Key takeaways

Stocks play an important role in a diversified investment portfolio, along with bonds and cash equivalents.

Stocks are usually seen as a riskier investment vehicle because they’re tied to the profits and losses of the companies you invest in, but there are ways to manage this risk.

Steps to investing in stocks include determining how you want to invest, what to invest in, how much to invest and putting a long-term investing strategy in place.

A diversified investment portfolio generally contains a balanced mix of asset classes including stocks, bonds and cash equivalents. But what exactly are “stocks,” and how can you invest in them?

Also referred to as equities, stocks are securities that give investors ownership interest in public companies, which issue stock to raise the cash needed to operate their businesses.

Investors receive dividends (if the company pays them) and benefit from share price appreciation over time if the company is successful. However, investors can also lose money if the share price falls, which is why stocks are generally considered a riskier investment than bonds or cash.

“A financial advisor can help you set goals for stock market investing and choose the right stocks based on your risk tolerance and time horizon.”

Rob Haworth, senior investment strategy director, U.S. Bank Asset Management

Let’s take a look at the current stock market environment, common types of stocks to invest in, and explore how to invest in stocks.

Investing in stocks today

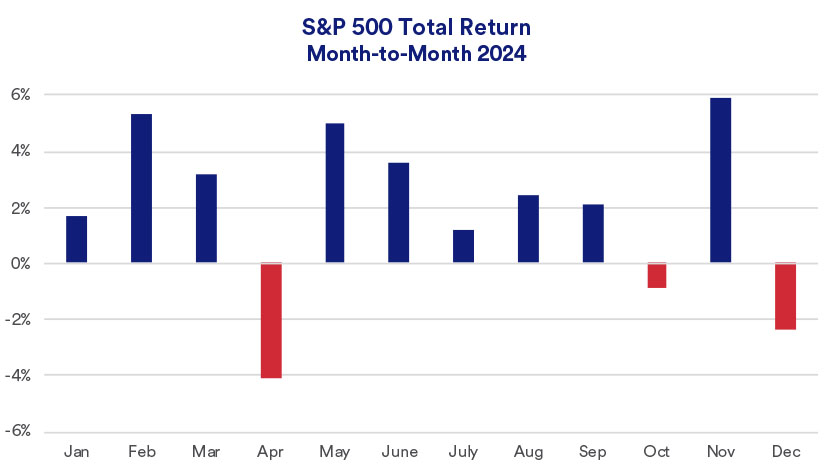

The U.S. stock market has been on a roll the past couple of years. In 2024, the S&P 500 total return was 25%.1

Rob Haworth, senior investment strategy director with U.S. Bank Asset Management, adds that the stock market reacted positively to the outcome of the 2024 election, adjusting its pricing once the uncertainty of the outcome was removed.

What happens over the next four years depends on a number of other factors, however. “We continue to see economic growth, inflation and Federal Reserve interest rate policy as the primary capital market drivers,” says Haworth. “There is potential for government policy to become more prevalent in investors’ minds as the new administration’s priorities develop.”

Even with stocks having risen significantly for two years in a row, Haworth believes that more upside potential remains for stock market investors.

Haworth says investors are increasingly focused on what’s to come from the new administration’s policies and their potential market impact. Several potential policies are already making headlines, such as extending tax cuts that were part of the Tax Cuts and Jobs Act and are set to expire at the end of 2025, and implementing potential new tariffs on imported goods.

“Markets will closely monitor the subsequent impact on economic growth and inflation,” says Haworth.

Haworth believes the U.S. economy could continue the growth it has seen since 2022. “Stock market earnings, as measured by the S&P 500 index, could actually be better in 2025 than what we saw in 2024,” he says.

