For those pursuing education after serving in the military, making sense of the tuition benefits can be tricky. Explore the basics of the GI Bill including qualifications and coverage, plus get seasoned tips from an Army Reserves officer and former student.

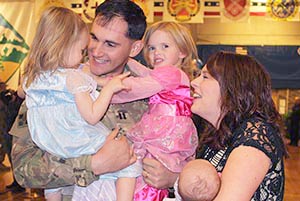

Returning to civilian life after serving in the military can be a rocky transition, and while assistance is available, understanding the benefits and opportunities in front of you can be challenging, too. Army Reserves officer and U.S. Bank Enterprise Strategist Andrew Gillson shares his experience using GI Bill benefits following his tour of duty; but first, let’s cover the basics.

What is the military GI bill?

The GI Bill is federal education assistance for military members and in some instances, their dependents. The bill was first enacted in 1944 for WWII Veterans, but now is offered to all honorably discharged military members who meet its requirements. While most use this funding to pay for traditional college education, it can also be used towards job training and study abroad courses (note: if studying abroad, only tuition is covered, not travel costs).

Who qualifies for the military GI Bill?

Most military members who served after September 11, 2001, can take advantage of the GI Bill. According to the U.S. Department of Veteran Affairs, you must meet one of the following requirements to qualify:

- You served at least 90 days on active duty

- You received a Purple Heart and were honorably discharged after any amount of service

- You served for at least 30 continuous days and were honorably discharged with a service-connected disability

- You’re a dependent child using benefits transferred by a qualifying Veteran or service member

How much time do you have to serve to get military GI Bill benefits?

The time you spend in service correlates to how much financial assistance you’ll be awarded. Spending up to 6 months in service gives you access to 50% of the benefits while serving 36 months or more grants you 100%, with varying benefit levels in between.

Do military GI Bill benefits expire?

It’s important to note that these benefits could expire depending on when you served. While the 2018 Forever GI Bill eliminated the expiration cap, it only protects military members whose service ended on or after January 1, 2013. If your service ended prior to 2013, you have a 15-year window from when you left the service until your benefits expire.

What does the military GI Bill cover?

Once you apply for this tuition assistance and are approved, here are some of the expenses you can have coverage on:

- Tuition and associated fees

- Monthly housing stipend for those in school more than half time

- Assistance with books and/or supplies up to $1,000

- One-time assistance to help you move from a rural area to attend school

When planning financially for your academic future, be aware of any limitations in your individual benefits package. Army Reserves member Gillson recommends keeping your housing situation top-of-mind when scheduling classes for this reason. “The G.I Bill pays a housing stipend only during the months that you are attending a class,” he says. “For example, if you aren’t taking summer classes you will not get a housing stipend over the summer. Also, the government will pro-rate the housing stipend for the number of days you are in class. [For example,] if your Fall semester ends on December 15th, you will only get 50% of your housing stipend.”

Another watchout Gillson warns of is being forgetful. “You have to ‘apply’ for your VA benefit before each semester,” he said. “Applying is easy… but it’s also easy to forget about.”

Maximizing your military GI Bill benefits

There are several ways to optimize your hard-earned benefits and get the most from your college experience.

- Do your research: To start, compare colleges to find a school that offers good benefits for military members like yourself. The VA Department offers a college comparison tool for pre-enrollment research. The tool includes information from tuition cost to whether others using GI Bill benefits also attend.

- Apply for additional resources: Even if you are receiving 100% coverage from your GI Bill benefits, it’s recommended all students submit a FAFSA to see if they qualify for any additional financial support. There are also scholarships you can apply for as a Veteran, even on top of your GI Bill benefits. Whether or not you receive additional financial support, the best time to figure out your financial game plan is now, before transitioning to your new student lifestyle.

- Accelerate the process: Testing out of subjects you’ve already covered is another strategy for making the most of your GI Bill benefits. College-Level Examination Program (CLEP) tests can help you bypass introductory classes and move on to more advanced classes faster. In fact, the GI Bill will cover the cost of your CLEP test through DANTES, otherwise known as the Defense Activity for Non-Traditional Education Support.

Beyond the military GI Bill: Making the transition to student life

When Gillson returned to a life of classes, he used the resources available to him to aid in that transition. “Chat with your university’s Veteran service department,” recommends Gillson. “Most universities have one.” Don’t be afraid to use those resources as they are there just for you. Gillson also recommends attending at least one event at your new school to get to know the culture; that event could be a campus tour, a sports game or Veterans’ enrollment day. “Going to events is a great way to learn about a school’s programs and meet other students and Veterans.”

We’re committed to helping military members and their families reach their financial goals. Learn more about military benefits available through U.S. Bank.