Turn your passions into plans.

We’re committed to helping you reach your business goals with one-on-one business coaching and tools that support you where you are today and tomorrow.

From maintaining inventory and operating expenses to buying equipment or real estate, U.S. Bank offers business loans and credit options that can help keep you on track.

Access working capital or funds to expand your business with a loan or line of credit. We offer competitive rates and flexible terms.

A U.S. Bank business credit card can help with unexpected expenses.

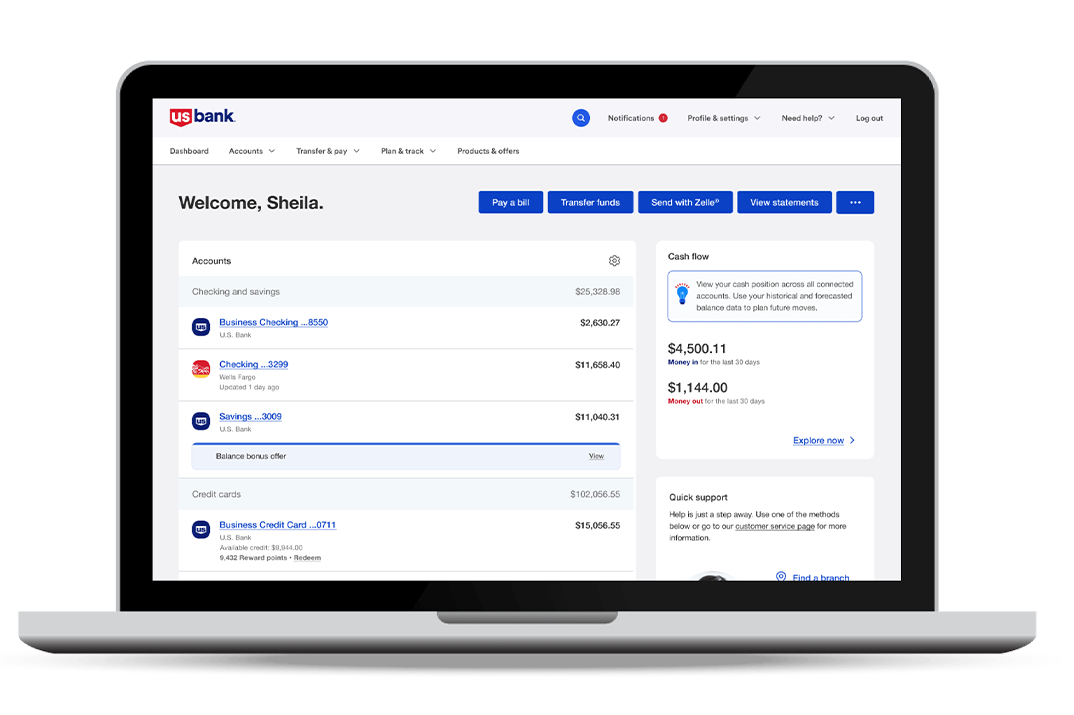

The online banking dashboard provides you access to useful business tools for forecasting income, tracking expenses and gaining insights to help you get ahead.

We’re invested in the success of all entrepreneurs. Available in nine key markets, U.S. Bank Business Access Advisors provide support to diverse business owners to help them achieve their goals.

My Business Access Advisor Tim was able to connect me with credit resources and has helped understand how to manage my business from an administrative standpoint.

– Eddie Boone, owner of Boone’s Quality Painting and Refinishing

Our resource center is filled with answers to common – and not so common – questions that come up along the way, as well as advice for getting ahead in the business world.

Evaluate your business goals and specific needs to help you decide between a loan or line of credit.

Understand what’s causing your cash flow woes and choose the right strategy to get your balance sheet back on track.

Get tips and advice that can help your business realize its full potential.

Simple tools and payment solutions to help you manage your business finances with ease.

Streamline your operations and make informed money decisions with a clear view of your finances in one place.

It’s easy. First, you’ll decide which loan is right for your business and then fill out an application either online or with a business banker. You’ll want to get together some documents to make it easier to apply such as your business and personal tax returns, financial statements and legal documents like your articles of incorporation.

With a business loan you’re loaned a lump sum of money you then repay with interest in fixed monthly installments. A business loan can help you finance general business needs like inventory, equipment or vehicles.

Yes, when you apply for a U.S. Bank business credit card you can request additional cards for your employees. You may also add employee accounts through online banking, or request employee card accounts be closed when needed.

Yes, the U.S. Bank Business Platinum credit card offers our lowest APR for those that qualify. To learn more and apply go to Business Platinum credit card.

U.S. Bank provides options that can help you adapt to market fluctuations. Learn more about our investment solutions and banking products where you can park excess cash.