Types of stocks to invest in

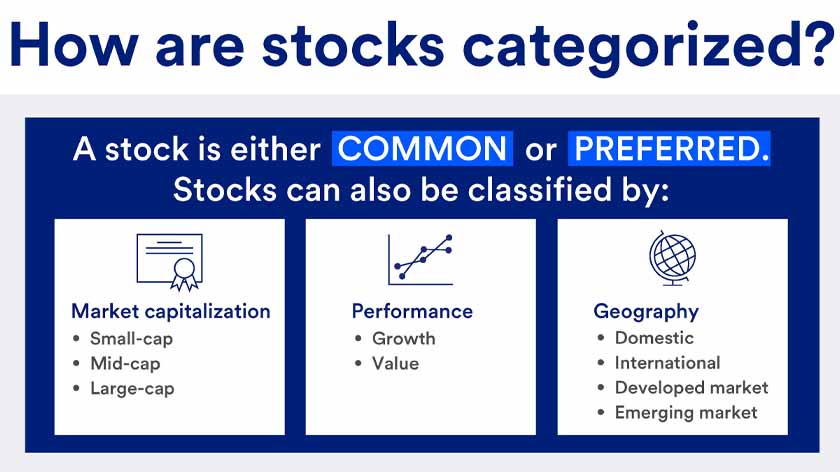

All stocks fall into one of two broad categories:

- Common stock, which entitles shareholders to company profits, which are usually paid in dividends. Common stock shareholders have company voting rights.

- Preferred stock, which entitles shareholders to dividend payments before they are issued to common stock shareholders. If a public company goes bankrupt, preferred stock shareholders are repaid before common stock shareholders. Preferred stock shareholders don’t have company voting rights.

Stocks can also be classified according to factors like market capitalization, performance and geography, including:

- Small-cap, mid-cap and large-cap stocks. These classifications are based on the size of the public company, as measured by its market capitalization.

- Growth stocks. Growth stocks are companies that are expected to grow at a faster rate than the broader market based on comparative measures such as earnings and sales.

- Value stocks. These stocks trade at a discount to other companies on price factors relative to earnings, sales or dividends amongst others.

- Domestic and international stocks. Domestic stocks are companies located in the U.S., while international stocks are companies located overseas. These are further divided into developed market (e.g., Canada, Australia, France, the U.K.) and emerging market (e.g., India, Mexico, Russia, Egypt) stocks.

How to buy stocks: An overview

If you’ve never invested in stocks before, getting started can feel a little intimidating. Here’s a six-step guide to help you start investing in the stock market.

1. Decide how you will invest in stocks.

There are two main options: do it yourself (DIY) or invest with the help of a financial professional. Haworth recommends that beginning investors work with a professional, at least at first. “A financial advisor can help you set goals for stock market investing and choose the right stocks based on your risk tolerance and time horizon,” he says.

2. Open an investment account.

Stocks are usually purchased through a licensed broker or advisor that makes trades on your behalf. So, the next step is to choose an investment account with a broker or advisor that’s best suited to your investing goals. You can open an individual or joint brokerage account through a licensed broker, on your own (referred to as a self-directed brokerage account) or via an investment advisor.

3. Choose stocks and/or funds to invest in.

You can buy individual stocks or purchase shares in a mutual fund or exchange traded fund (ETF). These vehicles pool money from many investors to purchase a basket of stocks. While buying individual stocks gives you more control, it can also be riskier. “Purchasing shares in a stock mutual fund or ETF gives you built-in diversification, which reduces risk,” says Haworth. In addition, mutual funds and ETFs are actively managed by professionals, which can make them a good choice for beginning investors.

4. Decide how much money to invest in stocks.

This will depend on your investing goals and budget — in other words, how much you can afford to invest. It’s smart to only invest money you won’t need for your living expenses in case you realize losses. You should also have an emergency fund of at least three to six months of expenses.

5. Set up a realistic, long-term investing plan.

When investing for retirement, many people contribute a set amount of money each month to a retirement account, a strategy referred to as dollar-cost averaging. The important thing is to create an investing plan you can stick to for the long term.

6. Manage your stock portfolio.

Haworth says it’s generally not advisable to check your portfolio every day, since stock prices can fluctuate frequently. Instead, plan to revisit your portfolio several times a year to make sure everything is in line with your investment goals. “You may need to periodically rebalance your portfolio to keep your investment mix consistent with your long-term plan,” says Haworth. This involves selling stocks that have appreciated beyond your long-term target weighting and purchasing stocks that have fallen below your target levels.

Whether you want to invest online or with professional guidance, there are options to invest your way.

The Standard & Poor’s 500 Index (S&P 500) consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. The S&P 500 is an unmanaged index of stocks. It is not possible to invest directly in the index.

Tags:

Explore more

How to invest in today’s market

With the market and economy in flux, how should investors position their portfolios to capitalize on potential opportunities, while guarding against risks?

Personalized investing guidance aligned with your goals.

Let us help you craft a portfolio that reflects your goals, time-horizon and values.