U.S. Bank ExtendPay® Plans provide a new payment option. You can divide eligible credit card purchases into equal monthly payments with no interest during your chosen payback period – only a fixed monthly fee.

No set-up fees

There are no fees to sign up and get started. Simply visit your credit card dashboard to check for qualifying purchases.

Earn rewards

Keep earning your same great rewards on your U.S. Bank Credit Cards.3

Flexibility

Choose the plan that works for you with 3, 6, 12, 18, and 24 month repayment options.5

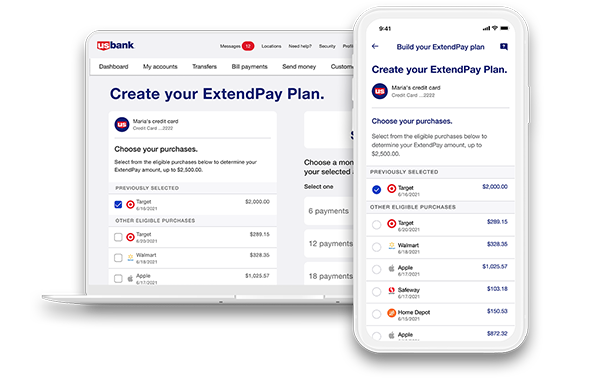

Complete an ExtendPay Plan in three easy steps.

1. Start by making a purchase of $100 or more using your U.S. Bank Credit Card.

2. Then visit your credit card dashboard by logging in to online banking or your U.S. Bank Mobile App.

3. Finally, select Explore ExtendPay to check for qualifying purchases or manage your open plans.

Learn how ExtendPay Plans can benefit you.

How to avoid paying interest on new purchases.

Frequently asked questions

FAQ apply to ExtendPay Plans set up on or after 4/1/22.

What are the benefits of an ExtendPay Plan, and how do I set one up?

No. An ExtendPay Plan doesn’t increase your card’s available credit. It gives you a payment option to help make budgeting easier.

If your credit card account is eligible for an ExtendPay Plan, you’ll receive a notification via email, or you’ll see ExtendPay Plan options when viewing your card account details or eligible transactions online.

For transactions to be eligible for an ExtendPay Plan, they need to be:

- purchased within 60 days prior to signing up for ExtendPay

- more than $100

- made at your regular purchase APR (not a promotional APR)

- less than your purchase balance when you sign up for ExtendPay

ExtendPay Plan eligibility may change based on your credit card account activity.

No. Only purchases made at the regular purchase APR can be put in an ExtendPay Plan.

If your business card account is eligible for an ExtendPay Plan, you’ll receive an email notification, or you’ll see ExtendPay Plan options in your account online. Only your company’s Authorized Officers (AO) can enroll in an ExtendPay Plan. If your company’s card program is set up with central billing, ExtendPay-eligible transactions can be selected by the AO when viewing the central billing account (which includes transactions made on employee cards). For companies with individual billing, the AO can only select transactions they made on their own card account.

Eligible cardmembers can start their ExtendPay Plan enrollment in a few different ways:

- using the link in their ExtendPay Plan invitation email

- by going to their card account details online

- within the transaction details of their eligible purchases

From here, you’ll choose which purchases to bundle and the length of your ExtendPay Plan. Confirm your details, agree to the terms and you’re set! We’ll reach out via email once your enrollment’s been confirmed.

Additional information about ExtendPay Plans, including your eligible purchases and maximum plan amount, will be provided at the time of enrollment.

You can have as many ExtendPay Plans open as you want - up to 50% of your credit line - as long as your account meets the necessary requirements.

The ExtendPay Fee is a fixed fee you’ll pay each month when you have an outstanding balance in an ExtendPay Plan. It’s calculated and shown to you at the time of enrollment. You won’t pay interest on purchases in an ExtendPay Plan during your chosen repayment period - just the fixed monthly fee.

ExtendPay Fees are calculated based upon the plan’s original principal amount, your credit card’s Purchase APR and other factors.

You can choose from a range of repayment options – from 3 to 24 months – designed to work with your budget. Your options may depend on your plan amount and will be shown during enrollment.

What are my options for repaying or managing an ExtendPay Plan?

