Key takeaways

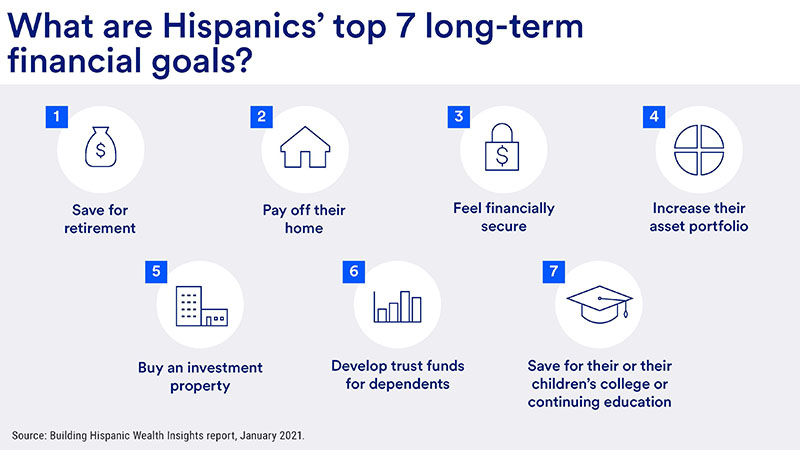

Hispanics/Latinos define financial success as caring for loved ones, helping the next generation and leaving a legacy.

Cultural beliefs can present barriers to financial success, including an aversion to investing and not saving for retirement.

Financial education, automating saving and working with a financial professional are three ways to get on the path to financial wellbeing.

Whether you identify as a Hispanic or a Latino, you probably love your family deeply and would go to the ends of the earth for them. You also want your family to be proud of you and what you’ve accomplished in life, and you want nothing more than to leave a financial legacy for your children and a mark on your community.

Affluent Hispanic/Latino people tend to see financial success as a pathway, opening doors not only for them but also their wider circle. A good share set aside a portion of their income to help extended family members both inside and outside the U.S.

Financial success: Working smarter, not harder

But while most Hispanics/Latinos believe that hard work pays, societal barriers and cultural beliefs can sometimes hinder their progress toward financial wellbeing.

“For many Latinos, success means that you build off your parents’ hard work,” says Christy Isordia, a Wealth Management Advisor with U.S. Bancorp Investments. “But we need to learn to work smarter, not harder, if we’re going to set ourselves up for success.”

A significant barrier to financial success for many Hispanics/Latinos, particularly those in older generations, is the fear of investing outside of real estate, especially stocks and bonds, she says.

“For many in the community, if they can’t see it, they can't touch it; it fluctuates too much for them,” Isordia says. “Even my mom doesn’t want to invest in stocks because she doesn’t want to lose anything. The fear of fluctuation is big for them.”

She also notes that many in the community also don’t understand financial terminology and thus avoid the investment world, assuming that it’s too complicated. These types of investing misconceptions can get in the way of building a solid financial future.

“We can help people be successful in their financial goals. Right now, their money is just sitting there, but we can help them build their investments so they can better realize their goals.”

Christy Isordia, Wealth Management Advisor with U.S. Bancorp Investments

Hispanics and retirement planning

Many older Hispanics/Latinos also haven’t engaged with the concept of saving for retirement, Isordia says, as it was always expected that their adult children would take care of them. This means that many older people didn’t seek out jobs with 401(k) plans, and they may not have had financial education on topics such as types of retirement plans, like IRAs (individual retirement accounts).

As part of this, younger generations have often taken on debt to assist aging parents or left their careers altogether.

“A lot of people in the community feel like they will have to leave their job to take care of their parents,” Isordia says. “They don't look at different options for parents, such as getting help from caretakers. This was especially true for taking care of parents in the Silent Generation, but I’m beginning to see some differences as baby boomers start to retire.”

A shift in legacy planning for Hispanics/Latinos

Older generations also didn’t tend to leave financial legacies for the next generation, preferring the mentality of, “I worked hard to get ahead; now you have to work hard to get ahead.”

“Now, more Hispanics and Latinos are making sure their kids are going to be OK, though I don’t feel that’s happening as much as it should, and we’re starting to educate people on that,” Isordia says.

With all that background in mind, here are five tangible steps Hispanics/Latinos can take today to begin working toward financial wellbeing.

Financial literacy for Hispanics/Latinos: Five ways to build a bright financial future

1. Begin investing.

Consider opening an IRA or taking advantage of an employer sponsored retirement plan. Either way, you’ll realize tax benefits and grow your money through compound growth.

“A lot of Hispanics and Latinos don’t open 401(k) plans to invest in because they don’t want to lose money,” Isordia says. “But I tell them that they’re losing money by not taking advantage of their employer’s matching contributions. I recommend that they at least start contributing the same percentage that their employer is matching, and then build from there.”

2. Automate saving.

Your responsibility is to you, your family and community, in that order. Think about paying yourself first by setting up automatic contributions to your retirement account.

“That’s a huge mind shift for Hispanics and Latinos, who have been raised to feel that taking care of themselves first is selfish,” Isordia says. “But you have to take care of yourself first to be able to effectively take care of others, including leaving a legacy for your kids.”

3. Support and protect your family.

Consider engaging in financial planning activities like securing insurance, saving for children’s education and estate planning.

“Planning is definitely something we have to educate Hispanics and Latinos to do more of,” Isordia says. “For example, after they die, a lot of their homes end up in probate, because they never really planned for how to appropriately transfer ownership to their kids. I tell my older clients, ‘You’ve worked so hard – do you want to lose it now to the state? Look at some ways for your kids to keep the house, as well as ways to transfer other aspects of your wealth.’”

4. Boost your financial education.

“There's always more to learn for all of us – even us doing this as a profession,” Isordia says. She also encourages parents and guardians to talk about money with their kids from an early age so they enter adulthood prepared to manage their finances.

5. Seek financial planning support.

An experienced financial professional can help you build a customized financial plan, which you’ll review regularly to make sure you’re on track.

“We can help people be successful in their financial goals, whether it's saving for retirement, buying a house or paying for their kids’ college tuition,” Isordia says. “Right now, their money is just sitting there, but we can help them build their investments so they can better realize their goals.”

If you need a financial professional, you don’t have to look very far. Start working with a financial advisor or wealth specialist today and create a strategy customized to your financial goals.

Tags:

Explore more

Wealth preservation: Key strategies to protect your wealth

Building wealth is only half the battle. These strategies may help protect it against market volatility and other events.

Our goals-focused approach puts you first.

We can help you identify and prioritize your financial goals and design a plan to work toward them, making adjustments as your needs evolve.