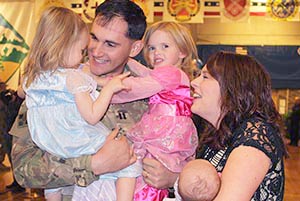

Before Kevin Breuer became an assistant VP at U.S. Bank, he served six years in the U.S. Army, and got out as a captain. Those were busy years: he was deployed twice, moved between four U.S. bases, and had three children.

Kevin shares the biggest financial challenges his family faced during his active duty in the military, as well as which resources he found most helpful.

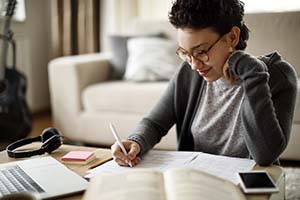

Q: Do you use a budget? And if so, how do you stick to it?

A: The first few years I was in the army, my wife and I didn’t really talk about money. We paid our credit card bill on time, and we weren’t in trouble by any means, but we weren’t intentional about where our money was going, and we didn’t communicate about it.

In 2015, while I was in Kuwait, my wife and I read a book on budgeting. After reading it, we paid off a significant amount of debt in nine months while I was deployed. Then we saved three to six months worth of income in an emergency fund and saved for a down payment for a house, all in about two years. Now we use an app to help us budget and we stick to it down to the penny. My wife and I talk about our budget every day, maybe more than once. Keep in mind that a budget doesn’t have to be a restriction, it’s knowing where you’re money is going, and being intentional about where it’s going.

Q: What kind of debt did you pay down? Did you use the Servicemembers Civil Relief Act (SCRA) to lower your interest rates?

A: I honestly didn’t know the Act existed until I started working at a bank. It might not be the most helpful for anyone joining straight out of college, but there are plenty of people serving right now who could take advantage of that protection and don’t.

Q: During your time on active duty, how did you handle major purchases, like homes or cars?

A: While in the military we purchased three cars and three houses. Basically every major duty station we went to, we purchased a house. When we purchased our third house, we saved for a down payment. We actually didn’t end up using a VA home loan the third time. We love that product, and we went through the process, but we just got a better rate with a conventional loan.

Q: Did you save for retirement while on active duty? Did others in your unit?

A: We did. We decided not to use the Thrift Savings Plan and opened our own IRAs. For a while, we just put whatever leftover money we had into the IRA and weren’t intentional about it. After we got serious about budgeting, we made sure to put 15 percent of our income into those IRAs, and now into my 401(k). We look for good mutual funds with a long track record of steady returns, and U.S. Bank has financial professionals that can help you with that.

Q: What were some of the biggest financial challenges you faced on active duty?

A: When it comes to budgeting and financing in the military, it’s all about managing transitions. Every transition is stressful and they happen all the time, whether it’s getting married or having kids. And, you move every two or three years. In between those changes, you have deployments, which are also transitions. All those things can make it hard to budget and to stick to your budget, especially if your family doesn’t communicate well about it. So it’s really about managing those transitions, and preparing for them.

For example, the military gives you different options for moving, like paying up front and getting reimbursed, or not paying for anything. You have to call all of your banks to make sure they know you’re moving. You have to make sure you have power of attorney squared away if you deploy. And make sure your family will be taken care of if something happens when you’re overseas; the military automatically gives you $400,000, but that’s not enough to sustain a family for very long.

Q: What advice do you have for people currently on active duty?

A: Do the research and make sure you’re intentional about everything, whether it’s planning a move or getting ready to deploy. If it’s your first deployment, find someone in your unit who can be a good mentor, and make sure your life is squared away before you leave.

And really, the biggest thing is communication with your significant other and making sure you’re on the same page for all the things that could happen. And check in on the day-to-day stuff, too. To this day, my wife still runs our daily finances, since that’s what she had to do when I was in the military, and that has been a blessing. That can alleviate a lot of the stress.

One thing that’s counterintuitive is that deploying can make it easier for your family to budget because you get a huge increase in pay, and while you’re gone all of your expenses are covered. It can be a good opportunity to pay down debt or start saving.

Q: Any final advice?

A: The last thing is to be careful about any “too good to be true” offers you encounter, especially those right outside of your base. There are payday lenders. There are used car lots that will give you 18 percent interest on your loans but make it seem like a good deal. These people know that servicemembers get a paycheck every two weeks and are ready to take advantage of that.

I had plenty of privates who came through and the first thing they did was buy a sports car without realizing they were paying 20 percent interest. The sergeants that those people report to could have steered them away from those decisions. So bringing questions to a superior or someone with more experience can help you avoid getting into some of those traps.

To get started on building your financial foundation, follows these steps to create your own budget.

Kevin’s 5 tips for active duty military

- Budget: Create one and track your spending. Be intentional with your spending. A budgeting app can help.

- Find a financial mentor: Someone in your unit went through whatever decision you’re dealing with.

- Go mobile: Make sure your bank offers online and mobile banking.

- Use your benefits: Don’t waste the resources that are available to you, such as the Servicemembers Civil Relief Act, the GI Bill and VA home loans.

- Pay attention: Be wary of scams meant to trap active duty military with deceptive advertising. Read the fine print and get a second opinion.

For more information and financial support for military members, contact the U.S. Bank Military Service Center.