Key takeaways

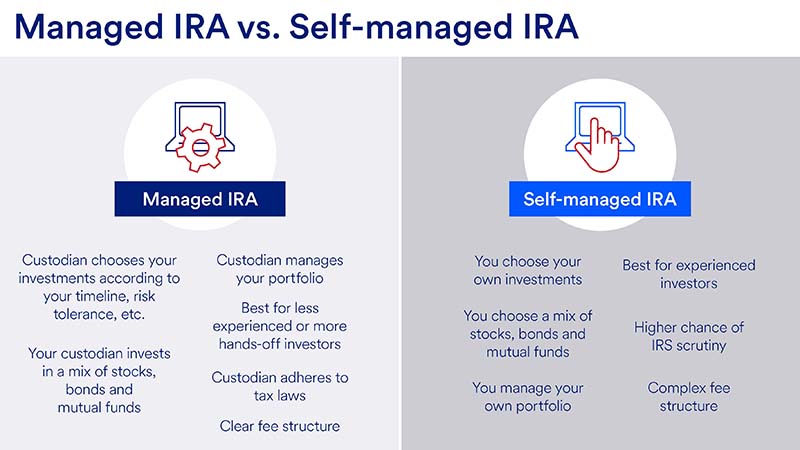

If you choose to manage your own IRA, you’ll select your own investments and manage the account.

A self managed, or DIY (do it yourself), IRA could be appropriate if you enjoy investing on your own and feel comfortable with your knowledge of the investments available within a traditional brokerage account.

Risks of managing your IRA include, but are not limited to, a lack of expertise, emotional decision-making and diversification challenges.

Are you someone who likes to research and educate yourself to accomplish tasks and projects? If so, managing your own individual retirement account (IRA) may be a good option to explore. A self-managed IRA allows you to choose your own investments from the myriad options provided within a custodial brokerage account.

Self-managing your IRA investments can be rewarding, but it also comes with risks and considerations that you need to carefully evaluate. As a result, this “DIY” IRA, and self-directed investing in general, may be more appropriate for seasoned investors, as it could be risky for someone who doesn’t understand the nuance of selecting appropriate investment options for their situation.

A note that if you’re interested in managing your own IRA, be sure to look closely at the account stipulations. Some self-directed IRAs allow you to invest in alternative investments such as commodities and futures. Others offer investment options more in line with a traditional IRA, such as stocks, bonds and mutual funds. This article will cover the second type.

Benefits of a self managed IRA

If you want to put your money into specific assets, sectors or industries, you can manage your own IRA to build a portfolio that matches your interests. Your earnings then have the potential to grow in the account and are tax deferred until you withdraw them.

You can open a self-managed IRA account as either a Roth, traditional or SEP IRA, with the latter applying to self-employed individuals or small business owners. Determining which IRA is best for your unique situation depends on your age, income and financial goals. Each type also has eligibility, contribution and withdrawal differences.

By managing your own IRA, you could fulfill your desire to take total control of your retirement savings. It can be satisfying to work hard on researching investments that may bring successful outcomes.

Don’t ignore the risks of a self-managed IRA

Managing your IRA gives you more control over your portfolio, but it also comes with potential risks. Review the following considerations to determine your comfort level with self-managing your IRA.

Make sure you have the appropriate investment expertise.

With a self-managed IRA, you’re responsible for choosing your own investments and managing your account, which means it’s usually a better option for experienced investors. Managing your own IRA requires a deep understanding of financial markets, investment strategies and asset allocation. Without this expertise, you may make poor investment decisions that can negatively affect your retirement savings.

Steer clear of emotional decision-making.

Emotions like fear and greed can lead to impulsive investment decisions. When managing your own IRA, it’s essential to stay disciplined and avoid making emotional decisions during market volatility.

Be aware of diversification and asset allocation challenges.

Diversifying your investments helps spread risk, but achieving proper diversification can be complex and time-consuming. Failure to diversify adequately may expose your IRA to greater risk. Creating the right mix of asset classes that suits your objectives and time horizon is a key factor in managing investment risk.

Monitor your portfolio regularly.

Stay informed about your investments and regularly review your portfolio. Adjust your strategy as needed to adapt to changing market conditions or personal circumstances.

Beware of trading limitations and tax issues on certain investments.

Some investments may be difficult to trade; for example, individual bonds may not be readily marketable for investors and can be onerous for anyone who is ready to begin taking distributions from their accounts. If you have questions on investments, the onus is largely on you in terms of which investments you add to your account. Certain types of investments can trigger tax implications within an IRA with unrelated business taxable income, or UBTI. Consider working with a tax advisor to ensure you stay in compliance.

Is managing your own IRA right for you?

Self-directed investing, whether it’s a general investing account or self-managed IRA, could be appropriate if you’re interested in doing your own research when investing, feel confident in your investing or investment knowledge and can withstand the ups and downs of the market.

Is a self-managed IRA right for you? Take this quiz, offered by U.S. Bancorp Investments, for actionable insights into what type of investing suits your financial goals and preferences.

Tags:

Explore more

Types of IRA accounts

An individual retirement account (IRA) is a tax-advantaged investment account designed to help you save for retirement. Review which type or types of IRA accounts meet your needs.

Open an IRA today.

Whether you prefer investing on your own or want professional guidance, we have an option to fit your needs.