Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

The economic landscape is shifting as the Trump administration pursues more aggressive tariff policies.

On April 2, 2025, President Trump laid out a sweeping wave of new tariffs affecting virtually all imports.

Stocks declined precipitously in response to the administration’s newly announced tariff regime.

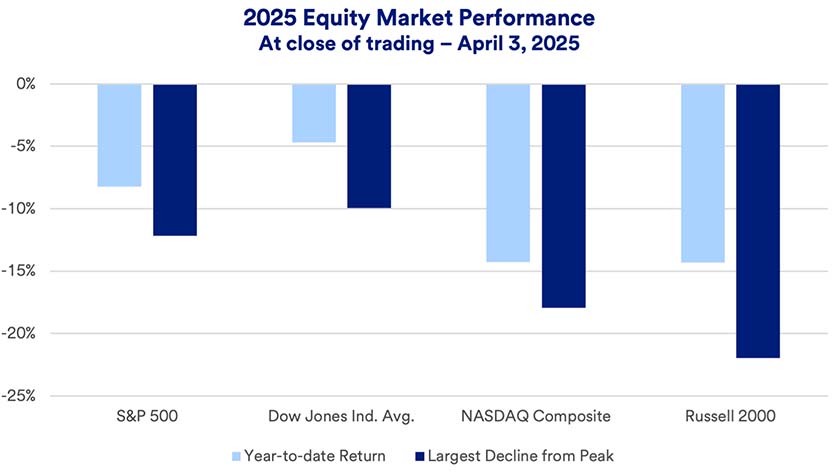

The Trump administration’s tariffs are roiling global equity markets. The S&P 500, Dow Jones Industrial Average, NASDAQ Composite Index, and Russell 2000 Small-Cap Index are all in market correction territory (a drop of 10% or more from peak levels). On April 3, 2025, the Russell 2000 Index crossed into bear market territory (a decline of 20% from peak values).1

President Trump’s April 2 announcement provided a level of clarity on his tariff intentions that was previously lacking. What’s less clear is the potential economic fallout from what represents a significant shift in the global trade environment.

President Trump’s more protectionist stance contrasts with an environment dating back to the 1980s promoting free global trade. As political barriers such as the Iron Curtain were dismantled, trade opened between “the West” and many countries in the Eastern bloc previously considered off limits. In addition, China shifted at least in part to more of a capitalist economic mindset. U.S. companies opened facilities in previously off-limit countries or established working relationships with companies within those nations.

“The April 2 tariff announcement came in far more stringent than markets anticipated. This has opened a new risk dimension for the global economy and for corporate profits.”

Eric Freedman, chief investment officer, U.S. Bank Asset Management

One result was companies moved significant manufacturing activity out of the U.S. as to capitalize on cheaper foreign production costs. While this took a toll on a segment of the domestic workforce, the global economy, including that of the U.S., enjoyed notable growth.

President Trump uses tariffs as a negotiating tool but also claims he is trying to impose tariffs on countries to promote fairer trade conditions for U.S. products. He also suggests tariffs generate significant federal revenue, allowing for lower personal income and corporate taxes.

“One aspect that’s affecting markets is the idea that tariffs generate near-term pain with an uncertain gain going forward,” says Rob Haworth, senior investment strategy director at U.S. Bank Asset Management. “The economy will feel tariffs’ growing impact without experiencing immediate upside.”

In February 2025, President Trump began implementing new tariffs, many targeting major trading partners such as China, Mexico, and Canada. On April 2, he laid out a far more comprehensive tariff policy that includes:

While the April 2 announcement did not include additional tariffs on Canada or Mexico, the Trump administration previously applied 25% tariffs to goods not compliant with the U.S.-Mexico-Canada trade treaty. In addition, 25% tariffs now apply to all automobile imports with a similar tariff on imported auto parts scheduled to begin in May. The administration has also applied universal 25% tariffs to steel and aluminum imports.

“The April 2 tariff announcement came in far more stringent than markets anticipated,” says Eric Freedman, chief investment officer for U.S. Bank Asset Management. “This has opened a new risk dimension for the global economy and for corporate profits.”

The net result of the nation’s new tariff policies represents a marked difference from previous policy and the highest U.S. tariffs on record since the early 1900s.2

Global markets are reeling after President Trump’s April 2 tariff announcement. On April 3, U.S. stocks suffered their worst one-day decline since 2020’s onset of the COVID-19 pandemic. As a result, the S&P 500 and NASDAQ Composite index are back in market correction territory (a decline of 10% or more from peak levels). The Dow Jones Industrial Average is on the verge of a correction. The small-cap Russell 2000 Index is now officially in a bear market, a decline of 20% or more from its recent peak.

Another concern with the current tariff policy is determining winners and losers. “It’s unclear what industries or equity market sectors would most benefit from tariffs,” notes Haworth. “The risk is that tariffs and retaliatory tariffs ultimately raise inflation while shrinking the economic pie.”

