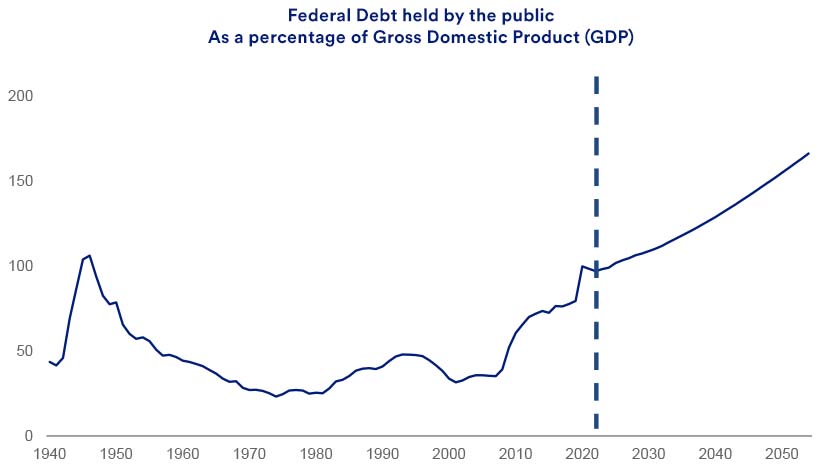

With new policy initiatives under consideration by the Trump administration, the burgeoning federal government debt takes on greater visibility. The national debt totals $36.2 trillion.1 Over the past 15 years, federal debt has doubled in size. Government policymakers and those outside of government frequently warn of potential negative consequences should the mounting debt trend continue. Up until now, the surging national debt has yet to notably detract from economic growth or capital market performance.

Yet debt issues are likely to draw increased attention. After 2025, reduced tax rates set by 2017’s Tax Cut and Jobs Act are set to expire. Among other initiatives, an extension of the tax cuts included in the 2017 legislation is high on President Donald Trump’s and the Republican-led Congress’ priority list. Without offsetting spending cuts or other sources of revenue, such as higher tariffs on foreign imports, tax cut extensions would likely exacerbate debt problems.

“Markets are aware of the issue, but not fully prepared for it,” says Rob Haworth, senior investment strategy director for U.S. Bank Asset Management. “Bond markets are where investor concern over rising debt will be most visible.” Yields on the 10-year U.S. Treasury note are hovering near 4.5%, which Haworth says may reflect some market uncertainty about continued debt growth.

U.S. national debt is an increasingly costly problem

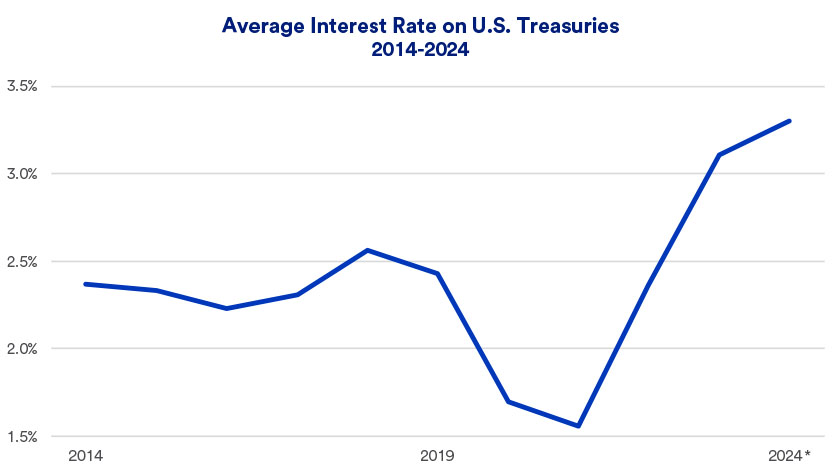

The rising costs associated with the federal government’s large accumulated debt add to the challenge. Interest rates jumped significantly beginning in 2022. As a result, interest costs on the debt are a larger component of federal government spending. The average interest rate for all federal government-issued interest-bearing debt has jumped in recent years, to 3.28% as of December 31, 2024. That’s more than double the average interest rate paid in 2020.2