Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

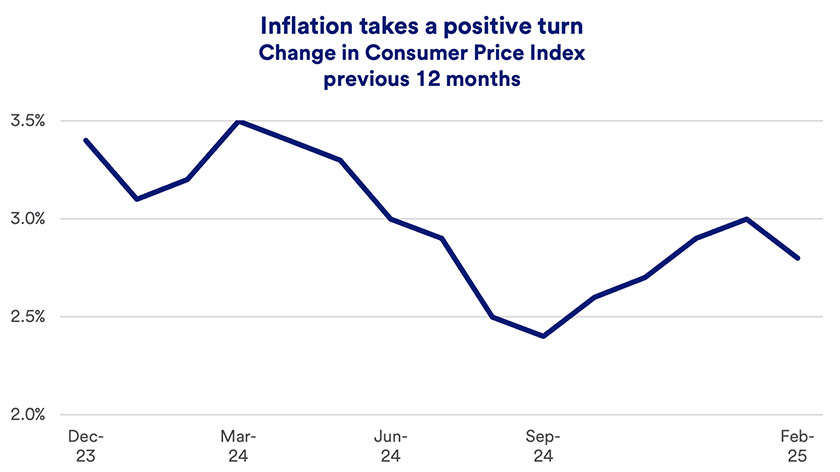

Despite rising inflation fears, the latest data indicate a declining Consumer Price Index (CPI).

CPI for the 12 months ending in February 2025 dropped to 2.8%.

It was a favorable sign amid a period of growing concerns over the potential for tariffs to inflame inflationary pressures.

Amid growing, inflation-driven pessimism among consumers, February’s Consumer Price Index (CPI) report provided modestly encouraging news.

After four consecutive months of rising inflation, CPI for the 12 months ending in February dropped to 2.8%, compared to 3.0% in January. CPI rose just 0.2% in February, compared to January’s 0.5% increase.1

Notably, energy costs for the 12 months ending in February are relatively flat, contributing to more favorable inflation numbers. “Oil prices dropped recently, although natural gas prices are higher,” notes Rob Haworth, senior investment strategy director for U.S. Bank Asset Management. Food costs over the same period rose 2.6%, though egg prices remained an issue. Due to millions of egg-laying chickens being destroyed in response to avian bird flu concerns, shrinking supplies resulted in higher egg prices, an issue that has drawn considerable attention. February’s inflation report shows egg prices up 10% for the month and, for the 12 months ending in February, up 59% (not seasonally adjusted). Other major inflation contributors are transportation services (+6.0% for the 12-month period) and shelter (+4.2%).1

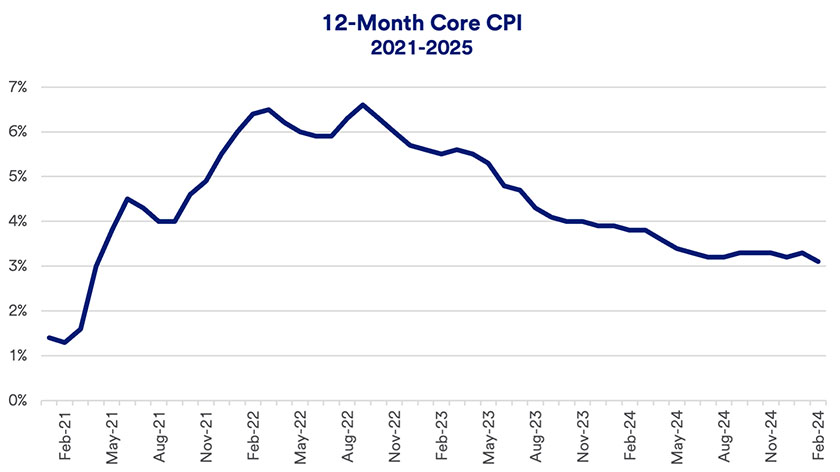

Core CPI, which excludes the volatile food and energy categories, draws significant market attention. For the 12 months ending in February, Core CPI rose 3.1%, its lowest level in nearly four years.1

“The Federal Reserve (Fed) is most focused on core data versus the headline CPI number,” says Rob Haworth, senior investment strategy director for U.S. Bank Asset Management. “Shelter costs are one area that is closely monitored here.” Haworth also notes that core services are another key measurement the Fed studies. “The rate of change is flat to slower, but still elevated.”