In early 2025, the negative impact of tariffs was concentrated in U.S. equity markets. While U.S. stocks are in negative territory for the year, overseas stocks are performing better. Industries highly reliant on overseas suppliers, such as technology and consumer discretionary sectors, are experiencing the most significant declines.3

Freedman says that trade relations are closely tied to other geopolitical tensions that have arisen among Western alliances. “These issues all coalesce into one broader question of geopolitical relations. There was a trading block of considerations in prior administrations, including trade agreements and alliances like NATO and the United Nations,” says Freedman. “These are less of a priority for the Trump administration, so it requires an adjustment and recalibration.”

Along with generating a new source of federal government income, another Trump administration tariff policy goal is to attract industry back to the U.S. Trump and others suggest that companies will determine it makes sense to build production facilities in the U.S. to avoid tariffs required on imported products. “There are thoughts that there will be tariff revenue and jobs that will emerge from tariffs,” says Freedman. “The question is when will those start while in the meantime, there are costs to be borne. Costs will come before revenue.” Freedman notes that companies choosing to build plants will require a significant dollar investment, and the process will take time.

Haworth points out that it isn’t possible to move all types of production to the U.S. “For example, most avocados come from Mexico,” says Haworth. “If tariffs are tacked on to avocado prices, buyers don’t have sufficient alternatives to replace them.”

In the near term, the impact of tariffs will likely remain an important economic consideration. “The greatest risk is that economic growth slows, and inflation increases,” says Haworth. In its most recent estimate, the Federal Reserve’s (Fed’s) policymaking Federal Open Market Committee projected such a scenario. The Fed’s March 19, 2025, Summary of Economic Projections showed inflation rising from current levels and 2025 Gross Domestic Product (GDP) growth falling below 2%.4 According to Fed chair Jerome Powell, “some good part of (goods inflation) is coming from tariffs.” However, Powell also believes that it may not affect longer-term inflation expectations.5

“Maybe we can weather the storm of slower growth and higher inflation,” says Haworth. “But it’s unclear where policy will sit, which complicates the investment environment.” The extent to which tariffs hamper economic activity is a primary equity market concern. If consumer spending rises as in recent years, markets will be better positioned to weather the storm. Investors' concern is whether significant economic weakness results if higher tariffs slow global activity. A key question is whether the Trump administration’s economic policy transition overtakes the underlying economic corporate profit momentum.

Despite the market’s recent gyrations, “We are big believers in staying invested,” says Freedman. “Investors should focus on an asset allocation strategy consistent with their liquidity needs, stomach for risk, and comfort with asset classes we believe in.”

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. The Nasdaq Composite Index is a broad-based market index that includes more than 3700 stocks listed on the Nasdaq stock exchange. The Russell 2000 Index is a stock market index that measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. The Russell 2000 is managed by London's FTSE Russell Group, widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies in the U.S. market. The S&P 500 Information Technology comprises those companies included in the S&P 500 that are classified as members of the GICS information technology sector. The S&P 500 Consumer Discretionary comprises those companies included in the S&P 500 that are classified as members of the GICS consumer discretionary sector. The MSCI EAFE Index is designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia (MSCI EAFE EU) and the Far East (MSCI EAFE Far East), excluding the U.S. and Canada. The MSCI Emerging Markets Index captures large and mid-cap representation across emerging markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

A tariff, also known as an import duty, is a government levy on goods imported into the country from other nations. Tariffs are collected when items clear through customs. Tariff rates vary by type of product and the originating country. In many cases, tariffs are applied to certain products or goods from specific countries to create a more competitive environment for domestic producers of similar goods.

In an international sales transaction, the buyer is usually responsible for paying a tariff. The importer of such a good pays the tariff to the government. The importer then may decide whether to pass this cost along to consumers by raising the domestic selling price of the good. This price inflation could alter consumer demand as the cost of the good rises.

President Trump has long been a proponent of tariffs to level what he believes is an uneven playing field for U.S. interests. Trump employed tariffs, particularly on China, during his first administration from 2017 to 2021. At the start of his second term, he added more tariffs on China and a new 25% tariff on steel and aluminum imports worldwide. He also laid out plans for 25% tariffs on Mexican and Canadian goods and tariffs affecting Europe and other countries. Trump’s approach represents a significant shift from previous administrations that promoted open trade between nations.

In early 2025, tariff policy actions and proposals appeared to be a visible aspect of increased market volatility. In about a three-week period, the S&P 500 experienced a market correction (a decline of 10% or more from its peak level). If the U.S. adds new tariffs and other countries apply retaliatory tariffs, investors may be concerned about a potential negative global economic growth impact. Markets, to this point, appear to be waiting for further clarification. According to Eric Freedman, chief investment officer of U.S. Bank Asset Management, “We understand there will be some tariffs, but how much is real, how much is a negotiating tactic, and when can I expect to have a clearer understanding of what consumer demand may look like.” Until those questions are answered, the potential market impact may be difficult to quantify.

Investors are increasingly focused on how the administration’s policy changes are impacting markets and the economy.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.