A merchant services account is one set up with a “merchant acquiring bank” that allows you to accept credit and debit cards and other electronic payments processed and approved. Your bank then distributes the funds into your merchant account.

Looking for a simpler way to manage business payments?

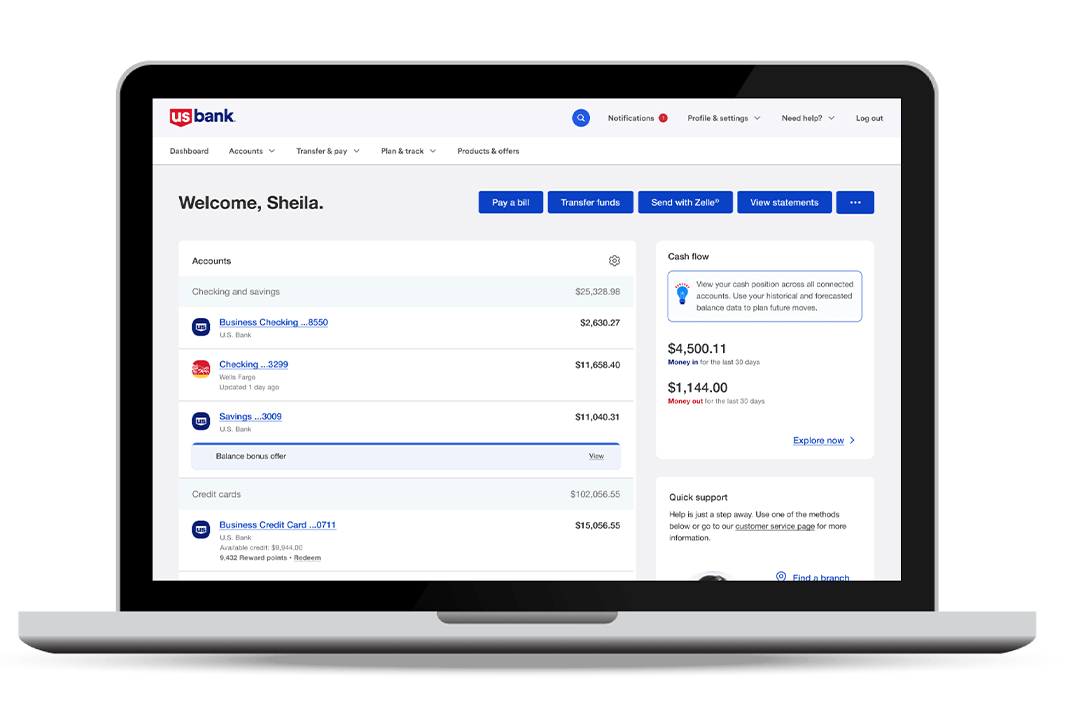

When you combine your payment solutions with a U.S. Bank business checking account, you get more ways to pay and receive funds plus access to the online banking dashboard.

Get started with a U.S. Bank business checking account.

A U.S. Bank business checking account is a launchpad for accounts payable and receivable. Plus, it gives you access to one centralized view of your business cash flow with our online banking dashboard.

Pay bills safely and quickly.

Experience the power of digital payments. Manage funds easily while reducing the risk of fraud.

Move funds faster with digital payments.

From online bill payments and wire transfers to Automated Clearing House (ACH) processing, pay your bills easily and securely with a U.S. Bank business checking account.

Manage business expenses with a credit card.

Get better cash flow and spending power with any of our hard-working credit cards.

Find proven payroll services.

U.S. Bank provides digital tools and partners with industry experts to make payroll processing and direct deposit faster and easier.

Receive payments like a pro.

Find the right payment tools for your business. Whether you want to accept payments online, instore, or on the go, we partner with you to set up a payments solution that meets your business needs.

Accept payments and operate your business.

Your U.S. Bank Payment Solution does more than accepts payments, including process transactions, manage inventory and plan employee schedules. A point-of-sale (POS) system can simplify and grow your business operations.

Provide more ways to process business payments.

Whether you’re just getting started or an established pro, a U.S. Bank business checking account adjusts to how your business flows with Zelle®,1 remote deposit capture (RDC)2 and cash services for faster payment acceptance.

Offer POS lending as a payment option.

Help your customers say “yes” by offering flexible financing. U.S. Bank Avvance™ is a first-of-its-kind integrated financing solution with loans issued by U.S. Bank. Merchants are funded within 48 hours and U.S. Bank handles the rest.

U.S. Bank stepped in to be my financial planner and give us guidance and support to help our business get to the next level.

TrueMan McGee

Explore business payment insights.

Get answers to questions from U.S. Bank Financial IQ.

How to accept credit card payments online.

When looking for a payment processing vendor, be sure to review fees and features that fit your business needs now and in the future.

Zelle® helps Sunriver Resort simplify payments.

Leaner payment processes ease the administrative burden for Sunriver Resort’s accounting staff.

Do I need a credit card for my small business?

Before applying for a business credit card, there are a few things to consider. For example: Does your business qualify for a credit card?

Take control of your cash flow.

Manage & run

Streamline your operations and make informed money decisions with a clear view of your finances in one place.

Plan & progress

Take your business to the next level with expert advice, lending solutions and staff management tools designed for growth.

Frequently asked questions

No matter your size or industry, U.S. Bank offers a variety of payment solutions that will meet your business (and your customers’) needs. View the range of payment solutions we have available to our U.S. Bank Merchant Services customers.

Cash flow keeps business in business. You need money in your account to pay invoices, payroll and achieve your goals. Everyday Funding3 allows you to get funding seven days a week so you can pay invoices quicker, cover your expenses faster and increase your cash flow efficiency. Everyday Funding works on weekends and weekdays which means funding is direct to your deposit account every day of the week. Everyday Funding is available at no additional cost for U.S. Bank depository account customers with a U.S. Bank Payment Solutions account.

U.S. Bank offers a variety of business credit cards to help build your business. With various features that include higher limits, low interest rates, better purchasing power and cash-back rewards, visit U.S. Bank business credit cards to find a business credit card that can help manage your transactions and cash flow.

We offer several solutions for paying your taxes with your U.S. Bank checking account. U.S. Bank payroll services for business provide digital and mobile app tools to process payroll. Roll by ADP® payroll mobile app is a self-service payroll tool that allows you to pay your employees in minutes. Also, included is a no hassle tax filing in all 50 states, backed by ADP’s tax guarantee.

Your U.S. Bank checking account will be used to withdraw your tax payments through U.S. Bank EasyTaxSM. EasyTax is a secure and easy way to make federal and state tax payments for businesses. Payments can be made online or over the phone.