BEC scams continue to evolve

Criminals continue to harvest personally identifiable information through the web and social media and use it to execute sophisticated BEC scams. They pose as trusted executives or vendors to either initiate unauthorized payments or change payment information to intercept disbursements.

According to the survey, 77% of BEC involved spoof emails designed to trick users into thinking they are interacting with a trusted source.

Educating employees on the threat of BEC and training them to identify spear phishing attempts is important to controlling BEC. .

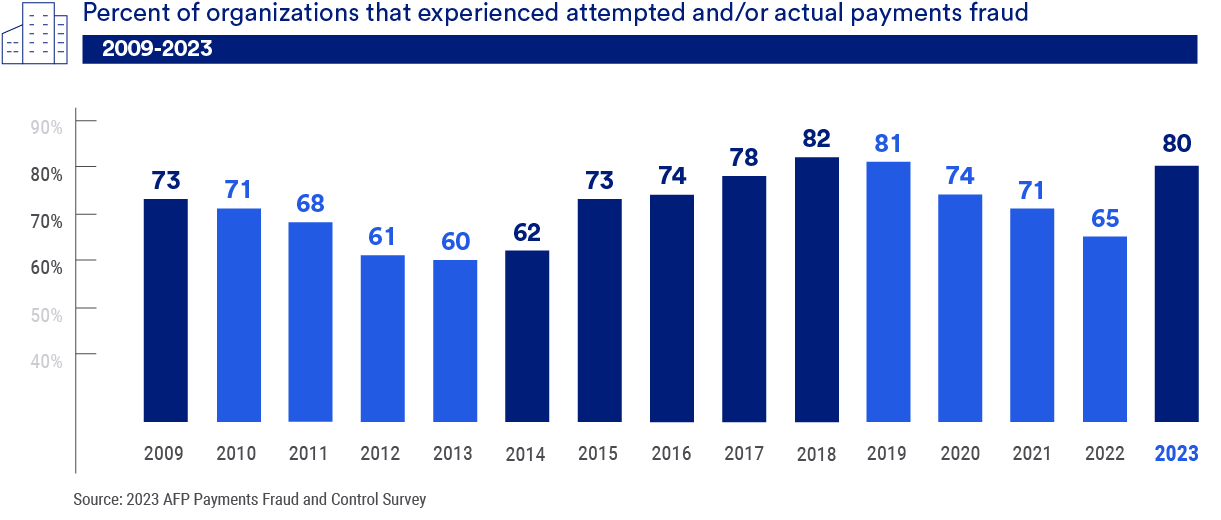

Checks remain primary target

Although businesses operate in a digital world, checks remain the primary target. Why? Their prevalence and technological advancements that have made it easier to create more convincing forgeries.

Almost two-thirds of organizations surveyed experienced attempted and/or actual payments fraud with checks. Paper checks remain especially vulnerable for criminals to steal them, alter payee names or amounts and then endorse and deposit them into accounts they created.

That dramatically outpaced the prevalence of other payments fraud attempts:

- Checks – 65%

- ACH debits – 33%

- Wire transfers – 24%

- Corporate/commercial credit cards – 20%

- ACH credits – 19%

According to the survey, the largest spike occurred with ACH debits. Meanwhile, corporate and commercial credit card fraud significantly decreased from 36% in 2022 to 20% in 2023, as did ACH credit fraud – down from 30% in 2022 to 19% in 2023.

How to protect your organization

Banks have vast experience fighting payments fraud, which often makes them a secure and trusted resource for guidance and mitigation advice following an attack.

In fact, 85% of respondents said they are most likely to seek assistance from their banking partners about what steps to take.

Kautz recommends that your organization take the following steps to help protect itself:

- Provide comprehensive training: All employees should receive training to help them identify and respond to potential attacks.

- Institute physical, digital and procedural controls: Require the use of dual approval for all payments. Establish a dedicated workstation through which all payments must be executed and limit employee access to personal email, all of which will limit your organization’s exposure to potential threats.

- Promote mindfulness: Executives should empower and encourage employees to think carefully, ask questions and verify, before executing transactions.

- Share personal information sparingly: Executives should avoid sharing biographical and direct contact information online, where cybercriminals can harvest it for use in BEC attacks.

“Companies hear about fraud in the news, but they think it won’t happen to them,” Kautz says. “That couldn’t be further from the truth. All it takes is one bad email or one wrong click.”

Don’t wait until your organization experiences a fraud attempt. Take time now to search for gaps in your fraud prevention program. Our fraud prevention checklist and tips to reduce corporate payments fraud can help:

U.S. Bank is committed to helping you meet your treasury management needs, including fraud prevention. To learn more, contact a U.S. Bank relationship manager or treasury management consultant.