Financial guidance and support, tailored for you.

Explore the benefits of working with a dedicated wealth team.

Key takeaways

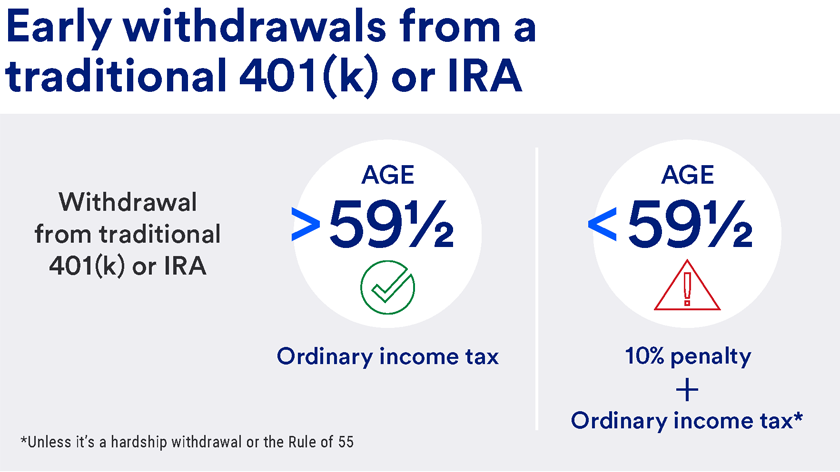

If you withdraw from an IRA or 401(k) before age 59½, you’ll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates.

There are several scenarios, known as hardship withdrawals, where you can avoid the 10% penalty. These include using the money for medical expenses, higher education expenses and a first-time home purchase.

If you have to withdraw money from your account, another option to avoid the penalty is to take out a 401(k) loan. Although the loan must be repaid within five years, you keep the tax benefits and your retirement plan on track.

To encourage retirement saving, the federal government offers special tax breaks for contributing to a qualified retirement plan like an individual retirement account (IRA) or 401(k).

But there’s a tradeoff: If you withdraw the money from the plan before you retire, you may have to pay an early withdrawal penalty on top of the ordinary income taxes that will be due upon withdrawal.

“Simply put, if you don’t follow the rules for qualified retirement plans, you’ll be penalized,” says Joni Meilahn, vice president and senior product manager with U.S. Bancorp Investments. “That’s why it’s critical to understand these rules before withdrawing money from a retirement plan.”

Read on to learn more about 401(k) withdrawal rules and traditional IRA withdrawal rules.

IRAs and 401(k)s are qualified retirement accounts, which means they receive favorable tax treatment. With traditional IRAs and 401(k)s, pre-tax money grows tax-deferred until you withdraw it in retirement, at which time you have to pay income taxes at ordinary income tax rates.

Roth IRA withdrawal rules differ from a traditional IRA because your money grows tax-free and you can withdraw it tax-free in retirement. The same withdrawal rules apply to Roth 401(k)s.

“Withdrawing money from a retirement account early and paying penalties and taxes should be an absolute last resort after you’ve exhausted every other option.”

Joni Meilahn, vice president and senior product manager, U.S. Bancorp Investments

For the purposes of account withdrawals, retirement is considered to be age 59½. If you withdraw from a traditional IRA or 401(k) before this age, those withdrawals are subject to a 10% early withdrawal penalty and taxation at ordinary income tax rates.

Roth withdrawal rules are different. Early withdrawals of Roth IRA or Roth 401(k) contributions are not subject to a 10% penalty, since they were made on an after-tax basis. However, withdrawals of earnings from Roth accounts made before age 59½ are subject to a 10% penalty and taxation.

Meilahn notes that you must begin taking distributions from traditional IRAs and, in some instances, 401(k)s when you reach age 73. “These are referred to as required minimum distributions, or RMDs,” she says.

There are some scenarios in which you could make early withdrawals from a retirement account without paying the 10% early withdrawal penalty. These are known as hardship withdrawals. For 401(k)s, check with your employer about which hardship withdrawals apply to your plan and how to get approved. You may be required to verify that you don’t have any other available financial resources to satisfy your financial need.

See the IRS list of early distribution tax exceptions.

When facing financial emergencies or cash flow shortfalls, it can be tempting to withdraw from a qualified retirement plan. However, Meilahn strongly discourages this.

“Withdrawing money from a retirement account early and paying penalties and taxes should be an absolute last resort after you’ve exhausted every other option,” she says. “Doing so can have a serious impact on your long-term retirement finances.”

If you really need to use the money in your retirement account before you’re 59½, Meilahn suggests taking out a 401(k) loan instead of taking an early withdrawal. Many 401(k) plans allow participants to borrow their own money and repay the loan via automatic payroll deductions. 401(k) loans usually must be fully repaid within five years unless the money is used to purchase a primary residence.

“Always look to a loan first if you don’t meet the qualifications for a hardship withdrawal,” says Meilahn. “You’re paying yourself back with interest and avoiding the 10% early withdrawal penalty. This also retains the tax benefits and keeps your retirement plan on track.”

The maximum 401(k) loan amount is $50,000 or 50% of the account’s vested value. Not all 401(k) plans permit loans, so ask your plan administrator about your plan’s loan provisions.

Meilahn points out another unique early withdrawal circumstance. Known as the Rule of 55, this allows you to withdraw money from your 401(k) penalty-free if you leave your job or are laid off during the year in which you turn 55, or later. Income tax would still be assessed on the money you withdraw, but the 10% early withdrawal penalty would be waived.

“The Rule of 55 only applies to the 401(k) plan at your most recent employer, not previous employers,” says Meilahn. “This rule can be a useful tool if you want to retire between the ages of 55 and 59½.”

It’s critical to understand the rules governing withdrawals from qualified retirement accounts. Otherwise, you could make costly mistakes that jeopardize your retirement financial security.

Thoughtful planning can make a significant difference in how you manage your money. Learn how our approach to financial planning can help you review financial opportunities from all perspectives.

Unlike a traditional IRA, a Roth IRA allows you to contribute after-tax dollars now and withdraw contributions tax-free in retirement. Get details on Roth IRA contribution limits, Roth IRA income limits and Roth conversions.

Whether you prefer investing on your own or want professional guidance, we have an option to fit your needs.