Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

Key takeaways

Existing home sales and housing starts were up in February.

Higher mortgage rates continue to hamper housing market activity.

Investor demand for REITs is slowly increasing.

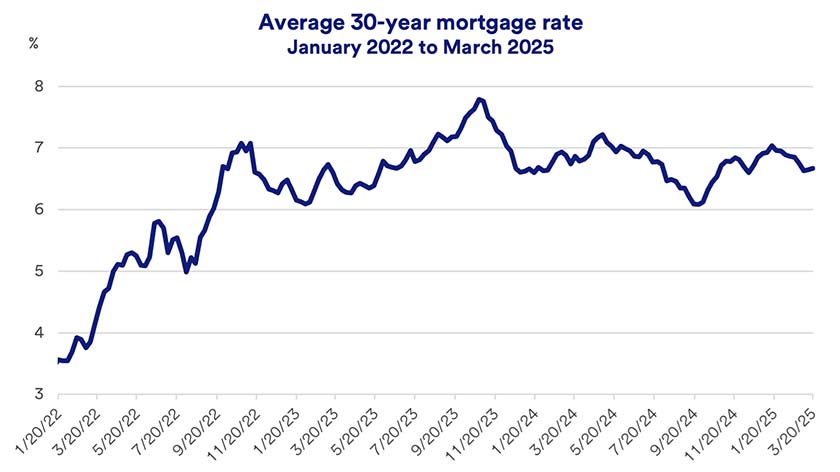

February’s housing market activity picked up, with increases in both existing home sales and housing starts. It provided an encouraging signal to what has been a long-struggling housing market. “Before February, weather-related issues slowed activity,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “Yet existing home inventories remain low, keeping home sales numbers down.” Average 30-year mortgage rates drifted modestly lower in recent weeks but remain well above early-2022 levels.1

In February 2025, existing home sales rebounded from a January setback, climbing 4.2%, expanding its annualized sales pace to 4.26 million homes. While improved from January, the annualized sales pace remains historically low. However, February 2025’s sales rate was down 1.2% from the same month last year.2 Haworth says elevated mortgage rates continue to hamper housing market activity. “People who currently own homes maintain a mortgage with an average rate near 3.5%,” notes Haworth. “That’s approximately 3% below today’s 30-year mortgage rate.

According to the National Association of Realtors, existing home inventory recently rose to the equivalent of a 3.5-month supply.2 That number held in February. Lagging existing home inventory has contributed to persistently high home prices. “Higher rates are making people in homes financed with low mortgage rates reticent to move,” says Haworth. “The challenge is we ultimately need more homes on the market.”

“The combination of rising home prices and elevated mortgage rates means that housing affordability remains a meaningful problem."

Rob Haworth, senior investment strategy director, U.S. Bank Asset Management

February 2025 privately-owned housing starts rose by 15% compared to January starts. While that’s an encouraging sign, housing starts remain below levels from the same period one year ago.3 Haworth also notes that homebuilder sentiment, a possible indicator of when supply might expand, is negative. “Homebuilders, for now, seem to be responding to slower traffic among potential buyers due to early 2025 weather issues,” he says. “It appears, however, that new homebuyers are still out in the market looking for the right buying opportunity.”

One problem, according to Haworth, centers on market uncertainties as new Trump administration policies emerge. “There’s a lot we don’t know about how, in the next 3-6 months, various policies might impact the labor market, interest rates and building supplies,” says Haworth. For example, possible immigration crackdowns may reduce the construction labor force. Tariff policies could impact building supply costs. Interest rates could potentially adjust higher if inflation again becomes a major issue.

