Between the end of trading on election day, November 5, 2024, through March 11, 2025, the S&P 500 lost 3.64%, often experiencing periods of significant volatility within that timeframe.1 While some market performance may be attributable to investor’s election outcome reaction and subsequent Trump administration policies, other factors have also come into play. In late 2024, the Federal Reserve was in the process of reducing short-term interest rates, generally considered a favorable sign for stocks. In addition, the U.S. economy continued to show persistent strength with the labor market holding up well, helping consumers maintain elevated spending levels. This contributed to continued corporate profit growth, a key stock market driver. In 2025, the environment became more uncertain amid a flurry of President Donald Trump’s proposed policy changes and multiple executive orders. That led to greater market volatility and subdued equity market performance.

Key takeaways

So far, increased capital market volatility accompanies President Trump’s second term in office.

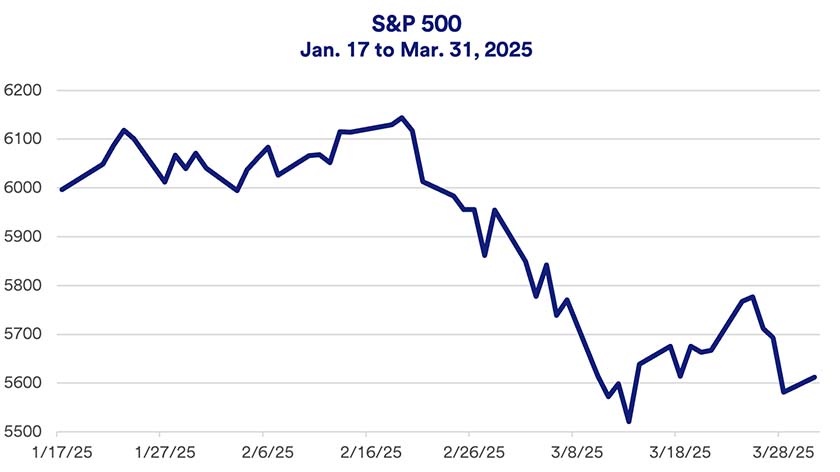

Through the end of March 2025, the S&P 500 is down more than 8% from February’s all-time high.

Tariffs continue to fuel market uncertainty.

Investors enter 2025’s second quarter facing a rocky capital market environment. After topping all-time records in mid-February, the S&P 500 closed March in negative territory. This represents a significant turnaround from initial market enthusiasm for President Donald Trump's second term. Markets are increasingly roiled by President Trump’s new tariff policies, adding to investor uncertainty. After its peak on February 19, 2025, the S&P 500 is down more than 8%.

The President’s tariff policies include several newly implemented tariffs, prospects for additional tariffs, and reversals of a handful of announced new tariffs. “Currently, Trump administration policy uncertainty is really all about tariff uncertainty,” says Rob Haworth, senior investment strategy director at U.S. Bank Asset Management Group. Haworth says equity markets are not reacting well to uncertainty. “Based on recent comments, President Trump doesn’t seem as focused on the equity market as investors hoped.”

Regarding current and forthcoming tariff plans, Haworth adds, “It’s all about how large the tariffs are, where they will apply, and how long they will last.” He notes that tariffs implemented in Trump’s first term were shorter in duration and smaller in magnitude.

Despite initial market enthusiasm in the wake of Trump’s November 2024 election victory, with the S&P 500 gaining 2.5% on the day following the vote, investor sentiment is transformed for now. Through March 31, 2025, equity markets as measured by the S&P 500 are down 2.96% since November 5, 2024, and 4.59% for 2025’s first quarter.1

“This is a roller coaster market with a wall of worry that’s under construction,” says Terry Sandven, chief equity strategist for U.S. Bank Asset Management Group. “We expect market volatility to remain elevated until we have more clarity.”

Economic uncertainty on the rise

Prior to the election, says Tom Hainlin, senior investment strategist for U.S. Bank Asset Management, “Investors worried about what would happen if inflation reaccelerated, what if the Federal Reserve had to raise interest rates, what if the election outcome is uncertain. We overcame all these hurdles.” Along with a narrow but clear Trump victory in November and the Republican sweep of the House and Senate, Hainlin notes consumer spending remains solid and corporate earnings are positive, both factors boosting post-election market sentiment.

“This is a roller coaster market with a wall of worry that’s under construction,” says Terry Sandven, chief equity strategist for U.S. Bank Asset Management. “There is a lot of uncertainty that goes beyond company fundamentals.”

The sentiment is markedly different today. “U.S. equities are navigating the crosscurrents between headwinds such as tariff talk and the risk of an economic slowdown vs. inflation, interest rates, and earnings, which are directionally consistent with higher equity prices,” says Sandven.

“The markets are focused on Trump policies as well as underlying fundamentals,” adds Haworth. “Tariff issues don’t impact all industries or companies equally.” Haworth points to the consumer discretionary sector, including automobile companies, as more susceptible to tariffs’ sting.

