Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

Interest rates have stabilized but remain elevated.

Equity markets continue advancing despite higher interest rates.

Interest rate projections for 2025 are clouded by scaled back expectations for further Federal Reserve rate cuts.

Equity investors appear unconcerned about higher interest rates – for now. In 2025’s opening weeks, U.S. stocks generally moved in a positive direction. Through mid-February, the S&P 500 generated a total return of 4.11%,1 while the Bloomberg Aggregate Bond Index returned 1.12% over the same period.2

In late 2024, the Federal Reserve (Fed) cut the short-term federal funds target rate three times. However, Fed officials currently project only two additional rate cuts throughout 2025.3 With the Fed remaining on the sidelines for now, equity investors are more focused on other issues, such as economic resilience. In both 2023 and 2024, the U.S. economy grew by close to 3%4 while the S&P 500 gained more than 25%.1

After peaking near 5% in late 2023, the benchmark 10-year Treasury yield dropped to 3.63% in mid-September 2024. It was then that the Fed began cutting rates, a development that triggered an equity market rally. However, bond markets moved in a different direction. By January 2025, 10-year Treasury yields jumped to as high as 4.79%. They have since retreated, leveling off close to 4.50%.5

“The 10-year Treasury yield is a key barometer for risk assets such as stocks,” says Eric Freedman, chief investment officer for U.S. Bank Asset Management. “At 4.50%, we’re in a pretty good spot. If 10-year Treasury yields jump to 5% or higher, that would be more problematic.”

“The 10-year Treasury yield is a key barometer for risk assets such as stocks,” says Eric Freedman, chief investment officer for U.S. Bank Asset Management. “At 4.50%, we’re in a pretty good spot,” in terms of equity market impact. “If 10-year Treasury yields jump to 5% or higher, that would be more problematic.”

In mid-December 2024, equity markets suffered a significant setback when the Fed announced its scaled-back 2025 interest rate cutting plans. Prior to that point, markets anticipated four or more 2025 rate cuts, but now projects no more than two. Nevertheless, investors ultimately shook off the news and markets regained upward momentum.

Yet Rob Haworth, senior investment strategy director with U.S. Bank Asset Management, says the Fed’s less aggressive rate cutting stance could create challenges. “It reduces or eliminates the equity market’s margin for error,” says Haworth. “This is especially true for smaller companies, which are most dependent on borrowing and will face higher interest costs given persistently elevated interest rates.”

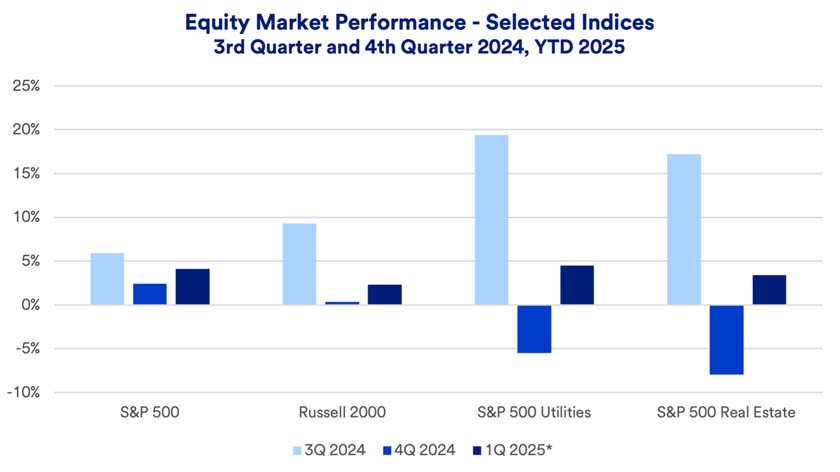

Even as stock markets continue trending up, certain market sectors are more susceptible to higher rates. “Interest rate sensitive sectors like utilities and real estate lost ground in late 2024 given the trend of higher Treasury bond yields,” notes Haworth. When Fed rate cuts were on the horizon in the third quarter, small-cap, utilities and real estate stocks performed well. However, the subsequent trend of higher long-term bond yields detracted from fourth quarter performance. Those sectors proved more resilient in the 2025’s first six weeks, though the impact of higher interest rates continued to dampen small-cap stock returns (Russell 2000).6

Haworth says the real estate sector is slowly working through challenges it faced since 2022 when interest rates began moving higher. “Despite ongoing debt concerns, there’s room for repair in the real estate market, which should help improve the environment for REITs (Real Estate Investment Trusts) going forward.” REITs are a common way individual investors gain access to real estate markets.

Interest rates remain an important consideration for equity investors. “The Fed isn’t headed back to the pre-2022 ‘zero interest rate’ environment,” says Haworth. “Inflation may be settling in at a higher level, in the 2.5% to 3.0% range. If that’s the case, the Fed is likely to ultimately set the federal funds target rate somewhere close to 3.0%.” The fed funds target rate currently stands at 4.25% to 4.50%. Given present interest rate trends, Haworth believes equities in general remain well positioned, driven primarily by strong economic fundamentals and solid corporate earnings growth.

As you assess your own circumstances, be prepared for potential stock price fluctuations in the near term. Stocks should continue to represent a key component of any long-term investor’s diversified portfolio. “In part, this is due to the fact that equity returns can help investors keep pace with inflation,” says Haworth.

Talk with your wealth professional about your comfort level with your portfolio’s current mix of investments and discuss whether any changes are appropriate in response to an evolving capital market environment consistent with your goals, risk appetite and time horizon.

Note: The Standard & Poor’s 500 Index (S&P 500) consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. The S&P 500 is an unmanaged index of stocks. It is not possible to invest directly in the index. Past performance is no guarantee of future results. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index and is representative of the U.S. small capitalization securities market. The Russell 2000 is an unmanaged index of stocks. It is not possible to invest directly in the index. Past performance is no guarantee of future results.

Interest rates can affect stock markets in different ways. Frequently, when rates rise, equities are challenged because investors can choose to invest in bonds that pay more attractive yields than was previously the case, rather than stocks. Higher rates can put pressure on stock valuations, as corporations may need to generate more attractive earnings to capture investor interest. Another way the interest rate environment affects stocks has to do with companies’ bottom lines. If a debt-issuing company faces higher borrowing costs due to rising rates, it may result in reduced company profits, which can be reflected in lower stock prices. These factors are among the reasons why equity investors pay close attention to the interest rate environment.

If the Federal Reserve raises the short-term federal funds target rate it controls (as it did in 2022 and 2023), it can have a detrimental effect on stocks. A higher interest rate environment can present challenges for the economy, which may slow business activity. This could potentially result in lower revenues and earnings for a corporation, which could be reflected in a lower stock price.

There is not a direct correlation on the direction of interest rates stemming from stock market movement. The state of the economy and inflation are bigger factors that help determine the direction of interest rates. In many circumstances, interest rate movements can affect stock prices. The biggest impact stock prices have on interest rates is on the demand for bonds. If stock prices decline, it may indicate investors are seeking to reduce portfolio risk and putting more money to work in bonds. This reflects an increase in demand for bonds, which typically allows issuers to offer debt at lower interest rates.

With the market and economy in flux, how should investors position their portfolios to capitalize on potential opportunities, while guarding against risks?

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.