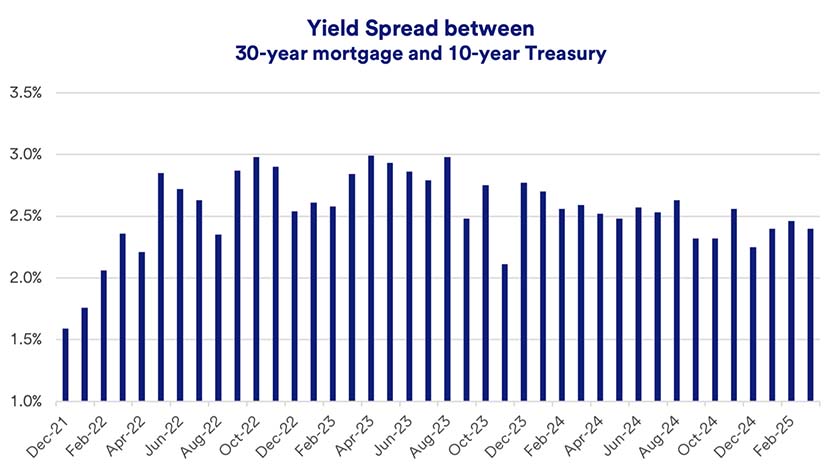

Mortgage rates are typically higher than yields on the benchmark 10-year Treasury note. Modestly declining mortgage rates in 2025 generally tracked with 10-year Treasury bond yield changes. “Today’s mortgage rates reflect bond market yields, but also a relatively wide premium spread between 10-year U.S. Treasury notes and mortgage rates,”4 says Haworth. He believes Federal Reserve (Fed) actions play a role in keeping mortgage rates elevated. “The Fed is still determined to reduce its $2 billion+ balance sheet of mortgage-backed securities,” he says. “The Fed isn’t a buyer in the market, so private investors need to step up.” Haworth says this results in tighter demand for mortgage-backed securities, keeping spreads higher compared to Treasury yields.

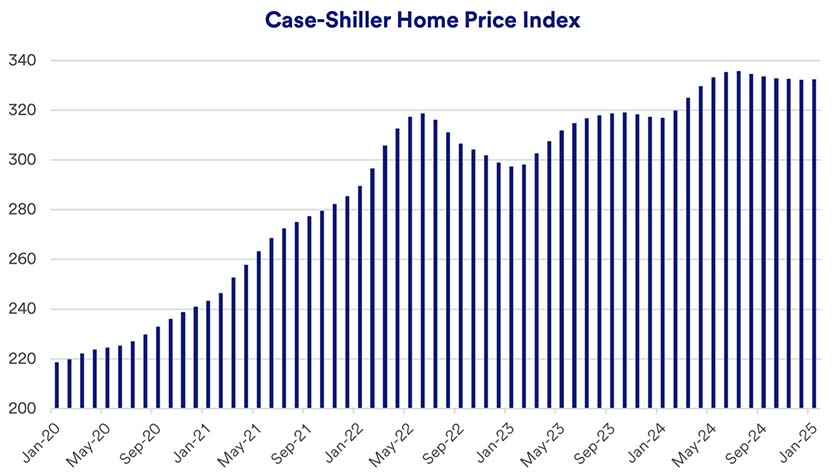

By mid-summer 2024, home prices, as measured by the Case-Shiller home price index, reached all-time highs. However, from August to December, home prices fell, but in total only about 1% below the index’s highest level. In January, the Case-Shiller index rebounded modestly.5

According to the residential real estate brokerage firm Redfin, the median monthly mortgage payment in January 2025 (based on average 30-year mortgage rates and home prices) was $2,793, only a few dollars below the all-time high.6 “The combination of elevated mortgage rates and higher home prices means that housing affordability remains a meaningful problem,” says Haworth.

Some investors seeking to enhance portfolio diversification turn to real estate investment trusts (REITs). In recent years, REITs have underperformed. On an average annualized basis for the five-year period ending in 2024, the S&P Developed REIT index gained just 1.59%, compared to 14.53% per year for the S&P 500 index. In 2025, REITS regained some ground, returning 1.95%% year-to-date compared to -1.63%% for the S&P 500.7 “Year-to-date strong REIT performance is mainly due to recent interest rate declines,” says Haworth. “Investor demand is slowly creeping up as fundamental REIT value is more apparent following a difficult period.”

Housing prices fell over a seven-month period in 2022 and early 2023 and housing demand dropped when mortgage rates first began to rise. However, housing prices recovered to new record levels in late 2023. After declining in three consecutive months in late 2023 and early 2024, housing prices recovered beginning in February 2024 and reached new all-time highs in consecutive months from March through July 2024. From August through December 2024, housing prices modestly declined.5 Still, homebuyers must deal with dual challenges of persistently elevated mortgage rates and still lofty home prices.

The decision to purchase a home may depend on many factors, including your own personal priorities and financial situation. Some people may require a larger living space or have a desire to settle in a specific community. Those priorities may take precedence over the current mortgage rate environment. “Some people will also buy the home that appeals to them regardless of mortgage rate conditions,” says Haworth. “Finding a different home down the line does not automatically substitute for the preferred house you find today.” While in an ideal world, mortgage rates would be more affordable, each potential homebuyer must determine the right time to purchase a house.

Interest rates began moving up in 2022, and mortgage rates followed suit. Today’s mortgage rates are close to double the rates that existed in 2021.1 As a result, homebuyers are required to make higher monthly mortgage payments. This caused some potential homebuyers to step back from the housing market. At the same time, it led some current homeowners who potentially were interested in moving to a different house to hold off doing so, and preserve their current, low mortgage rate. Therefore, housing activity has slowed significantly, attributable primarily to the recent change in the interest rate environment.

Consider consulting with a wealth management professional to determine when and how real estate investments might be a good fit for you.

As interest rates change, learn what the ripple effects across capital markets may mean for investors.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.