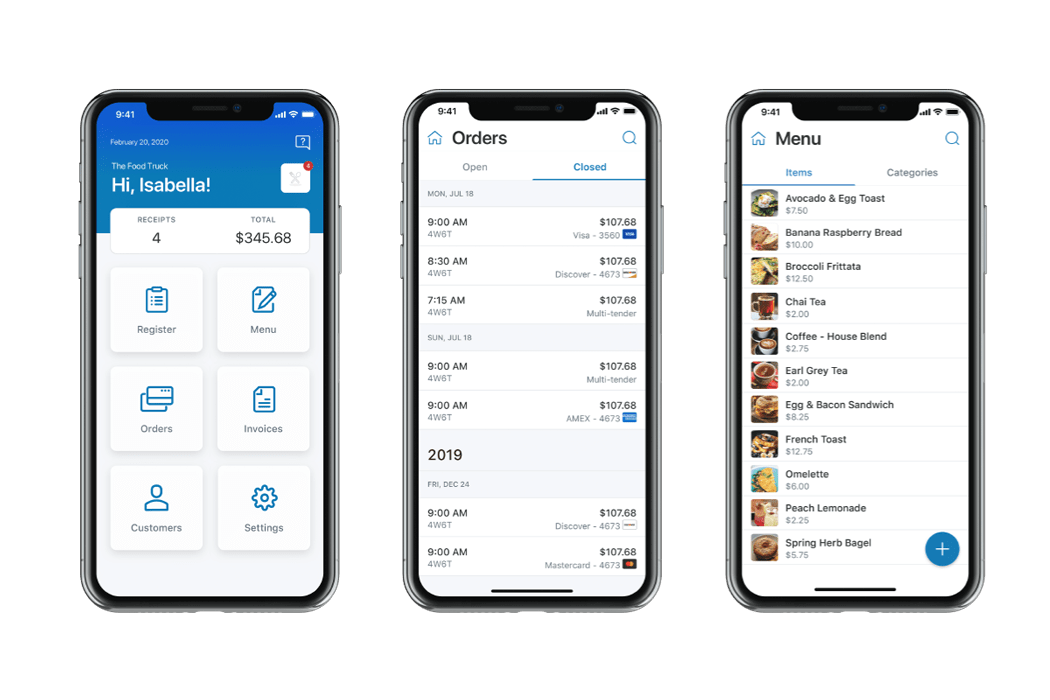

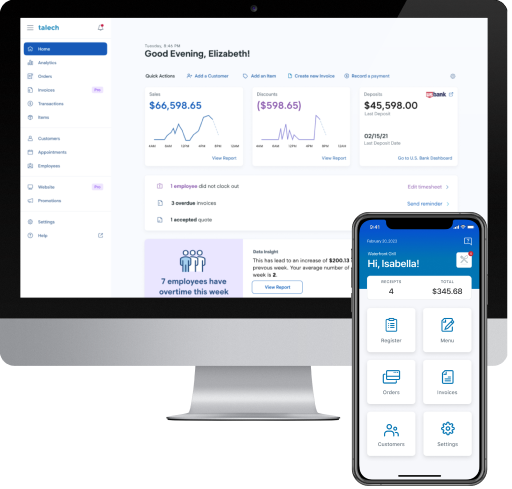

- Order management including splitting items, item level notes and custom discounts

- All major credit and debit cards, Apple Pay, Google Pay and Samsung Pay accepted

- Inventory tracking

- Automatic and manual charges

- Paper, SMS and email receipts

- Multi-level user access

- Customer management

- Supported cash drawer and printers

Elavon, a division of U.S. Bank, transaction fees apply.2