Low fees

Investing online typically has lower fees than investing with an advisor in person

Investing and trading online is an easy, low-cost way to start putting your money to work. With a do-it-yourself investing approach, you can easily buy and sell stocks and exchange-traded funds (ETFs)1 on your own. Or, if you want a little more guidance, just tell us your goals and comfort with financial risk and we’ll put you in a portfolio that is managed for you and automatically rebalances to keep you on track.

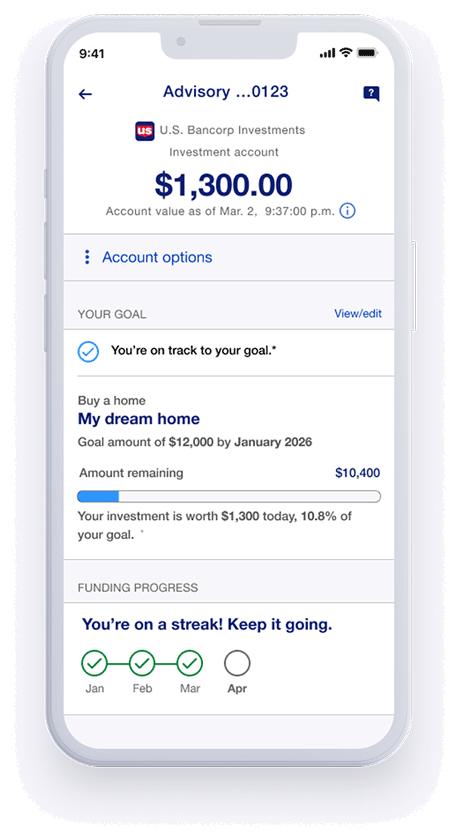

Automated Investor, our robo-advisor, uses technology and industry insights to manage your investments for you. You tell us your goals, your comfortability with risk and how much you want to begin investing and Automated Investor does the rest. If you need help, an investment professional is just a phone call away.

If you’re an experienced investor, we offer a way to control how your money is invested. Manage your own portfolio with a self-directed brokerage account from U.S. Bancorp Investments. Choose from stocks, options, exchange-traded funds (ETFs) and over 10,000 mutual funds to trade.

Managed for you

Managed by you

Explore ways to start investing with U.S. Bancorp Investments by answering a few simple questions. When you’re done, you can review your investing options and considerations based on your answers.

Learn what a robo-advisor is, how it works and some of the benefits of using one.

If you’re the type of investor who likes to do your own research, managing your own IRA could be a good option for you. Review the pros and cons of a self managed individual retirement account.

You know investing is important, but you may not know how or where to begin.