Run your business efficiently with U.S. Bank business checking accounts.

Security

Minimize risk and protect company information with fraud prevention tools.

Money movement

Transfer money and pay multiple billers in minutes.

Connect programs

Integrate your third-party accounting, budget management and tax programs for a full view of your finances.

Monitor cash flow

Forecast cash flow with a business banking dashboard to help you plan ahead.

Get more out of our featured business checking accounts.

Discover more business checking accounts designed for your needs.

Get started with an opening deposit of $100.

Need more information? We’ve outlined comprehensive account pricing, terms and policies in these brochures:

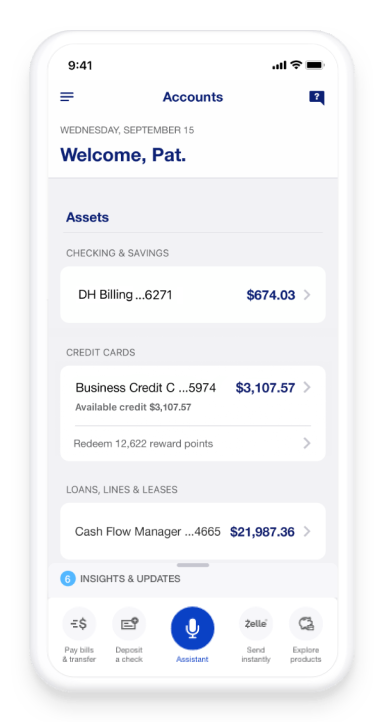

Business banking 24/7

Explore more business checking resources.

Compare business checking accounts.

Get an in-depth snapshot of our business checking accounts.

Unsure which account is right for you?

Answer a few questions to find the right fit for your business.

Easily switch to a U.S. Bank business checking account.

Use our business EZ Switch Kit to transfer to a U.S. Bank business checking account.

Frequently asked questions

To open a business checking account, you’ll need:

- Your business’s Employer Identification Number (EIN) or tax ID number, or your Social Security number if you’re a sole proprietorship.

- Articles of Incorporation, Articles of Organization or a charter or similar legal document that indicates when your company was formed. (Not required for sole proprietors.)

- Social Security number for you and anyone else authorized to sign checks or make transactions on behalf of your company.

- Name, email address and phone number for any additional owners with 25% or more ownership in the company.

- Learn more about application requirements based on your business structure

We can help you find the business checking account that’s right for your business. Get a recommendation.

First, you’ll want to determine which features and benefits are the best fit for your business needs. Visit our business banking comparison chart to see all the flexible and convenient account options U.S. Bank has to offer, or take a short quiz to get a personalized recommendation.

Yes. Every U.S. Bank business checking account includes a U.S. Bank Visa® debit card.