Should I itemize my taxes?

How to build a financial plan that covers your savings and expenses

Minimizing your tax liability is an important step in growing your wealth and meeting your financial goals. That’s why it’s critical to reduce the portion of your income that’s subject to tax—especially if you’re in a higher tax bracket.

Claiming as many deductions as you can on your annual return is important, but shrinking your tax bill requires year-round planning.

Income can come from many sources, from salary to lottery winnings. But as far as the Internal Revenue Service (IRS) is concerned, not all of it is subject to federal tax. Understanding the difference between taxable and non-taxable income is important when putting together a tax and financial plan.

Taxable income is the portion of your annual income that the IRS deems is subject to tax. Your taxable income is determined using a few pieces of information:

You might also hear about modified adjusted gross income (MAGI), which is used to calculate your eligibility for certain tax credits. Your MAGI is your AGI with certain deductions or income added back in.

Common sources of taxable income include:

Non-taxable income is income that the IRS does not levy tax on at the federal level. Non-taxable income includes but is not limited to:

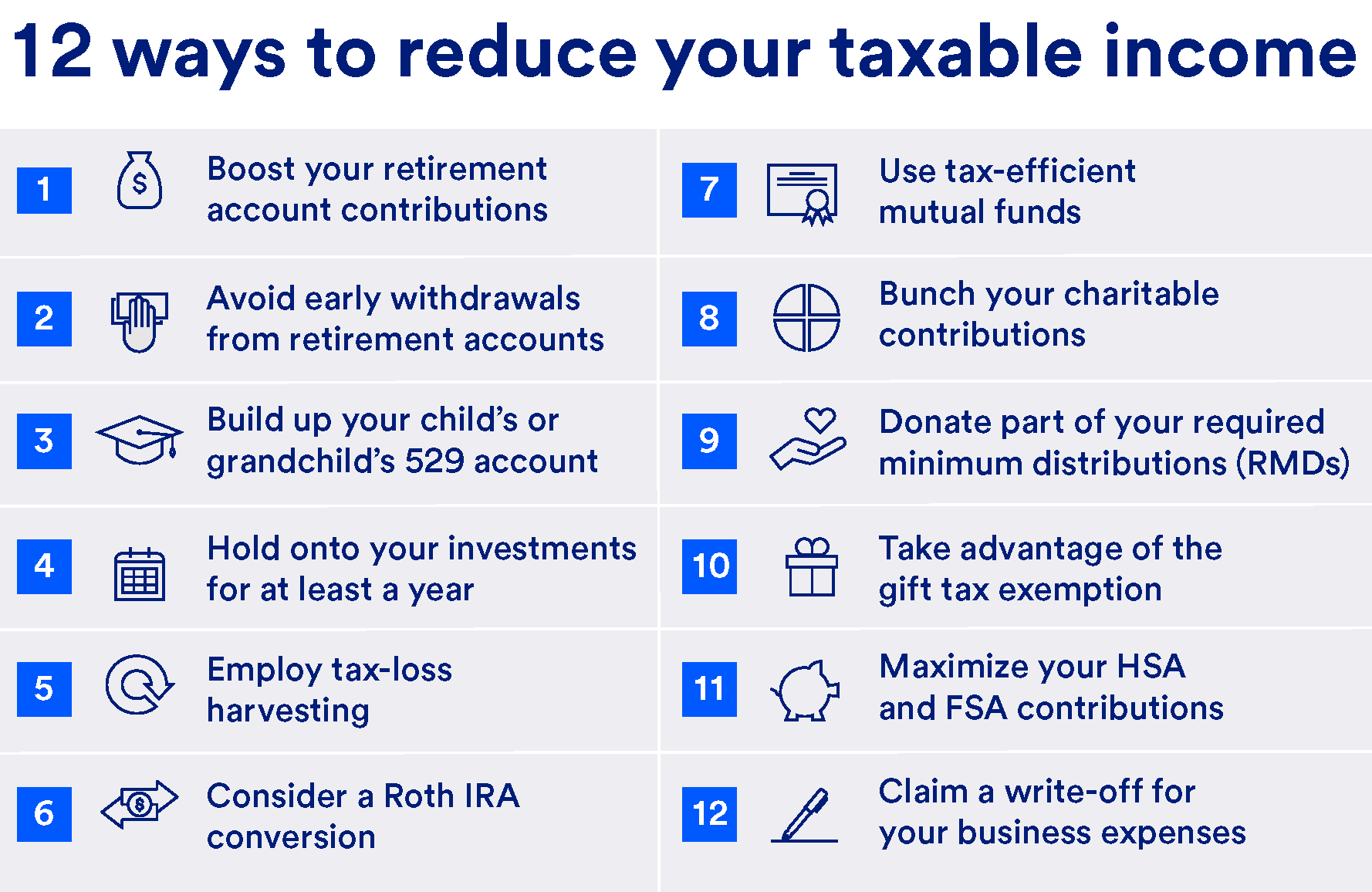

Here are 12 of the most effective ways to lower your taxable income, so you can hang onto more of what you earn.

Making pre-tax contributions to a traditional 401(k) or 403(b), up to the annual limit, is one of the easiest ways to reduce your taxable income while building your nest egg.