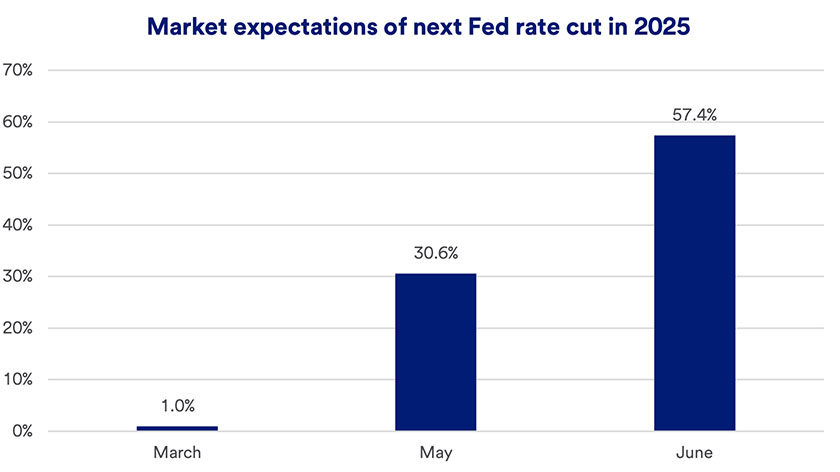

February’s favorable inflation trends are one factor the Fed is likely to assess as it determines its interest rate strategy from here. From September to December 2024, the Fed reduced the federal funds target rate, a key rate that can impact mortgage rates, auto loans and other consumer credit products, by 1.0%. The Fed tempered expectations for 2025 rate cuts. The Fed meets in mid-March with markets not anticipating another rate cut yet. Current projections anticipate the next Fed rate cut to occur in June.2

The Fed has indicated a desire to return the fed funds target rate to what it considers a neutral range, although, according to Haworth, “It’s not clear if the Fed now considers its neutral level to be 3% or 4%.” The rate is currently set to a range of 4.25% to 4.50%. The Fed targets 2% inflation, as measured by the annual change in the personal consumption expenditure (PCE) price index, a measure of spending on goods and services.3 In recent months, progress toward the Fed’s 2% inflation target slowed. For the previous 12 months ending in January 2024, headline PCE trended modestly lower to 2.5%. The narrower “core” PCE (excluding the volatile food and energy categories) dropped to 2.6% compared to the 2.8% readings for the previous two months.4

“Though core inflation prices remain higher than overall inflation, the Fed can live with that at current levels,” says Haworth.

While existing inflation challenges are a key focus for markets and Fed policymakers, less clear are future inflation factors. The Trump administration implemented a range of new tariff policies, including 20% tariffs on Chinese imports and 25% tariffs on steel and aluminum imports from all countries. More potential tariffs are on the table with other countries applying reciprocal tariffs. “The magnitude of tariffs currently being proposed are well beyond previous tariff levels,” says Haworth. “This could push prices higher.”

“The magnitude of tariffs currently being proposed are well beyond previous tariff levels. This could push prices higher.”

Rob Haworth, senior investment strategy director, U.S. Bank Asset Management

That concern is reflected in flagging consumer confidence. The University of Michigan’s February 2025 consumer sentiment survey showed a 10% drop in consumer sentiment from the prior month’s survey. Consumers also became much more fearful of inflation. While anticipating prices rising over the next year by 3.3% in January’s survey, consumers now anticipate inflation topping 4% in the 12 months ahead.5

“Consumers aren’t buying into the idea of temporary inflation,” says Eric Freedman, chief investment officer for U.S. Bank Asset Management. “If tariffs should add to current inflation levels, it’s a pretty high level of price increases on top of today’s 2.8% inflation rate.”

Given uncertainty around tariff policies and other Trump administration economic measures, Fed Chair Jerome Powell says the Fed is watching potential inflationary effects. Powell notes that “survey respondents, both consumers and businesses, are mentioning tariffs as a driving factor.” Nevertheless, Powell believes most long-term measures are consistent with the Fed’s 2% inflation goals.6

As inflation leveled off in 2023 and 2024, equity markets responded favorably. In 2024, the S&P 500 registered its second consecutive year of 25%-plus total returns. Markets have been on a more volatile course in 2025’s opening months, with the S&P 500 reaching an all-time high in mid-February, only to drop more than 9% in less than three weeks.7 While many underlying economic and market fundamentals remain positive, policy uncertainty connected to Trump administration policy proposals may contribute to short-term market swings.

It’s important to remember that a consistent long-term strategy tends to work to the benefit of most investors. This likely precludes any dramatic changes to your asset allocation strategy in response to today’s capital market environment.

The inflation rate measures the change in living costs for the average consumer over a given period. While there are various measures of inflation, the one most followed is the Consumer Price Index (CPI), a measure of changes in the prices paid by urban consumers for a market basket of consumer goods and services. The inflation rate for the 12 months ending February 2025 (as measured by CPI) was 2.8%.1

Changes in living costs, reflected by inflation, represent a loss of purchasing power. This is an important consideration not only in your day-to-day living, but in your long-term financial planning. To improve your quality of life over time, you’ll want to see your income grow faster than the inflation rate. To retain your lifestyle in retirement, you want to be sure that income you receive from your own investments and other sources keeps pace with changes in living costs over the course of retirement. This is why inflation has such a significant impact on individuals.

The Federal Reserve, which is charged with maintaining stable prices, targets a long-term inflation rate of 2%. Between 2012 and 2020, the annual inflation rate was between 0.7% and 2.3%. Since that time, inflation has been much higher. It stood at 7.0% in 2021, 6.5% in 2022 and 3.4% in 2023 before dropping to 2.9% in 2024.6 Still, headline inflation remains above the Federal Reserve’s 2% target.3

Work with a financial professional to determine what steps may be most appropriate for your situation.

Investors wonder if the S&P 500 pullback in March – as President Trump’s sweeping tariff policies are implemented – represents an emerging bearish trend for stocks.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.