Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

In early 2025, even after two consecutive years of 25%-plus total returns, U.S. stocks remain well positioned.

Underlying economic fundamentals and strong corporate earnings create a solid underpinning for U.S. equities.

Capital markets, such as the equity and fixed income markets, match those who have capital to invest with businesses, government entities and entrepreneurs seeking capital to underwrite their plans.

Despite early-year volatility, stocks in 2025 remain well positioned given key underlying fundamentals. The S&P 500 followed up its 2023 total return of 26.29% with a 2024 total return of 25.02%.1 While investors should be prepared for a degree of market volatility, there are reasons to expect that for 2025, stocks can again generate positive returns.

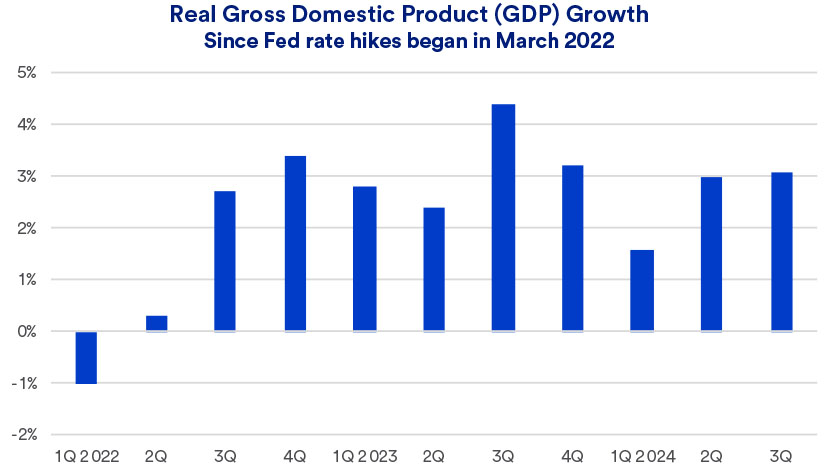

The economy is one key factor driving market optimism. In 2024, economic growth appeared to build momentum. Strong consumer spending is key to ongoing growth. It was responsible for much of the economy’s recent strength. “We still think consumers are in good shape,” says Eric Freedman, chief investment officer for U.S. Bank Asset Management. That should support strong fourth quarter 2024 growth (when it is reported in late January 2025) and continued Gross Domestic Product (GDP) growth going forward.

Capital markets match those who have capital to invest with businesses, government entities and individuals seeking capital to underwrite their plans.

Freedman sees the economy’s strength as critical to continued earnings growth. Corporate earnings are a key stock market driver. In both 2023 and 2024, technology stocks led the market, and Freedman says they remain poised for further gains. “We still like technology stocks,” says Freedman. “There’s a reason for tech stock premium valuations – we’re seeing many companies’ information technology budgets expand.” That should mean continued revenue and earnings growth for technology providers.

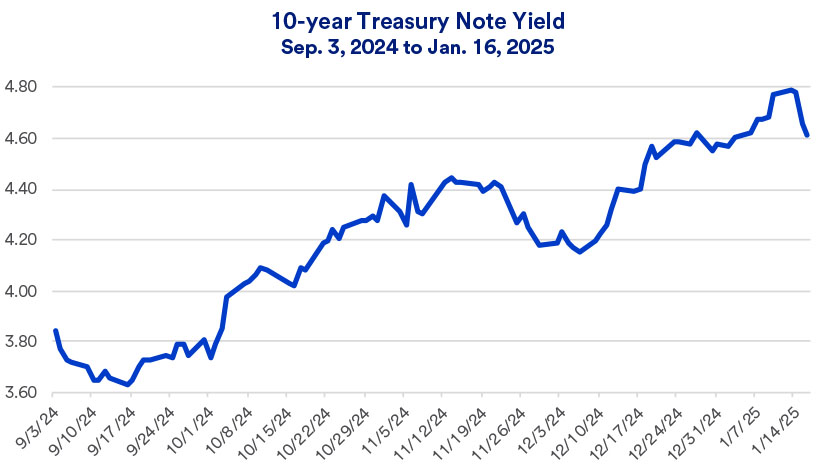

Since late 2022, the U.S. equity market trended in a positive direction, though it encountered increased volatility beginning in December 2024. A contributing factor, according to Rob Haworth, senior investment strategy director with U.S. Bank Asset Management, is longer-term bond yields drifted higher. “With 10-year Treasury bond yields approaching the 5% range, investors sensed there’s more risk in the markets than was the case previously,” says Haworth.