After creating an ExtendPay Plan, it can take 24 to 48 hours for it to appear in your account.

No. Once your ExtendPay Plan has been confirmed, it will remain active until the balance is paid in full. Plan lengths are final and can’t be changed. However, there are no penalties for early payoff.

You may pay off your ExtendPay Plan balance early by paying your credit card balance in full. That includes any account activity since the previous statement – even pending transactions. To successfully pay your full balance, wait for any pending transactions to post to your account before making your payment.

Any payment made above the minimum payment due, will be applied to your highest APR balances first. That’s why your ExtendPay balance will be the last to be paid off.

Once you’ve paid your ExtendPay Plan balance in full, your ExtendPay Plan is completed, and no further ExtendPay Fees will be charged.

Your ExtendPay Plan will cause your monthly minimum payment to increase. Until the ExtendPay Plan is paid in full, your monthly minimum payment calculation will include your regular monthly payment amount (based on non-ExtendPay Plan balances) plus the monthly ExtendPay Plan principal and monthly ExtendPay Fee. See the minimum payment section of your Cardmember Agreement for more information.

Your final payment may be less than in previous months, due to payments received. But your payments will add up to the total you see when you enroll.

For new ExtendPay Plans – set up April 1, 2022, or later – your payments are included in your credit card’s minimum monthly payment. If you set up multiple new ExtendPay Plans, they will all be included in your total minimum monthly payment. Another option would be to pay your Plan Adjusted Balance, which is the amount you need to pay on your account each month to avoid any interest charges on new purchases during that statement period. It includes your monthly ExtendPay payment due plus the non-ExtendPay portion of your remaining statement balance. You can manage your payments from your account dashboard.

For ExtendPay Plans set up before April 1, 2022: Your ExtendPay Plans are a separate account from your credit card account and will appear under Loans, lines and leases in your account dashboard via online banking or the mobile app. You can view your plan balance and manage payments there.

If your autopay preferences are set up to pay more than the minimum payment due, you may want to adjust your payment amount. If your existing autopay preferences would pay off your entire statement balance, you’ll be prompted to update your preferences before you confirm your ExtendPay Plan.

You can adjust your autopay preferences at any time after setting up an ExtendPay Plan. If your automatic payment is scheduled within two business days from the date you requested the modification, we are unable to cancel or adjust the amount of that payment. Future autopay payments will reflect your requested adjustment.

If you have an ExtendPay balance, the Plan Adjusted Balance is the amount you must pay on your Account each month to avoid paying interest on new purchases. It includes your monthly ExtendPay payment due plus the non-ExtendPay portion of your remaining statement balance. Check your Cardmember Agreement for full details.

Any late or missed payments are subject to late fees and may result in account closure. Any unpaid balance remaining on your ExtendPay Plan after the chosen pay-back period becomes subject to the APR and minimum payment calculation for purchases outlined in your Cardmember Agreement.

How does an ExtendPay Plan affect my rewards or transactions?

Yes. Your eligible purchases will still earn any rewards your credit card would otherwise offer.

Yes. If you pay your previous statement balance, or Plan Adjusted Balance, in full by your payment due date each month, you have a 24- to 30-day interest-free period for new purchases. See your Cardmember Agreement for more information.

If a purchase you’ve selected for an ExtendPay Plan is refunded by the merchant, the returned amount will be credited to your current credit card account balance. Since the refund won’t specifically be applied to the ExtendPay Plan, your ExtendPay balance and monthly minimum payment will not change unless your current balance is paid in full, including any activity on your credit card account since the previous statement.

You can dispute purchases that are in an ExtendPay Plan the same way you dispute other credit card transactions. When you dispute or claim fraud on a purchase that’s in an ExtendPay Plan, your ExtendPay Plan will be reduced by the disputed amount, and all fees paid to date for the disputed transaction will be credited to your ExtendPay Plan. Any prior payments made to your ExtendPay Plan for the disputed transaction will be credited to your revolving balance. Your next statement will reflect your adjusted fixed payment amount.

If the disputed transaction rebills for any reason, it will be set up in a new ExtendPay Plan with the original term length and billed the same monthly fee for the transaction.

Additional questions? Please call the number on the back of your card and a Cardmember Service representative will be happy to help.