Key takeaways

Among other fiscal policy matters on Congress’ agenda, suspension of the debt ceiling is high on the list.

The U.S. Treasury Department has implemented “extraordinary measures” to temporarily keep the government functioning.

Congress must act soon to allow the issuance of additional Treasury debt to meet government funding needs.

In its first weeks since taking office, the 119th U.S. Congress has taken little action, with most of the headlines from Washington D.C., dominated by President Trump's executive actions. However, there are major fiscal issues on the table that require Congressional action. Addressing the debt ceiling is one of them.

The debt ceiling requires frequent adjustments to allow the federal government to continue to borrow to pay its obligations. While this is sometimes addressed as a standalone issue, in 2025 it is likely to be rolled into broader legislative actions. To keep the government functioning, Congress not only must extend the U.S. Department of the Treasury’s borrowing capacity but must also finalize a fiscal year 2025 budget. In addition, a key Congressional priority is to consider an extension of the Tax Cuts and Jobs Act (TCJA), the terms of which are set to expire at the end of the year. If not extended before 2026, tax rates will rise.

When must the debt ceiling be addressed?

The actual Congressional deadline to address the debt ceiling issue is not yet clear. The Treasury has now applied what are referred to as “extraordinary measures,” to generate additional cash to meet financial obligations while staying within the existing debt limit. These measures allow Treasury to temporarily reduce certain types of government debt. “The situation is further complicated during tax season, because it’s not certain how tax receipts and tax refunds will balance out,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “It’s a question of how net flows will impact available funds.”

“Markets witnessed battles over the debt ceiling before, and always saw the situation resolved, says Rob Haworth, senior investment strategy director for U.S. Bank Asset Management. “The expectations are that this will happen again.”

Debt ceiling extensions were mostly routine matters until recent years, when Congress’ self-imposed requirement to raise the debt ceiling became more political. As a result, Congressional action on suspending the debt ceiling limit often didn’t occur until right up to a funding deadline, or even after. “Markets witnessed battles over the debt ceiling before, and always saw the situation resolved,” says Haworth. “The expectations are that this will happen again.”

The need for such Congressional action has occurred nearly one hundred times since World War II. Congress last suspended the debt ceiling in June 2023, sufficient to carry it into January 2025. At that time, then Treasury Secretary Janet Yellen began implementing extraordinary measures

What is the debt ceiling?

The federal debt is the total amount of money the government owes for spending on everything from Social Security and Medicare to defense programs and other types of domestic and overseas expenditures. The debt limit set by Congress represents the funds that the U.S. Treasury is authorized to raise through debt security offerings to pay the government’s operating costs.

Although it’s a somewhat arcane procedure, raising the debt ceiling allows the U.S. Treasury to continue debt issuance to pay for Congressionally approved federal government spending. “Increasing or suspending the debt limit does not authorize new spending commitments or cost taxpayers money,” explained Yellen. “It simply allows the government to finance existing legal obligations that Congresses and Presidents of both parties have made in the past.”1

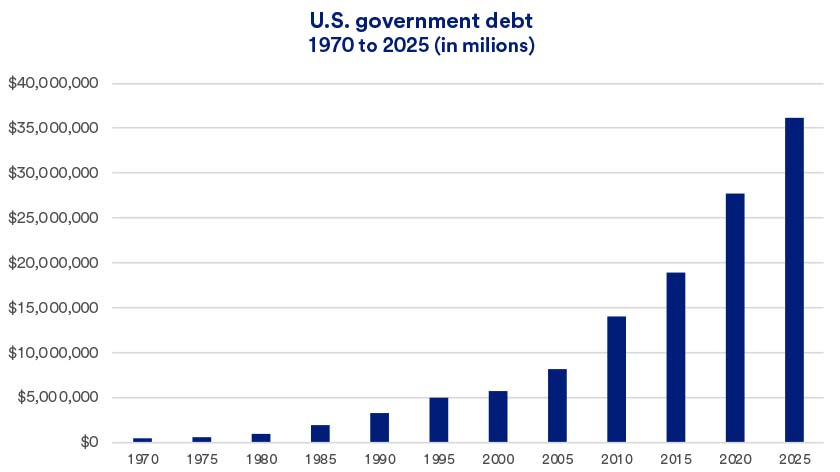

U.S. federal government debt steadily climbed in recent years. In early 2025, total debt exceeds $36 trillion.

