Can the job market hold up?

Investors and Federal Reserve (Fed) policymakers are closely attuned to labor market trends. Haworth believes the Fed is increasingly focused on maintaining a healthy employment environment and will be inclined to cut interest rates as necessary to maintain it. So far, with the unemployment rate at 4.0% and average hourly earnings rising faster than the inflation rate,7 to this point, little Fed action seems required. The Trump administration is taking major steps to reduce federal government employment, but federal workers make up roughly 2% of the overall nonfarm job market, according to Beth Ann Bovino, chief economist for U.S. Bank. “The loss of federal jobs would be a negative shock, but we would need to suffer several shocks in order to experience a recession,” says Bovino.

A real-time indicator of labor market strength is found in initial weekly jobless claims data. For the week ending February 22, 2025, jobless claims jumped to 242,000, the highest level since early December.8 According to Haworth, “That number is still historically low.” He says a longer-term, rising jobless claim trend must be seen before markets will consider it a troublesome trend.

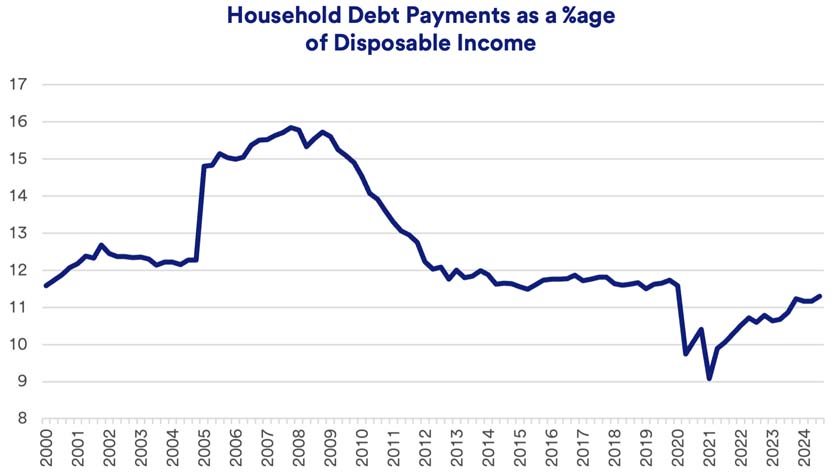

At least for now, Haworth believes the labor market can sustain consumer momentum. “In the current environment, consumers have tools to deal with credit issues and they’re taking advantage of that,” says Haworth.

It’s important to consider the current economic outlook as you evaluate your own portfolio of investments. Talk to your wealth planning professional to assess how your portfolio can be best positioned, keeping in mind current market dynamics and your long-term financial goals.