The contribution limit in 2025 is $23,500. If you’re age 50-59 or 64 and older, you can contribute an additional $7,500. If you’re 60-63, you can contribute an additional $11,250 due to the Secure 2.0 Act.

If you already maxed out the employer match on your workplace plan (or are planning to), diverting some of your money to an individual retirement account (IRA) may allow you to benefit from a wider range of investment choices. Depending on your income level and whether you’re covered by a retirement plan at work, you may be able to deduct some or all of the contribution on your tax return.

You should think twice before making withdrawals before age 59½ from an IRA, or age 55 if you have a 401(k). You’ll ordinarily have to pay income tax on the money you pull out. And except for certain situations, like a hardship distribution from your employer plan, you’ll face a 10% penalty as well.

To avoid that outcome, make sure you have an emergency fund that can provide for three to six months’ worth of expenses—and avoid using your long-term assets for discretionary expenses.

Read more about 401(k) and IRA withdrawal rules.

A 529 education savings plan allows you to make tax-free withdrawals for eligible college or K–12 expenses. But it may also bring you a nice tax break now, depending on where you live.

More than half of states provide a credit or deduction on your state return when you put money into a 529, although most require you to make the contribution to the plan they sponsor. Some states only allow the 529 plan account owner (or the account owner’s spouse) to claim a state income tax benefit.

Any capital gains you acquire when you sell a stock or other asset within a year is taxed at your ordinary income rate. But if you keep the stock or asset for longer than that, you pay a much lower rate: 0%, 15% or 20%, depending on your income. Holding onto those assets bit long can translate into significant tax savings.

Selling your investments for a loss isn’t typically your goal. But if they’ve decreased in value toward the end of the year, you can use those losses to offset the capital gains you incurred. This tactic, called tax-loss harvesting, can help increase your income tax refund or lower the amount of tax you owe when filing a return.

Just be aware of the wash-sale rule, which prohibits you from replacing the asset right away. Your loss is disallowed for tax purposes if you sell stock or other securities at a loss and then buy substantially identical stock or securities within 30 days before or 30 days after the sale.

Moving some of your pre-tax retirement money into a Roth IRA can be a smart move, especially if you expect your income to increase by the time you make withdrawals. However, any amount you roll over is taxable in the year of the conversion, so you have to be careful not to withdraw an amount that will put you into a higher tax bracket.

To avoid any surprises regarding your income, a Roth conversion is a strategy you typically want to consider toward the end of the year. Working with a tax professional can help ensure that you minimize the short-term tax hit that you’ll experience.

Any returns you generate from a 401(k) or IRA are tax-deferred, so you won’t owe the IRS until you take distributions after age 59½. But if you have a standard brokerage account, any capital gains, interest and dividends are taxable in the year they’re realized.

Buying tax-efficient funds such as exchange-traded funds (ETFs), which trade less frequently and limit dividend-paying assets, can help limit your tax liability and boost your net return.

If you’re making substantial charitable gifts, you might consider bunching two years’ worth of contributions into a single year to shrink your tax bill. For example, you could contribute the combined amount in December of Year 1 or January of Year 2, depending on your tax situation. If the total gift is large enough, you may find that your itemized deductions for that year exceed your standard deduction.

Some retirement accounts, including traditional 401(k)s and IRAs, are subject to required minimum distributions (RMDs). These are IRS-mandated withdrawals that kick in when you reach age 72 (or age 73, if you turn 72 after Dec. 31, 2022).

You may get a nice tax break by contributing part of that distribution directly to a nonprofit through a qualified charitable donation, or QCD. If the money goes straight from your IRA to the charity, you don’t add it to your earned income. Therefore, you get a tax break on the donation, even if you don’t itemize deductions on your return.

If you have a substantial amount of assets, minimizing the federal estate tax will allow your heirs to receive a larger share of your wealth. Gifting some of those assets during your lifetime can help reduce the amount that’s subject to this tax.

For 2025, you’re allowed to gift each individual up to $19,000—or $38,000 if you’re married and file a joint return. Any amounts above that threshold count against the gift and estate tax exemption that applies to assets you leave to your heirs.

As long as you have a high-deductible health plan, you can put up to $4,300 of pre-tax money (or up to $8,550 if you have family coverage) into a health savings account in 2025. One of the perks of an HSA is that whatever funds you don’t use during the year stay in your account. You can even save them until you retire, when your medical expenses will likely increase.

If your employer offers a flexible spending account for medical or childcare expenses, you can also reduce your taxable income by making contributions there. Unlike health savings accounts, FSAs don’t require you to have a specific type of health plan. But you forfeit any amount you have left over at the end of the year, so you have to be careful before making your annual election.

Whether you run your business full-time or on the side, keeping track of your expenses can mean considerable savings at tax time. As long as the costs are “ordinary and necessary” to running the business, you can use them offset your income.

Potentially, you can claim a deduction for any number of expenses, from salaries and interest payments to depreciation and advertising costs. If you own a pass-through entity like a sole proprietorship, partnership or S-Corporation, you can deduct expenses on your personal return even if you claim the standard deduction.

As always, it pays to consult your tax or financial advisor, who can help you take steps to reduce your taxable income throughout the year and as part of your broader financial plan.

Learn how our approach to financial planning can help you see a full view of your financial picture.

Related content