2023 Corporate Responsibility Report available now

Featured story

U.S. Bank Foundation Opportunity Fund helps small businesses grow and thrive

We give back.

We invest our time, talents and resources to uplift people. We care about the causes that matter to our clients and communities.

U.S. Bank Foundation

The U.S. Bank Foundation drives philanthropic initiatives, including grants, nonprofit donations, and employee giving and volunteerism efforts.

Corporate sponsorship

We partner with organizations across the country to support communities and meet business goals.

Disaster relief and financial recovery

Our disaster help line and financial assistance programs aim to protect our clients when they need it most.

"We’re powering opportunities for growth and innovation. This work helps us evolve our business and have a positive impact on people and the planet.”

— Reba Dominski, U.S. Bank Senior Executive Vice President and Chief Social Responsibility Officer

We enable financial wellness.

We empower people to manage their finances, build wealth and thrive in their communities.

Financial inclusion products

We’re creating flexible, accessible products that serve a wide range of financial needs. These include our Simple Loan, Business Diversity Lending Program, Bank Smartly® Checking, Safe Debit and secure credit cards.

Our people and services

We’ve created custom employee roles, free programs and digital tools to support our clients’ and communities’ financial well-being journeys. For example, our Goals Coaching program helps people turn passions into plans.

Financial education

We help people understand the financial building blocks to achieve their goals — from budgeting and saving to building credit and investing.

Financial IQ

The financial education section of our website contains a wide catalog of articles, tools and insights to help with money management and more.

U.S. Bank Student Scholarship

Our scholarship program teaches financial wellness concepts and has awarded hundreds of thousands of dollars to help students pay for college.

Featured story

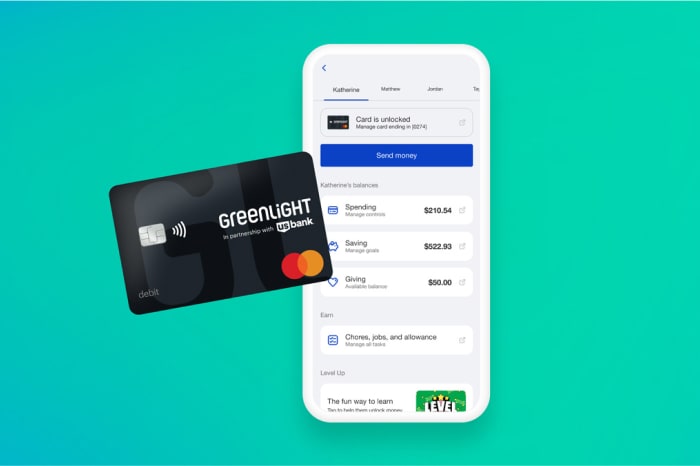

Empowering more families to teach kids about money with Greenlight

U.S. Bank Access Commitment®

Access Commitment is our long-term approach to support underserved communities, including communities of color, on their path to building generational wealth.

U.S. Bank Access Home

U.S. Bank Access Business

Business Access Advisors offer direct assistance to small business owners in key markets.

U.S. Bank Access Wealth

Our wealth specialists provide resources and guidance to help people in underserved communities build wealth and work toward their financial goals.

We celebrate inclusion.

We are committed to diversity, equity and inclusion (DEI) for all key stakeholders – from employees and suppliers to clients, consumers and the communities we serve.

Featured Story

Diversity Lending Program helps entrepreneur grow business, hire more employees

DEI at U.S. Bank

Our approach to DEI means creating a space where people feel they belong. Their voices and ideas matter to us.

Diverse customers and communities

We celebrate diverse cultural groups and support their journeys toward owning homes, running small businesses and building wealth.

Human rights and ethics

Our culture of ethics and integrity is at the heart of our purpose. We work to ensure the safety and dignity of employees, customers and communities.

We operate responsibly.

As the largest superregional bank in the United States, we have a responsibility to serve employees, clients and communities. We take that responsibility seriously.

Featured Story

Howard University welcomes solar to its campus in partnership with Volt Energy

Environmental, social and corporate governance (ESG)

We empower communities, drive more equitable access to financial resources and support the transition to a low-carbon economy.

$100 billion community commitment

The U.S. Bank community benefits plan (CBP) is a five-year, $100 billion commitment to help people and communities thrive.

Supplier development and diversity

Our program identifies, develops and builds strong relationships with small and diverse businesses.

U.S. Bancorp Impact Finance

We’re an industry leader in providing financial solutions that help create positive impact for communities and the environment.

“For more than 35 years, U.S. Bancorp Impact Finance has leveraged our purpose and strengths to create lasting community impact.”

— Terry Dolan, U.S. Bank Vice Chair and Chief Administrative Officer

Corporate responsibility reports

Our corporate responsibility and community impact reports reflect our environmental and cultural efforts in the communities we serve. Explore our latest reports to dive deeper into our work and where we plan to go next.