Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

Technology stocks are off to a slow start in 2025.

This follows two particularly strong years for the technology sector.

Evolving dynamics involving artificial intelligence are contributing to investor uncertainty.

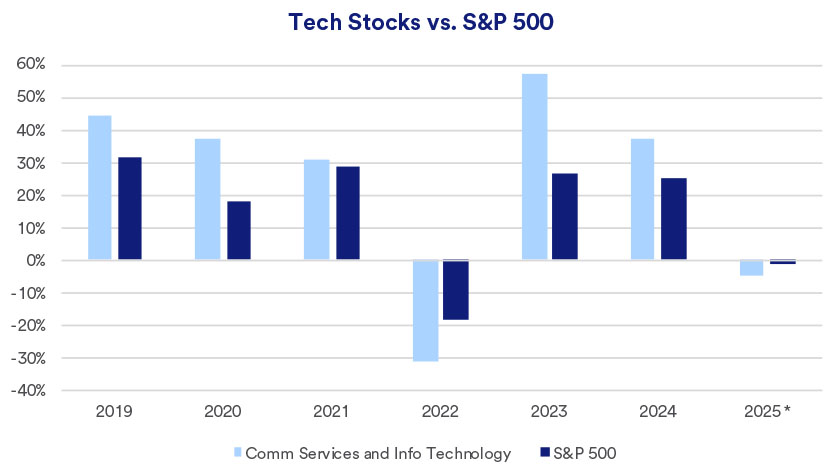

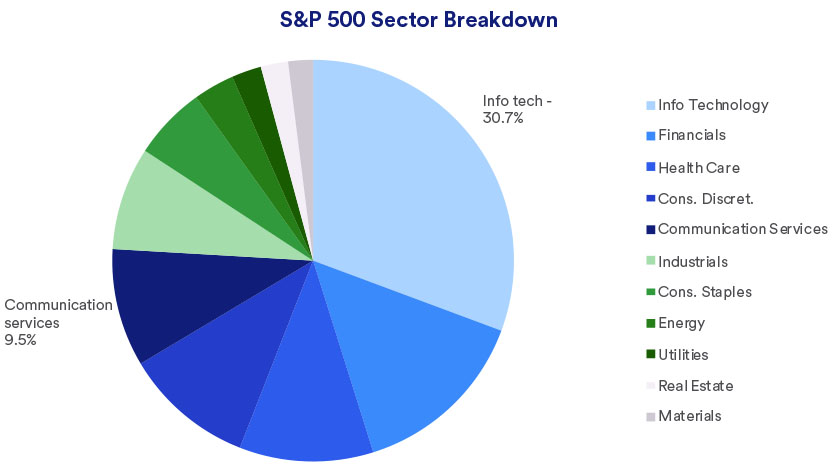

Technology stocks are in the unusual position of trailing the broader stock market so far this year. Year-to-date through March 5, 2025, S&P 500 performance is relatively flat, with a total return of - 0.45%, while the S&P 500 Communication Services and Information Technology sector’s total return was -4.42%. Stocks within this sector comprise two-fifths of the S&P 500’s weighting. Although nearly all other S&P 500 sectors are in positive territory year-to-date, technology issues, due to their prominent position, dragged down the broader market.1

These market dynamics stand in stark contrast to the previous two years. Notably, the S&P 500’s stellar 2023 and 2024 total annual returns, exceeding 25% each year, were driven by a narrow group of stocks dubbed “the Magnificent Seven.” Five of those stocks represent the largest components of the S&P 500’s Communication Services and Information Technology Index. All but one of those stocks encountered headwinds to start the year.