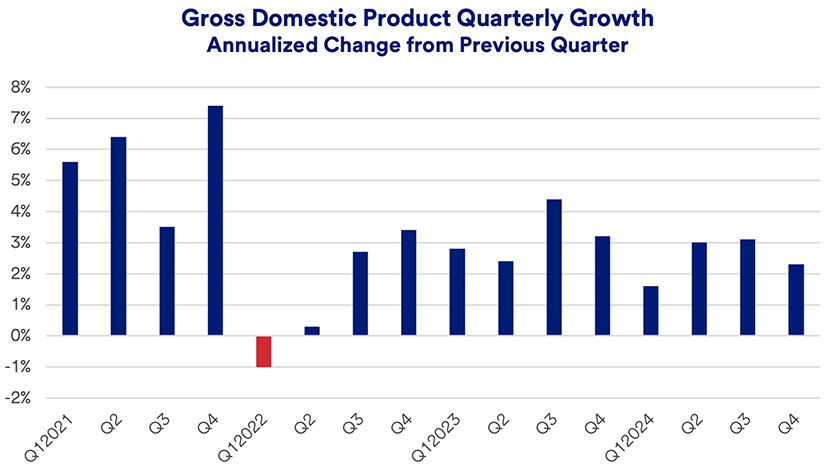

The economy finished 2024 with solid growth, but there are questions about its direction going forward.2

Trump administration policies remain an economic wild card. “There’s a lot of uncertainty about the impact of government actions such as rising tariffs,” says Haworth.

Federal Reserve’s response

The first quarter 2025 Gross Domestic Product report won’t be released until April 30, 2025. Until then, investors are weighing other economic signals. The Fed’s policymaking Federal Open Market Committee revised its 2025 economic projections. This includes an uptick in inflation expectations and the unemployment rate, as well as slightly lower economic growth expectations.3

Based on recent surveys from the University of Michigan and the Conference Board, consumer sentiment is dropping.4 Haworth says it’s unclear that this will result in constrained consumer spending, but the markets are watching it closely. “The market still anticipates at least two Fed interest rate cuts this year,” says Haworth, “but there’s still uncertainty about how the Fed will react to economic data.” The threat of rising inflation, brought on in part by new tariffs, is an increasing concern. “The hope is that any inflationary impact is temporary,” says Haworth.

“The American consumer really isn’t buying the idea of temporary inflation,” says Eric Freedman, chief investment officer for U.S. Bank Asset Management Group. “They have a sense that inflation may come in north of 4%.” The equity market’s recent retreat may partly reflect rising cost fears. “There’s a concern that the core consumer may slow spending, which would create issues for corporations trying to maintain earnings growth,” says Freedman.

Stock market under Trump

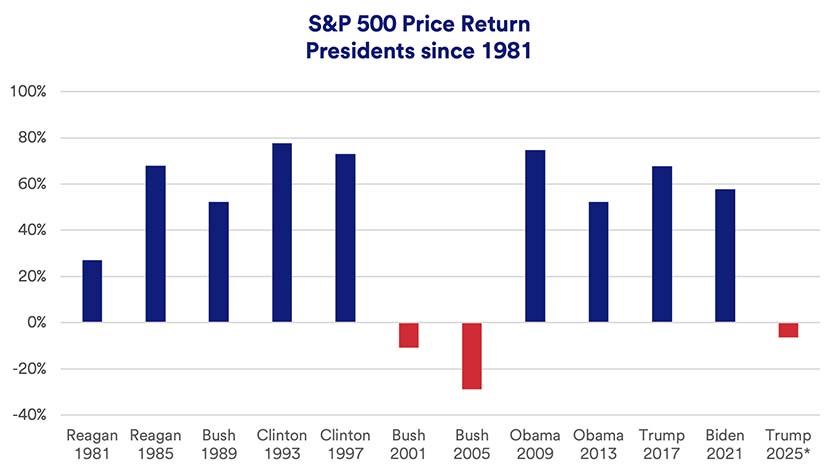

Early investor enthusiasm for Trump’s victory may in part reflect the fact that markets generally prospered from 2017 to 2021 during Trump’s first term. However, more than two months into Trump’s new term, markets are in solidly negative territory.1 At this very early stage, the S&P 500’s performance at the start of Trump’s term contrasts with other administrations.

If you have questions, talk with a wealth planning professional. The U.S. Bank Wealth Management team is always here to help.

Frequently asked questions

Investors tend to assess a variety of factors. Federal government policy, often driven in large part by the President, is only one of those factors. Another major story boosting markets is that the U.S. economy in 2024 grew at a 2.8% annualized rate, considered a reasonable expansion pace in a high-interest rate environment.2 Consumer spending helped fuel economic growth, which in turn benefited corporations, that continue to experience solid profit growth. In today’s environment, investors are also considering Trump policies, such as expanded tariffs, and the potential economic ramifications.

During President Joe Biden’s term, equity market performance was comparable to that generated by markets during President Donald Trump’s first term. Through Biden’s four-year term, which ended January 20, 2025, the S&P 500 gained 57.85%. In Trump’s first term, the S&P 500 gained nearly 68%. Since 1980, Trump’s first-term record ranks as only the fifth-best market return during a four-year presidential term. The top-performing markets over four-year presidential terms during that span were: (1) Bill Clinton, 1993-1997, + 77.68%; (2) Clinton again, 1997-2001, +72.97%; (3) Barack Obama, 2009-2013, 74.80%; and (4) Ronald Reagan, 1985-1989, +68.05%.1

Tags:

Explore more

Is this a market correction?

Investors wonder if the S&P 500 pullback in the first quarter – as President Trump’s sweeping tariff policies are implemented – represents an emerging bearish trend for stocks.

Access a broad range of investments, vetted by a team of experts.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.