Asset classes explained: Cash, bonds, real estate and equities

Certificates of deposit: How they work to grow your money

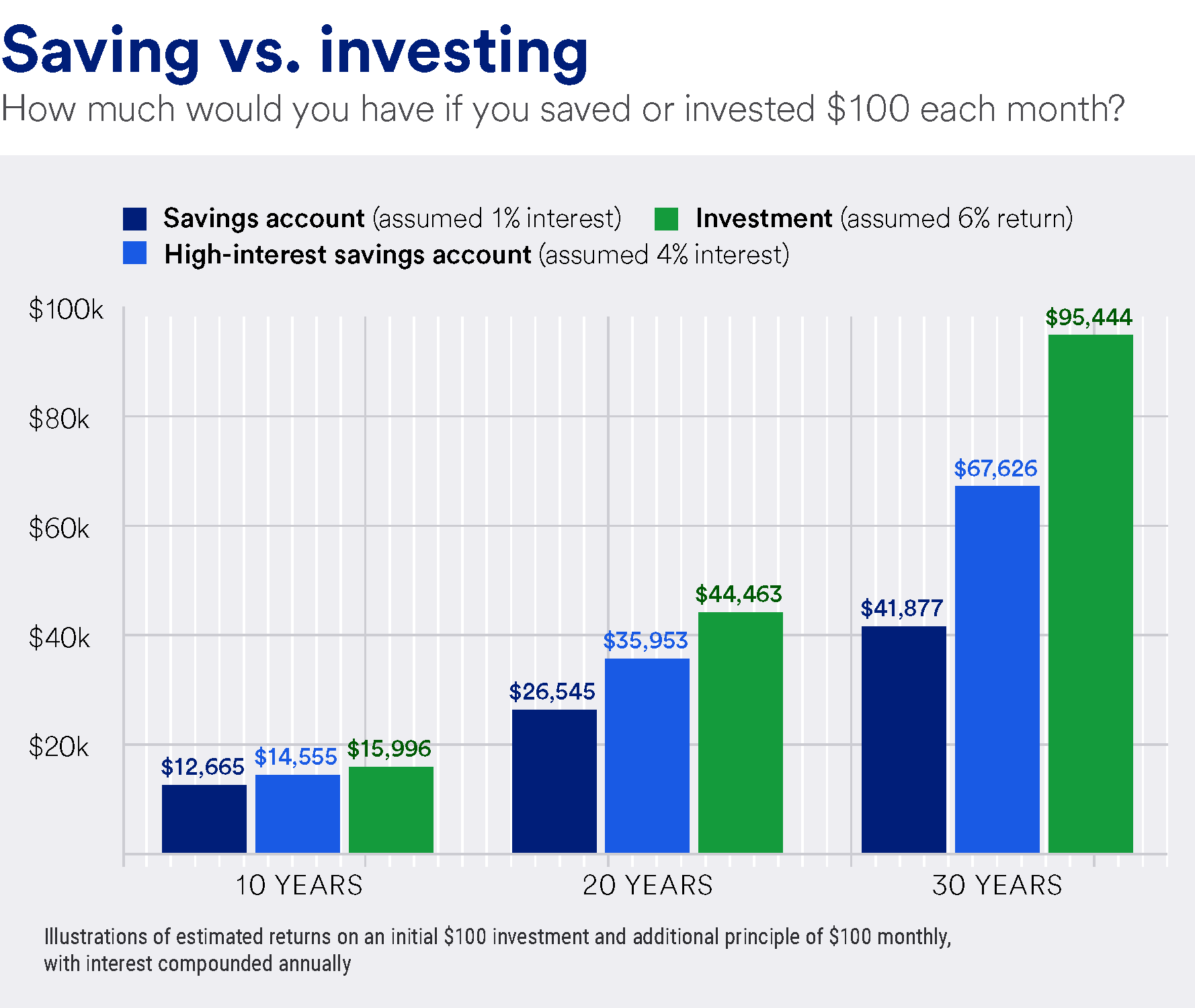

There are some key differences between saving and investing. Both strategies involve accumulating money for future use, but their level of risk is not equal. And how you determine when to save and when to invest will depend on your budget and financial goals.

Fortunately, you can do both at the same time, which means you don’t have to choose one or the other.

Saving is generally considered a good approach if your financial goal can be reached in five years or less, such as planning for a vacation or buying a house. The money you put into a savings account is more liquid than the money you put into investments.

Investing, on the other hand, can help you work toward reaching your longer-term goals, such as retirement or a college fund for your future children or grandchildren. When it comes to investing, patience is key. The longer your money is invested, the more potential it has to grow and earn compound growth, which occurs when you reinvest the investment’s earnings to potentially generate more earnings.

Investing’s primary selling point is the potential for long-term wealth creation. Here are a few reasons why:

Watch this video on how to diversify your portfolio.

There are many types of investment vehicles, including:

While you can buy and sell these assets at any time, some types of investments may need more time to mature, and there could be costs or penalty fees associated with selling or removing money from investments before they come to term. Others are more marketable (easier to sell), but you may not want to sell during a market downturn, so it’s better to approach them as long-term investments to get the best potential for growth.

A good way to start investing is through a retirement account. This could be a 401(k), an IRA or both.

Retirement accounts are typically made up of a mix of investment types such as stocks, bonds, mutual funds and ETFs. You can either set up your own ratio of these investment types, or choose a target date fund, which is an investment mix that’s optimized for your anticipated retirement date.

For example, if you’re close to retirement, your investment mix will often include lower-risk assets, whereas the farther away you are from retirement, the more risk you may be willing to take on, because you’ll have more time to bounce back from any market volatility.

While investing can help you achieve long-term financial goals, there should be a place for savings accounts in your financial plan, too. Here are a few benefits of keeping some of your money in a savings account:

Saving is the lower-risk, lower-return option. Savings accounts can come in the form of:

If you deposit money and leave it in a savings account, it will accrue interest over time, but typically at a lower rate than what investments have the potential to provide. You agree to let the bank keep your money for a while (sometimes a set amount of time, as with a CD; sometimes indefinitely, as with a savings account). In turn, the bank gives you a percentage of interest on that cash.

In general, you should begin building savings and pay off high-interest debt before you dive into investing, especially as protection against unexpected costs. The rule of thumb is to have at least three to six months' worth of your household income set aside in an emergency fund.

Remember, your financial plan should include both savings and investments vehicles, depending on your short- and long-term goals. It’s important to understand both the risks and rewards of savings vs. investing.

|

|

Risks |

Rewards |

|---|---|---|

|

Saving |

|

|

|

Investing |

|

|

Saving

Risks

Rewards

Investing

Risks

Rewards

A healthy financial plan isn’t about deciding between saving vs investing. It involves both: saving for goals in the short term and investing for long-term growth.

Whatever your financial situation and goals, start thinking about both options, and consider discussing your plans with a financial professional.

They can help you put together a financial plan that accounts for both your short- and long-term goals and advise on the risks and rewards of vehicles that will help you best work toward those goals and build a strong financial future.

Take this quiz, offered by U.S. Bancorp Investments, to learn more about your investing choices.