Ready to save?

Maximize your savings with competitive CD rates.

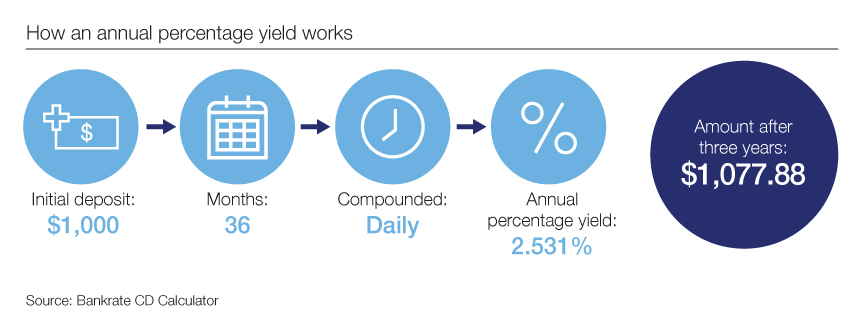

You probably already have a checking or savings account from which you pay monthly bills and cover daily expenses. You might even have a retirement savings account like a 401k or IRA. If you also have some extra money that you won’t need right away, consider growing it with a certificate of deposit (CD). A CD may give you a higher return than a traditional savings account, while still allowing you to withdraw your money after a set period of time that you select when you open the account.

Maturity: Your CD reaches maturity at the end of the term you chose when you opened the account. Then, either you can withdraw the money, or you can reinvest in another CD. If you do nothing, a bank typically will automatically reinvest your money in another CD with the same term. If you want to withdraw your money or move it into a CD with a longer or shorter term, you’ll need to let the bank know during the grace period of the CD. This is a period of time after the CD matures during which you can make changes to your account with no penalty. Then, you can transfer your deposit to your checking or savings account, or you can purchase another CD with a different term.

Early withdrawal: If you withdraw money before the CD’s term ends, you’ll usually have to pay a penalty. This penalty varies, but you may have to give up some of your interest earnings.

Laddering: Many savers may try to take advantage of the higher interest rates CDs tend to offer while also attempting to keep their savings semi liquid. They often do this by purchasing more than one CD. For example, you might deposit money in a one-year, two-year, three-year, four-year and five-year CD — a strategy known as laddering. With this approach, one CD would mature each year, and you would be able to access the original funds and earned interest without paying a penalty. This also may be a valuable approach if interest rates rise more generally throughout the economy. When interest rates increase broadly, you are likely to earn a higher interest rate on a new CD account.

CDs may be a good choice if you have budgeted well and have some money in savings that you’re unlikely to need right away. Consider other CD pros:

If you're uncertain about your spending plans for the next few months or years, or if you'll need to take money out of savings soon for a major purchase, a CD may not be the best choice. The penalty for early withdrawal removes some flexibility and value in those cases.

Additionally, they're not a good substitute for a broader strategy to invest for retirement, because they generally earn lower interest rates relative to other options, such as purchasing stocks, bonds or mutual funds. That means it can be harder to use CDs to accumulate the funds you'll need for retirement.

Traditional CDs: These CD accounts are the most common and have fixed interest rates and terms. This means the interest rate and length of time you will keep your deposit in the account are set when you make the initial deposit, and they won’t change until the CD matures. Traditional CDs also require you to pay a penalty if you withdraw your money before the account matures. But there are other types of CDs with different terms that could be a good fit for your savings plans.

Trade-up CD: This type of CD offers a lower interest rate at the beginning of its term than a traditional CD does. However, it also gives you an opportunity to earn more. If interest rates rise on CDs with similar terms before your CD matures, you can choose to raise the interest rate of your account at least once during the term. If rates don’t rise, however, you could miss out on the higher interest rates offered by traditional CDs. A trade-up CD could be a good choice if you expect interest rates to increase soon.

Step-up CD: Like most CDs, a step-up CD has a set interest rate at the beginning of its term. A step-up CD also typically starts with a lower interest rate than a traditional CD with a similar term. But unlike other CDs, the rate on a step-up CD rises at specific stages over the life of the CD. For example, in a 28-month CD, the interest rate might rise after seven, 14 and 21 months. A step-up CD may be a useful option if you expect interest rates to rise, but you are concerned about having to choose the best time to increase the rate, as you would with a trade-up CD.

No-penalty CD: Suppose that you are interested in purchasing a CD, but you’re unsure about whether you may need the money before the CD term ends. A no-penalty CD, as its name suggests, does not require you to pay a penalty if you withdraw your money before the account matures. The tradeoff is that this type of CD generally offers a lower interest rate than that of a traditional CD, which do have a penalty for early withdrawal.

CDs can be part of a sound financial plan. To learn which kinds of CDs might be best for you, speak with your banker or accountant.

Ready to save? Explore CD rates at U.S. Bank today.

What to read next