Swipe, tap, insert

2.60% + 10¢

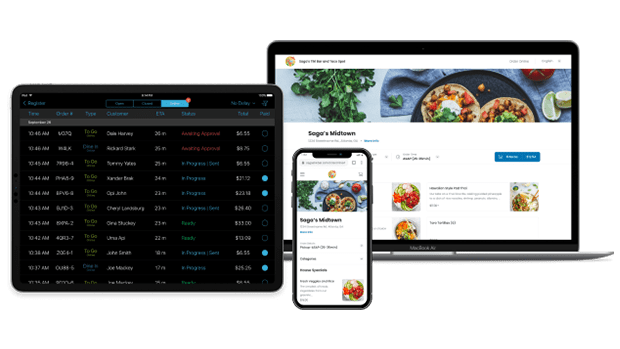

Whether you run a retail store, restaurant or service-based business, U.S. Bank offers a point-of-sale system to help you manage and streamline your operations.

Manage tables, fire tickets by course, and split checks by position. Customize your menu and offer contactless dining and online ordering. Maintain tight controls with employee roles and sell online with online ordering. Make closing a breeze with real-time reporting on revenues, payments, and tips.

Improve your retail operations with a POS from U.S. Bank. Accept all major credit cards and contactless payments, including Apple Pay. Simplify returns with support for refunds, exchanges or store credit. Gain insights into your top selling products with real-time reports.

Whether you have a stall at a farmers’ market or you’re selling tea at a festival, our mobile POS solutions give you the essentials of a point-of-sale with the flexibility to reach customers anywhere.

Get the tools for running your service business more efficiently. You can accept online bookings, set employee schedules, track customer activity and deliver a high-class customer experience that keeps them coming back.

Now available on the talech Mobile app.

Competitive credit card processing fees help you offer more payment options for your customers. We also have programs to help reduce the cost of acceptance. With pricing1 starting at:

Generate invoices and send them to customers with our POS software. Use customer profiles to quickly generate new invoices. No paperwork, no postage, no delays.

Drive sales and improve staff efficiency with online appointment booking. Customers can book appointments from your website, and your team can view appointments in real time. Create, confirm, change or cancel appointments with ease.

Increase revenue with easy online ordering. Set up your own mobile-friendly online ordering site in minutes, showcase your products and start taking orders right away.

Grow sales and gain new customers with digital or physical cards that customers can purchase online or in person. Our POS software makes it easy to add a standard barcode and/or QR code for easy scanning.

Never miss a beat with our industry-leading 24/7 customer support. A real person is always available to answer your questions at no additional cost.

Improve cash flow with industry-leading funding, available 7 days a week, with no daily funding limits.2

With EMV, contactless payment options, PCI-DSS, and end-to-end encryption, your customer payment data is protected by the latest authentication and security technology.

Looking for comprehensive POS solutions? Our specialists can help build a customized point-of-sale system for multiple locations and larger enterprises.

Point-of-sale (POS) systems are widely used across various industries to streamline the process of conducting sales transactions, manage inventory, and improve overall business efficiency. Some industries where POS systems are commonly used include retail, restaurants, hospitality and lodging, entertainment, healthcare, salons and spas, service-based businesses, e-commerce, automotive and more.

Deciding to use a POS system depends on a few factors. In general, if you take payments, you should use a POS system. POS systems are particularly beneficial for retail businesses, restaurants, and service providers that deal with a high volume of transactions and require features like inventory management, sales tracking, and reporting. But even mobile businesses like food trucks, or farmers’ market vendors can benefit from a POS system. U.S. Bank offers several POS plans for all types of businesses. We offer mobile POS plans up to full-service POS systems.

Point-of-sale systems work by facilitating and automating the various tasks involved in taking payments. The process typically involves several steps, including product database setup (each item in inventory receives a unique identifier, such as a barcode, and includes information like price and description; item scanning; price calculation; payment processing; receipt generation; inventory management; reporting and analytics; and security.

POS systems can vary in terms of features and capabilities. Some businesses may use basic or free POS systems that handle essential functions, while others may opt for more advanced systems with additional features like customer relationship management, loyalty programs, and online integration. The goal of a POS system is to streamline and enhance the efficiency of the sales process while providing businesses with valuable insights into their operations.