|

Stock |

Price Gain 2023-2024 |

YTD 2025 Price Change |

|---|---|---|

|

Apple |

92.73% |

-6.76% |

|

Nvidia |

819.16% |

-12.65% |

|

Microsoft |

75.76% |

-4.86% |

|

Meta Platforms |

386.55% |

12.12% |

|

Alphabet (Class A) |

114.55% |

-9.65% |

Stock

Apple

Price Gain 2023-2024

92.73%

YTD 2025 Price Change

-6.76%

Stock

Nvidia

Price Gain 2023-2024

819.16%

YTD 2025 Price Change

-12.65%

Stock

Microsoft

Price Gain 2023-2024

75.76%

YTD 2025 Price Change

-4.86%

Stock

Meta Platforms

Price Gain 2023-2024

386.55%

YTD 2025 Price Change

12.12%

Stock

Alphabet (Class A)

Price Gain 2023-2024

114.55%

YTD 2025 Price Change

-9.65%

Source: WSJ.com. Reflects price change from 12/31/22 to 12/31 24; and from 12/31/24 to 3/5/25. No taxes or fees are assumed.

“Technology’s struggles seem linked in large part to changes in perception around the artificial intelligence (AI) marketplace,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. Much of that change came with the emergence of a Chinese-developed AI platform known as DeepSeek. Along with delivering results comparable to many existing, American platforms, it was reportedly developed for a far lower cost and requires much less energy demand to operate than other models. “We generally saw some softening in AI investment spending growth rates,” says Haworth. “The result is we’re seeing slowing growth expectations that previously drove technology stock prices much higher.”

Recent AI developments add a level of technology sector uncertainty that didn’t exist before, but the general outlook remains favorable. AI and cloud computing account for a significant portion of today’s corporate spending, as companies seek to enhance productivity and boost their bottom lines. “The information technology spending we’re seeing is not just from consumers, but on a business-to-business basis,” says Eric Freedman, chief investment officer for U.S. Bank Asset Management. “That’s what companies are spending their capital on.”

“The information technology spending we’re seeing is not just from consumers, but on a business-to-business basis. That’s what companies are spending their capital on.”

Eric Freedman, chief investment officer, U.S. Bank Asset Management

In the near term, says Haworth, investors are increasingly focused on technology stock valuations. “In the long run, these valuations look fine, but in the short run, we have questions to overcome.” Haworth points out such questions include, “How will global tariffs, if implemented, affect the environment and what should AI development costs be in light of the new information that emerged with DeepSeek?”

In recent weeks, the stock market experienced heightened volatility, with technology stocks hardest hit. Do elevated tech stock valuations make them more vulnerable if market weakness persists? “We’d have to see a meaningful earnings deterioration for that to occur, which doesn’t seem likely given current conditions,” says Haworth.

The Trump administration’s increasing focus on expanding tariffs with major trading partners could potentially dampen economic growth. “In a slowing growth environment, technology stocks tend to hold up better because they aren’t as subject to cyclical economic patterns,” says Haworth. “That may mean the current tech stock downturn’s floor is closer than we think.”

Investors have long been drawn to the tech sector’s innovative nature. “Fast is getting faster, and speed, scale and efficiencies across the board don’t happen without technology,” notes Terry Sandven, chief equity strategist with U.S. Bank Asset Management. “To a large degree, technology is impacting all sectors of the economy in all walks of life.” In recent years, the Communications Services and Information Technology index, while experiencing some volatility, has regularly outperformed the broader S&P 500 index. So far in 2025, that trend is reversed.1

“Technology companies offer the potential for strong earnings growth that’s not specifically connected to the business cycle,” says Haworth. “Most of the performance we see is driven by secular, rapid business growth.”

Information technology stocks currently represent the largest sector of the benchmark S&P 500 Index, comprising more than 30% of the index’s value. When you add in communications services stocks, many of which connect with the technology arena, the group represents 40% of the S&P 500.2

AI spending is likely to continue to drive future technology sector growth. “It’s the major investment story for the sector in terms of build out, hardware, infrastructure, software and ultimately, implementation,” says Haworth.

“What’s not clear yet is how companies investing in AI as a way to increase efficiencies or monetize services for end users will benefit from these advancements,” says Haworth. “Ultimately, building out an AI engine needs a buyer on the other end. Who will buy at what cost and how does that become profitable?” muses Haworth.

