Estate planning documents: Living trusts vs. will vs. living will

How to start investing: A beginner’s guide

As you build your personal wealth, the routine choices you make can affect your success in the long term. Having a written financial plan can help you set goals for yourself and your family and ensure you’re in control of your money.

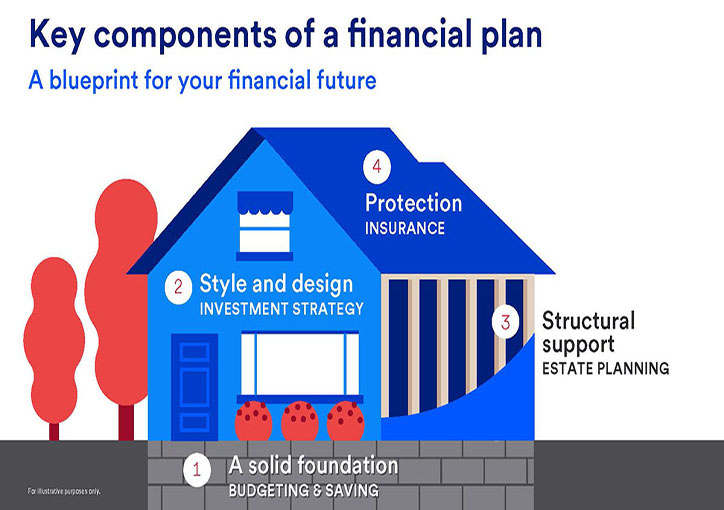

Think of the planning process like building a home: Each part of the plan, like a room in a house, is designed for comfort, protection and stability. The process will result in a blueprint for positive financial decisions, no matter where you are in life.

A financial plan is like a blueprint for your future. It aims to:

A comprehensive plan takes all aspects of your financial life into consideration. That includes things like budgeting, saving and investing, taxes, estate planning, and insurance, just to name a few.

Financial planning requires ongoing conversations and should evolve as you age and your life changes. You may not define all your goals at once and they’re also likely to change over time. The important part is to start the planning conversations early and determine the direction you want to go.

A house needs a solid foundation, and so does your financial plan. It allows you to create a structured approach to managing your finances, and budgeting and saving are key components. You can’t build wealth without having a handle on your expenses.

Once you have your expenses under control, you’ll be ready to build the other components of financial planning.

If you don’t already, start tracking and categorizing your monthly income and expenses. You could use a spreadsheet or an app, such as the money tracker in U.S. Bank mobile app. The important thing is to choose the method you’re most likely to use regularly.

You may want to think about your spending in terms of fixed vs. flexible expenses to help you see where you could make savings.

After you’ve assessed your spending and potentially cut some of your flexible expenses to make room in your budget, focus on paying down high-interest debt, such as credit cards.

Next, use what’s left over to build your emergency fund for added stability. Once you have enough saved to cover three to six months of household expenses, you can put your leftover income toward other financial goals.

If your budgeting efforts have resulted in some extra cash each month, the best way to save for long-term goals like retirement is investing. But before you start, it’s important to develop an investing strategy that’s appropriate for your financial plan.

Your investment strategy should be designed based on your financial goals, age, time frame, and risk tolerance. Having a clearly defined strategy will help you determine how to invest and the amount of risk you’re willing to take.

Depending on your goals, your investing options may include:

In a well-built house, beams and walls provide stability and support. An estate plan gives your financial plan structure, provides direction on how your assets should be managed and distributed and can help you pass on a family legacy to your loved ones.

Make sure to designate beneficiaries on your financial accounts and life insurance policies. And consider working with an attorney to set up important documents, such as a will, trust and financial and healthcare powers of attorney. Review your estate plan regularly and update it as necessary, especially after significant life changes.

Read more about estate planning:

Why estate planning is important

As you work toward building your wealth, you also need to think about how to protect it. Just as a roof shields your belongings, insurance can help reduce risk and protect your assets. While it may be an expense, insurance may provide long term value and protection for your wealth.

You may consider different types of insurance plans, such as home, life, disability and long-term care insurance. As your needs and the needs of your loved one’s change, review and update your coverage.

Read more about insurance:

Why insurance is important in financial planning

Building your personal wealth is an ongoing process, but a financial plan can help you remain on track as you work toward your goals. The sooner you start financial planning, the better, because the benefits of starting early will have a significant impact later. Remember:

Just as you build a home to keep your family safe and healthy, you should use the key components of financial planning to help you make stronger financial decisions both now and in the future.

When it comes to creating a financial plan, you don’t have to go it alone. Learn about our approach to financial planning.

Related content