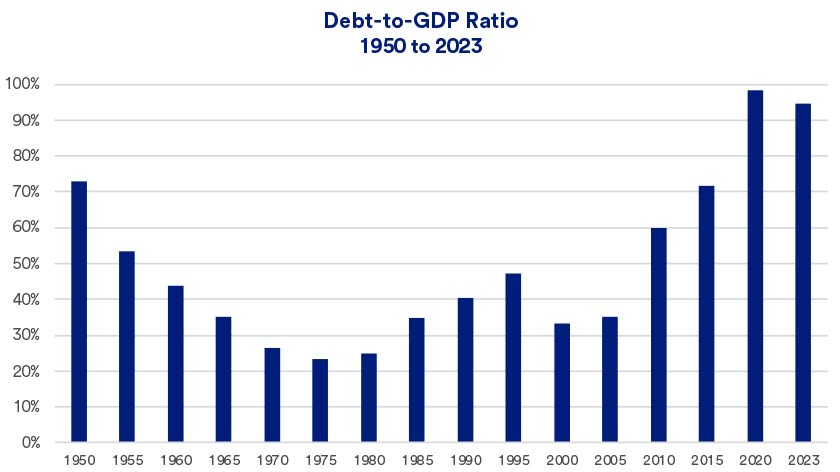

Growing government debt that’s consistent with the nation’s economic growth is not considered problematic. However, as a percentage of Gross Domestic Product (GDP), the primary measure of the nation’s economy, debt has become more significant in recent years.

Differentiating between debt and deficits

Media reports frequently reference government deficits as well as the federal government debt. While related, they represent two distinct features of government fiscal policy.

According to the U.S. Department of the Treasury, the deficit is the difference between the money taken in by the government (revenue) and what the government spends (outlays) in a given year. For example, in 2024, the U.S. government ran a $1.83 trillion annual deficit.2

Debt, on the other hand, represents accumulated deficits over the years. The government has incurred deficit spending in every year since 2001.

A potential resolution

Republican leadership in both the House and Senate are crafting legislation that includes addressing the debt ceiling limit. Passing an additional debt ceiling suspension, at this point, will likely be linked to other policy measures within the same package. Congress also faces a March 14, 2025, deadline to approve the fiscal 2025 budget or, at least, pass a continuing resolution to keep the government funded. Tax policy provisions are also likely to be included in any legislative package, along with possible cuts to certain federal government programs.

“Both the budget deadline and the debt ceiling issue give Congress an incentive to resolve one or preferably both issues before a government shutdown occurs,” says Haworth. The last government shutdown took place in late 2018 and early 2019, lasting 35 days.

How markets view debt and budget challenges

It’s become more common for Congress to regularly run up against deadlines before suspending the debt ceiling. As a result, markets appear to be taking today’s pending deadline in stride. “The market’s not going to start worrying about it until we approach a shutdown date,” says Haworth.

While government budget and debt issues previously led to modest external rating agency downgrades for U.S. Treasury debt, Haworth doesn’t see a major threat of further downgrades. “There isn’t any apparent reason for rating agencies to raise doubts about the U.S. government’s ability to honor its debt obligations,” says Haworth.

Staying focused

With the flurry of news out of the nation’s capital since President Trump regained the White House, it can be easy for investors to become distracted. Yet such events, when they occur, represent just one factor to consider as you assess how your own portfolio is positioned given current market and economic dynamics and your long-term financial goals.

Talk to your financial professional if you have questions or want to discuss your particular situation.

Tags:

Related articles

Economy maintains momentum

After two years of solid growth, how is the economy setup to perform in 2025?

2025 Investment Outlook

While we continue to focus on growth and inflation as the two principal capital market drivers, geopolitics will likely attract considerable investor attention to start 2025.