solid. “Even though economic growth may slow, it’s still growing sufficiently to spur corporate earnings growth,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. He notes that even the risk of higher inflation may benefit stocks. “Higher costs give companies some pricing power, so even elevated inflation can support nominal earnings expansion.”

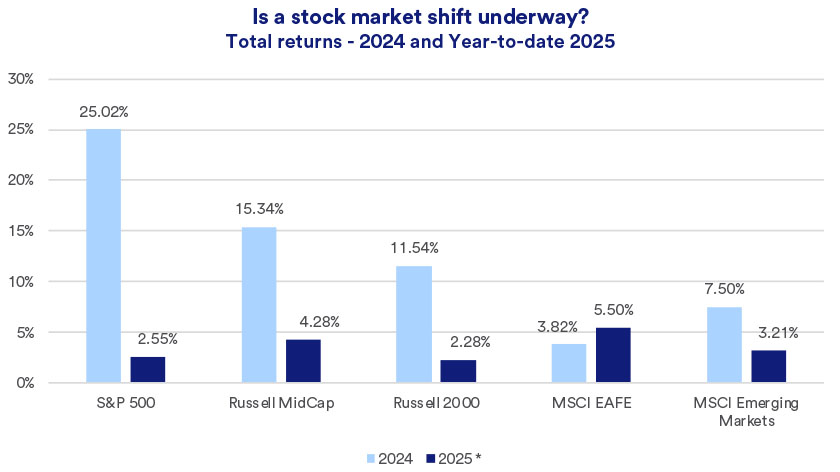

In both 2023 and 2024, investors showed a strong preference for large-cap stocks, particularly technology-oriented companies. This worked to the benefit of the S&P 500 over other equity market segments. In 2025, the environment shows more balance, with international stocks (MSCI EAFE and MSCI Emerging Markets) and mid-cap stocks outpacing large- and small-cap stocks. 2

“We’re seeing more participation from non-U.S. equities,” says Eric Freedman, chief investment officer for U.S. Bank Asset Management. “The global consumer, particularly in Europe, appears to be in incrementally better shape.” That should help boost overseas economies, benefiting global equity markets.

Trump administration tariff policies and proposals add a variable that investors must consider. Tariffs would likely raise costs for importers and consumers, which could contribute to elevated inflation and higher interest rates. Haworth notes that this could create headwinds for small-cap stocks. “Smaller companies typically contend with higher financing costs, less pricing power than larger companies and more sensitivity to higher input costs. As a result, small-cap stocks may face more risk than other market segments.”

Throughout 2024, solid economic growth buoyed corporate earnings. In 2024, Gross Domestic Product (GDP), the key measure of economic growth, expanded at a 2.8% rate, just under 2023’s 2.9% GDP growth rate. 3

“The economy’s held up reasonably well to this point because of the strong labor market, and consumers’ fairly strong financial position. On balance, we’re still optimistic about the consumer, particularly among middle- and upper-income consumers.”

Eric Freedman, chief investment officer, U.S. Bank Asset Management

“The economy’s held up reasonably well to this point because of the strong labor market, and consumers' fairly strong financial position,” says Freedman. “On balance, we’re still optimistic about the consumer, particularly among middle- and upper-income consumers.”

In mid-September 2024, after the Federal Reserve (Fed) initiated the first of three federal funds target interest rate cuts, bond market sentiment changed. Yields on the 10-year U.S. Treasury note rose by more than 1% to a peak of 4.79%. Yields retreated modestly since. 4 “The good news is that long bond yields appear to be holding steady,” says Haworth. “Inflation will be a key data point to watch.” Haworth notes the Fed has scaled back 2025 rate cut plans and may curtail rate cuts completely if inflation accelerates.

“The 10-year Treasury yield in the 4.5% range is in a good spot,” notes Freedman. “If yields get to 5% or higher on a sustained basis, that could be more problematic.” For now, says Freedman, bond investors appear to be waiting to see if more specific tariff plans come to fruition before adjusting for the potential inflationary impact.

