Key takeaways

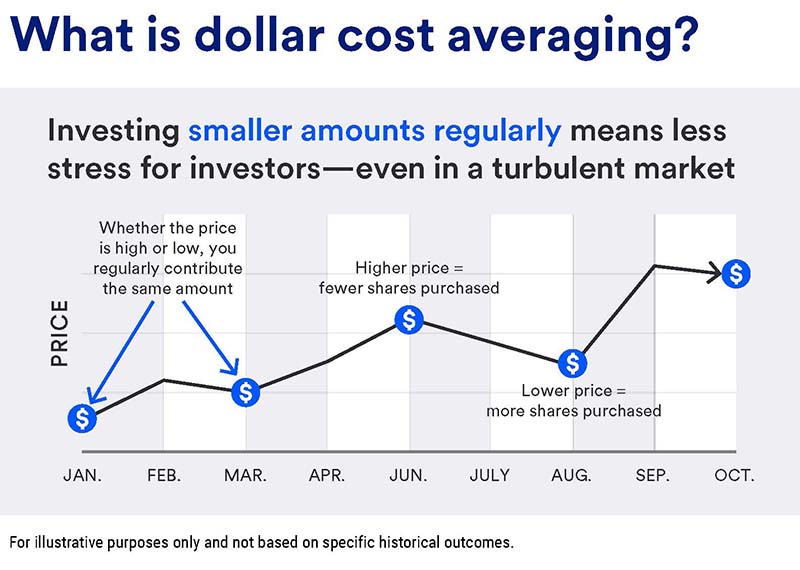

Dollar cost averaging is the process of purchasing an investment on a regular schedule. An example is a 401(k), where an employee contributes the same amount each month.

There isn’t a financial advantage to a dollar cost averaging strategy, apart from the regularity of investing.

Instead, it brings psychological benefits and helps investors ride the ups and downs of the market without as much stress.

Recent market volatility has a lot of investors wondering how to minimize its impact on their portfolio. No one wants to see the balance on their accounts decline. One strategy that can help balance out the volatility is called “dollar cost averaging” (DCA), and it can provide benefits to any type of investor.

“We're often confronted with the question, ‘How do I get started investing?’” says Rob Haworth, senior investment strategy director for U.S. Bank Asset Management. “You may have a lump sum of cash from the sale of a business or property and are looking to put the money into a diversified portfolio of stocks and bonds. Or you could have a form of continuous cash flow, such as savings from your paycheck, and you want to know how to help it grow. Dollar cost averaging can be a good strategy for both situations.”

How does dollar cost averaging work?

Dollar cost averaging (or DCA investing) is the process of purchasing investments on a regular schedule instead of putting a large sum of money into the market all at once. The amount of money invested using this approach is usually smaller than a lump sum would be, but the contributions will build up steadily over time.

One of the most common dollar cost averaging examples is when an employee signs up for a workplace retirement plan, such as a 401(k). They agree to contribute a set percentage of their income into the retirement plan each pay period.

How to dollar cost average

For a specific DCA investing example, someone making $150,000 per year who is paid twice a month would receive gross pay of $6,250 per pay period. If they allocated 10% of their pay to a 401(k), they would be saving $625 out of each paycheck. At the end of the year, they would have saved $15,000. The return on the funds inside of their 401(k) would fluctuate based on the market.

“You're putting a regular amount to work in the market over time without regard to price. Sometimes prices will be higher, sometimes they'll be lower, but you essentially continue to accumulate investments.”

Rob Haworth, senior investment strategy director, U.S. Bank Asset Management

Advantages of dollar cost averaging

Interestingly, research has found that there isn’t a significant financial benefit of dollar cost averaging, such as earning an extra return, when compared to a lump sum investment. The biggest advantages to a dollar cost averaging strategy are the psychological benefits it can provide.

Dollar cost averaging helps you feel comfortable with uncertainty.

As prices in the market rise and fall, the value of stocks and bonds change, too. Dollar cost averaging helps investors become accustomed to fluctuations. “You're putting a regular amount to work in the market over time without regard to price,” says Haworth. “Sometimes prices will be higher, sometimes they'll be lower, but you essentially continue to accumulate investments.”

Dollar cost averaging investing makes “timing the market” obsolete.

It can remove the regret an investor may experience if they don’t time the purchase of the stocks or bonds just right. Dollar cost averaging takes a patient approach. It removes the desire to try to time the investment, since there is no way to know the best day to buy. “We're human beings, and we know from behavioral science that we will feel bad and perhaps abandon our plan if we put all our money to work and the market goes down the very next month,” says Haworth. “One of the ways to balance such emotions is consistently putting your money to work and not thinking about having the timing exactly right.”

Dollar cost averaging takes the emotion out of the investment decisions.

“You aren’t making your decision based on if the market is up or down, or how you feel about what’s happening in the market,” says Haworth. “Time will be on your side, even if you started your investments at a market peak.” He says two years should be enough time to put meaningful amounts of money to work, as investors can take advantage of that ebb and flow of the market.

Dollar cost averaging investing removes decision fatigue.

With dollar cost averaging, you don’t have to determine how many shares to purchase based on price. It takes away the discipline needed to make regular investments since it creates an investment habit that’s predetermined and automatic.

Is a dollar cost averaging strategy right for you?

Dollar cost averaging can offer a variety of benefits, but there may be times when investing a lump sum into the market is the better choice. It’s important to work with a financial professional to determine the best tools and strategies for meeting your financial goals.

“Your financial professional will work with you to think about your cash flow needs and your ultimate financial goals, setting that ultimate strategic allocation,” says Haworth. “Then they can also figure out your path to getting there. Time in the market can matter more than trying to time the market.”

From working with a financial professional to investing online, learn more about your investing options.

Tags:

Explore more

Should I buy-and-hold stocks for long-term investing?

Instead of trying to time the market, consider buying stocks and other securities and holding on to them regardless of changes in the market. Read more about the benefits of this long-term investment strategy.

Personalized investing guidance aligned with your goals.

Let us help you craft a portfolio that reflects your goals, time-horizon and values.