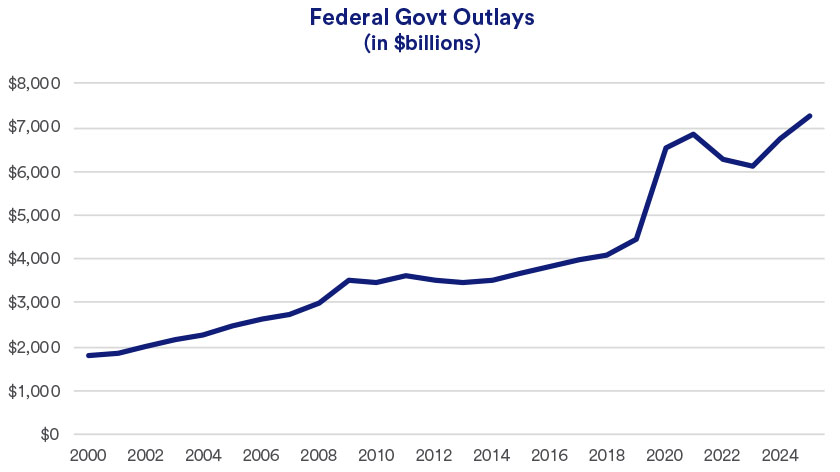

With yet another deadline looming, Congress passed a stopgap spending measure in March that forestalls a government shutdown. While Congress fell short of approving a formal 2025 budget, it funded the government through the fiscal year’s September 30, 2025, end date. This spending package includes a slight increase in defense spending from previous levels and $13 billion in cuts to domestic nondefense spending.

When President Donald Trump signed the measure into law on March 15, it staved off a partial federal government shutdown. Shutdown threats in recent years have become somewhat common, with Congress often struggling to agree to budget terms. With this new measure, Congress is granted some breathing room until it begins work on legislative passage of a new budget for fiscal year 2026.

Debt limit and tax extensions

Congress will soon be required to extend the nation’s debt limit. Doing so allows the U.S. Treasury to continue issuing debt to meet government funding obligations that exceed current tax revenues. Already, the U.S. Department of the Treasury was forced to implement “extraordinary measures” in how it manages obligations to keep the government from defaulting on its debt. However, by summer 2025, these are likely to be exhausted. At that point, a Congressional debt ceiling extension will be required. Some members of Congress have even suggested it may be time to consider legislation that would eliminate Congress’ debt ceiling suspension requirement altogether.

Attention likely shifts now to 2017’s Tax Cuts and Jobs Act, which expires at year’s end. The Republican-led House and Senate are seeking to extend most or all of the tax cuts included in the original bill. However, they must also determine how to offset the negative revenue impact with budget cuts. In addition, President Trump has asked for new tax relief, including eliminating tax on Social Security benefits and on tip income for some workers.

“An additional item that’s been put on the table is eliminating the tax-free status of income from municipal bond debt,” says Rob Haworth, senior investment strategy director for U.S. Bank Asset Management. This is seen as a way to raise revenue that would offset cuts in federal tax rates. However, it would require states and municipalities to offer higher yields in order to attract investors, adding to their expense.

It is expected to be several months before Congress finalizes a tax package. To this point, work on Capitol Hill has been in the background. “Today, markets are focused on Trump administration policies,” says Haworth. In the administration’s opening months, this included the implementation of significant tariffs on foreign imports and the potential for additional tariffs, actions that raise inflationary concerns. It’s also included revamping government agencies and cutting government positions as part of a spending reduction effort.

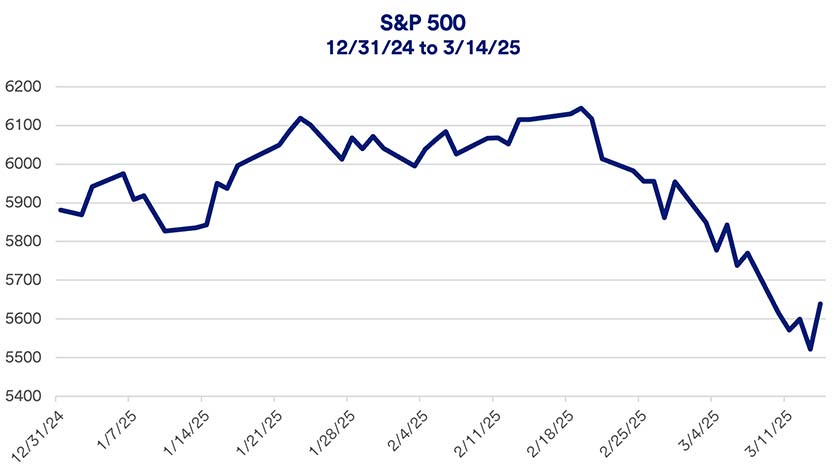

Haworth notes that other factors such as the economy's strength, inflation, corporate earnings and monetary policy, all still contribute significantly to market performance. However, in early 2025, concerns about potential economic fallout from dramatic Trump administration policy shifts resulted in a volatile stock market.