How does inflation affect investments?

Understanding yield vs. return

Interest rates help determine both the cost of borrowing money and the reward for saving money. Higher or lower interest rates can have ripple effects throughout the economy, including on your investments.

Let’s dive into how interest rates work, what causes interest rates to rise or fall, and how they affect your savings and investments.

Interest is a term that can refer to both the cost of borrowing money and the return earned on an investment.

When you borrow money from a financial institution, you’re obtaining a loan in exchange for a small fee, which is the interest you pay to the financial institution. And when you invest money in a savings account, bond or other money market product, interest is the return you receive on your investment.

There are two main types of interest: simple and compound.

The interest rate is the percentage that dictates how much interest you’ll pay or earn on a financial product.

A higher interest rate means you’ll pay more to borrow money or earn more on an initial investment. A lower interest rate means you’ll pay less to borrow or earn less interest on your investment.

Interest rates on a financial product can be higher or lower based on several factors.

One factor is the Federal Reserve’s (the Fed) monetary policies. While the Fed doesn’t set all interest rates, all interest rates are influenced by the Fed’s target federal funds rate and other policies. (More on how this works below.)

There are also personal factors that influence the interest you pay on a loan, mainly your “creditworthiness.” A bank or other entity may look at your FICO credit score, bank statements and other financial documents before deciding what interest rate to offer you. If you have a good credit score, for example, you may be viewed as more likely or able to pay off your debt and therefore qualify for a lower interest rate.

Interest rates can also be fixed or variable.

The Fed sets a target range for the federal funds rate, which is the rate banks charge each other for short-term loans. The Fed also sets the discount rate, which is the interest rate banks pay when they borrow directly from the Federal Reserve.

While neither of these is the same as the interest rate you’ll pay on a loan, the target federal funds short-term interest rate influences it.