Notably, December 2024’s favorable inflation reports, showing that core inflation (excluding the volatile food and energy sectors) is relatively stable, was seen as a positive market signal. Stocks rallied on the news.

“If consumers are still spending and sentiment about services businesses remains strong, there’s room for equity markets to build on last year’s gains,” says Haworth.

The yield on the benchmark 10-year U.S. Treasury, which dropped to 3.63%, in mid-September, reached 4.79% in 2025’s early trading days.2 The spike in bond yields occurred after the Federal Reserve (Fed) began a series of interest rate cuts totaling 1.0%. Only after December 2024’s encouraging inflation report came out did bond yields reverse their upward trend.

Haworth says given the economy’s current strength, investors are likely to enhance portfolio returns by adding to equity positions and trimming their fixed income positions.

In today’s environment, Haworth says investors should pay particular attention to four primary factors:

The economy’s continued growth is largely dependent on the consumer’s strength. “How strong and resilient will consumers continue to be? That’s an open question,” says Haworth. The healthy labor market kept consumers in a strong position. Haworth notes that consumer debt appears to be at reasonable levels. “Consumers are managing their balance sheets more effectively, and they’re able to do so because we have very low unemployment and reasonable wage growth.”

Earnings, or a company’s profits, are typically one of the biggest drivers of capital market performance. “S&P 500 earnings appear to be coming in at double-digit levels for 2024, and we’re expecting that again in 2025,” says Haworth. “Companies are generating profits at a solid pace.” A continuation of that trend should help support stock prices going forward, though equity market valuations are relatively high coming off two years of outsized returns.

In the fall of 2024, the Fed projected four interest rate cuts in 2025. However, in December 2024, they lowered expectations to just two rate cuts.3 While the Fed can adjust interest rate policy based on economic data, its altered forecast is considered a cautious signal. From the date of the Fed announcement through mid-January, the S&P 500 dropped 3.5%, but sentiment improved after the mid-January release of December’s inflation report.

With the new Trump administration and a Republican-controlled Congress in charge of federal government policy, markets will consider the impact of tariffs, tax plans and immigration enforcement, among other policy matters. “At this point, markets are anticipating more clarity on policy specifics from the Trump administration,” says Freedman. Markets may, over time, react to the new policies’ economic implications.

While these factors are likely to have the greatest impact on equity and fixed income markets, investors need to be aware that other events can temporarily impact the markets and potentially contribute to investor uncertainty. Read more about our capital market perspective in our quarterly investment outlook.

Here are answers to some fundamental questions that may help you better understand capital markets and how they work.

Capital markets are a way to bring together individuals or institutions with money (also known as capital) they wish to invest, and various entities that seek money to underwrite costs to meet specific purposes. Capital markets also facilitate the issuance of securities on an exchange, where stocks and bonds are offered by those seeking capital, to be purchased by investors seeking to put capital to work.

For example, government entities regularly issue debt securities (bonds) to meet costs for major capital projects or, in the case of the federal government, finance day-to-day expenditures. Investors, in effect, lend money to the government entity by purchasing a bond. The borrower is required to pay interest on a timely basis and repay principal when the bond matures.

Capital markets are most commonly consist of stock and bond markets.

A key to capital markets is the issuance of securities. Entities seeking to raise capital will issue debt or equity securities that are exchanged with investors. A corporation, for example, may issue new shares of stock, at a set price. However, once on the open market, the price of a security is generally always changing, reflecting demand in the market.

When raising capital, companies or entities may issue new shares of a stock or bonds, with proceeds from investors going directly to the issuer to meet its current financial purposes. Original issues of stocks and bonds are not always accessible to individual investors, such as in an initial public offering (IPO) of stock. Most individuals purchase stocks on the secondary market, where those who previously purchased stocks or bonds can re-sell the securities they hold.

There are similarities between the two; however, capital markets typically refer to the issuance of new securities to raise capital, while financial markets can refer to all forms of securities trading.

Financial markets encompass a wide variety of exchanges involving traditional securities like stocks and bonds, as well as other types of assets and contracts. Most individuals trade securities on the secondary market.

As you assess your own financial goals, understanding the current and anticipated performance of capital markets may help you more effectively position your assets to achieve your objectives. Discuss your circumstances with your wealth professional to help determine the best approach for you.

Our investment strategies are designed to weather all types of market cycles. Learn about our investment management approach.

Instead of trying to time the market, consider buying stocks and other securities and holding on to them regardless of changes in the market. Read more about the benefits of this long-term investment strategy.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.