“Be prepared to take what the capital markets offer given the current environment’s realities,” says Freedman. He advises that long-term investors consider positioning their portfolios with an overweight position in equities relative to fixed income, and a neutral weight invested in real assets. Freedman adds, “It’s critical to have a financial plan that’s tied to the specific goals you hope to achieve.” With a plan in place, you can more readily identify investment strategies that align with your goals.

Investors should capitalize on the opportunity to add global diversification, says Haworth. “Although it looks like the U.S. economy remains stronger than those of overseas markets, valuations of non-U.S. stocks are more attractive, so they offer some opportunity as well,” says Haworth.

Based on your goals, timeline and risk appetite, consider these additional portfolio strategies:

Have questions about the economy, markets or your finances? Your U.S. Bank Wealth Management team is here to help.

Note: Tax-loss harvesting does not apply to tax-advantaged accounts such as traditional, Roth and SEP IRAs, 401(k) and 529 plans. Private equity investments provide investors and funds the potential to invest directly into private companies or participate in buyouts of public companies that result in a delisting of the public equity. Investors considering an investment in private equity must be fully aware that these investments are illiquid by nature, typically represent a long-term binding commitment and are not readily marketable. The valuation procedures for these holdings are often subjective in nature. Private debt investments may be either direct or indirect and are subject to significant risks, including the possibility of default, limited liquidity and the infrequent availability of independent credit ratings for private companies. Structured products are subject to market risk and/or principal loss if sold prior to maturity or if the issuer defaults on the security. Investors should request and review copies of Structured Products Pricing Supplements and Prospectuses prior to approving or directing an investment in these securities. Investments in high yield bonds offer the potential for high current income and attractive total return but involve certain risks. Changes in economic conditions or other circumstances may adversely affect a bond issuer's ability to make principal and interest payments. Derivatives can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on performance. Employing leverage may result in increased volatility. These investments are designed for investors who understand and are willing to accept these risks. Reinsurance allocations made to insurance-linked securities (ILS) are financial instruments whose performance is determined by insurance loss events primarily driven by weather-related and other natural catastrophes (such as hurricanes and earthquakes). These events are typically low-frequency but high-severity occurrences. In exchange for higher potential yields, investors assume the risk of a disaster during the life of their bonds, with their principal used to cover damage caused if the catastrophe is severe enough. The Standard & Poor’s 500 Index (S&P 500) consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. The S&P 500 is an unmanaged index of stocks. It is not possible to invest directly in the index. Diversification and asset allocation do not guarantee returns or protect against losses. Past performance is no guarantee of future results.

In the current environment, investors might consider an overweight allocation to equities, reduced positions in fixed income investments and a neutral weighting in real assets. In 2024, equities generated another solid performance year. At the same time, fixed income investments gave back some ground recently, due in large part to continued U.S. economic strength. As always, consult with your wealth management professional to determine the most effective investment strategy aligned with your own goals and risk tolerance.

In 2024, domestic large-cap equities were the capital markets stand out performers. The market’s 2023 and 2024 performance was driven by technology-oriented stocks benefiting from investor enthusiasm about developments related to artificial intelligence. In early 2025, technology stocks lagged the broader market, and U.S. mid-cap and overseas stocks outpaced U.S. large cap stocks. While U.S. equity market valuations may appear somewhat elevated given the market’s recent strong returns, analysts remain optimistic about 2025 corporate earnings growth, which could fuel further stock market upside. However, you may wish to consider dollar-cost averaging to help offset market volatility risk. You also should consider broadening your portfolio to include global diversification, to take advantage of opportunities in other economies.

In the short term, markets are unpredictable and can experience temporary up-and-down movements. Investors need to position assets designed to meet long-term goals with a willingness to withstand some short-term market swings. In today’s market, stocks have enjoyed two years of significant returns, but not without volatile periods. Bond performance has been less favorable given persistently elevated interest rates. Be sure to consult with your financial professional to assess your own risk tolerance level and position your long-term assets accordingly.

Persistently elevated inflation continues to vex consumers and policymakers alike.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.