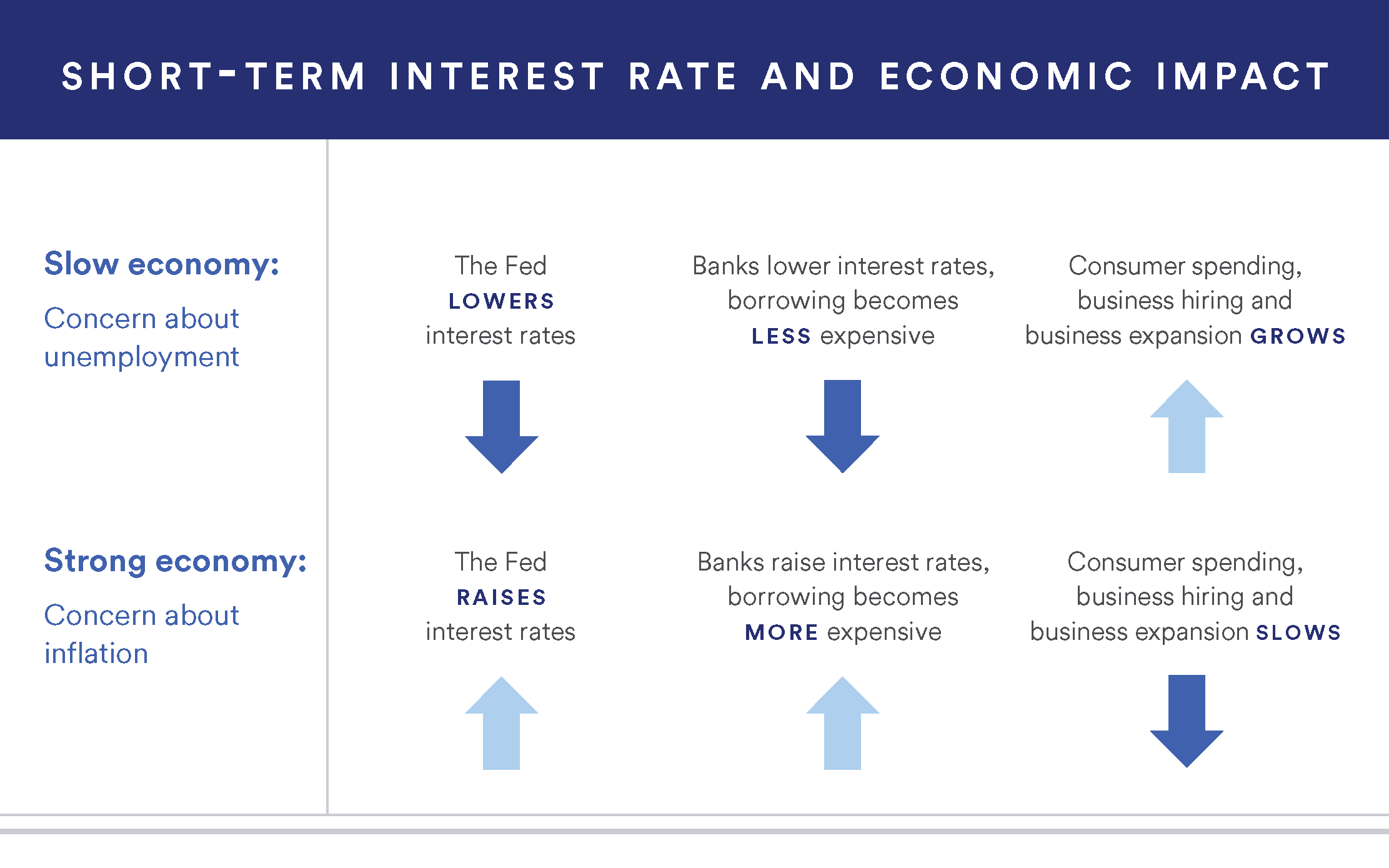

Reasons the Fed might use its monetary policy to influence interest rates include:

When it comes to the Fed’s influence on interest rates and how raising interest rates can help inflation, it’s important to understand that the Fed has a triple mandate: to promote maximum employment, moderate long-term interest rates and stabilize prices.

When prices are rising more quickly than the Fed’s target 2% annual rate of inflation, the spending power of consumers and businesses decreases, which in turn destabilizes the economy and puts the triple mandate at risk.

To cool inflation, the Fed may use its influence to raise interest rates. Higher interest rates make it more expensive to borrow, meaning that consumers and businesses will be less willing to spend money. This decreases demand, theoretically bringing prices down.

Understanding how, and when, the Fed changes rates can help you address any impact on your investment portfolio. Stay up to date on the latest Fed interest rate changes.

A bank will usually use the Fed’s target fed funds rate to set its own prime rate, which is often, but not always, the amount of interest you’ll pay on a loan.

Banks often follow the “fed funds plus three” formula. So, if the fed funds rate is 5.25%–5.50%, the prime rate tends to be about 8.50%.

However, a bank could adjust the interest rates on its loans according to supply and demand, an individual borrower’s creditworthiness or other factors.

Interest rates and bonds have an inverse relationship: When interest rates rise, bond prices fall, and vice versa. Newly issued bonds will have higher coupons after rates rise, making bonds with low coupons issued in the lower-rate environment worth less.

It’s helpful to understand the following three concepts regarding the bond and interest rate relationship.

Read more about how interest rates affect the bond market.

In contrast to bonds, stock prices are not directly affected by interest rate changes.

When interest rates rise, banks often increase loan costs for consumers and business loans, which can reduce spending and lower stock values. Higher interest rates may lead companies to halt business expansions and put a pause on hiring.

There’s no guarantee that an interest rate change will affect stocks, however. With a balance of stocks and bonds, your portfolio may be better positioned to maintain more stability despite a change in interest rates.

Read more about the current impact of rising interest rates on the stock market.

It’s smart to consider how rate changes might affect elements in your portfolio other than stocks and bonds.

In summary, here’s how interest rates may affect different accounts and investments:

Interest rates raised |

Interest rates lowered |

|---|---|

|

|

Because interest rate fluctuations can affect your savings and investments in different ways, there is no single action you should take when they change.

Stay focused on your financial goals, stick to your plan and work with your financial professional to construct a portfolio that is diversified enough to help weather any short-term effects of an interest rate change.

Your financial plan should reflect your goals, risk tolerance and time horizon. Learn how our approach to financial planning can help you achieve your vision of success.

Related content