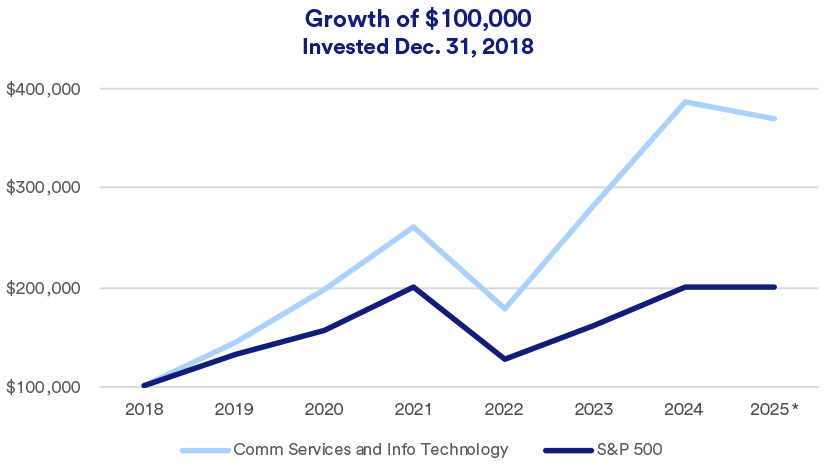

The track record for tech stocks, particularly in recent years, is historically impressive. A hypothetical $100,000 invested in the S&P 500 Communications Services and Information Technology index on December 31, 2018, grew to a value of more than $391,000 by mid-December 2024. While some of those gains were relinquished in early 2025, the accumulated value still far surpasses the return on of the same amount invested in the S&P 500 over the same period.

Recent technology stock volatility isn’t unusual or particularly surprising, given the previous two years’ outsized results. Haworth notes that technology stocks tend to be subject to greater price fluctuation than the rest of the market. “With today’s elevated valuations, there is some risk, but also potential opportunities for future growth.” Haworth expects technology sector dominance of the stock market to gradually level off. “Over time, we should see more beneficiaries in the global economy beyond technology names.”

Although the technology sector is always subject to short-term volatility, Sandven remains optimistic about the sector’s long-term potential. “Companies are looking to get bigger, faster and stronger. They’re not doing that through hiring more people. They’re doing that through technology spending.”

Haworth is likewise optimistic about technology stocks. Nevertheless, he notes that investors need to be selective in their approach to this sector. While some technology startups achieve tremendous success, many firms fail to get off the ground.

As you assess the most effective ways to position your portfolio consistent with your goals and time horizon, be sure to consult with your financial professional.

The S&P 500 Index consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. It is an unmanaged index and direct investment in the index is not possible.

Technology stocks represent companies that primarily engage in businesses relating to current and emerging technologies. They can range from computer hardware and software firms to internet companies to medical device companies, along with many other industries with technology at their core. Technology firms make up many of the largest stocks in today’s market.

For much of the 2010s through 2021, technology stocks appeared to benefit, in part, from a favorable environment featuring low interest rates and significant market liquidity. That supported investments in growth stocks where investors focus less on current earnings and more on potential future earnings. In 2022, as inflation and interest rates moved higher, tech stocks suffered a significant correction, generally performing worse than the broad stock market. However, in 2023 and 2024, with interest rates still high, investors demonstrated greater interest in technology stocks, particularly among companies associated with emerging artificial intelligence (AI) advancements.

Except for a brief period of underperformance in 2024’s third quarter, technology stocks mostly managed to maintain the momentum generated during their spectacular 2023 performance. In early 2025, technology stocks underperformed the broader stock market. Despite that, many technology-oriented stocks carry high valuations. Investors should carefully assess whether a tech stock under consideration is considered “expensive” from a valuation perspective. Tech stocks may not necessarily offer the most attractive values in today’s market. However, for companies that can continue to generate revenue and earnings growth, they retain appealing upside potential. Be sure to consult with your financial professional.

Does a new era of tariffs and retaliatory tariffs run the risk of raising inflation while shrinking economic growth?

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.