Key takeaways

Tasks to do before a baby arrives include preparing for parental leave and exploring HSA/FSA options.

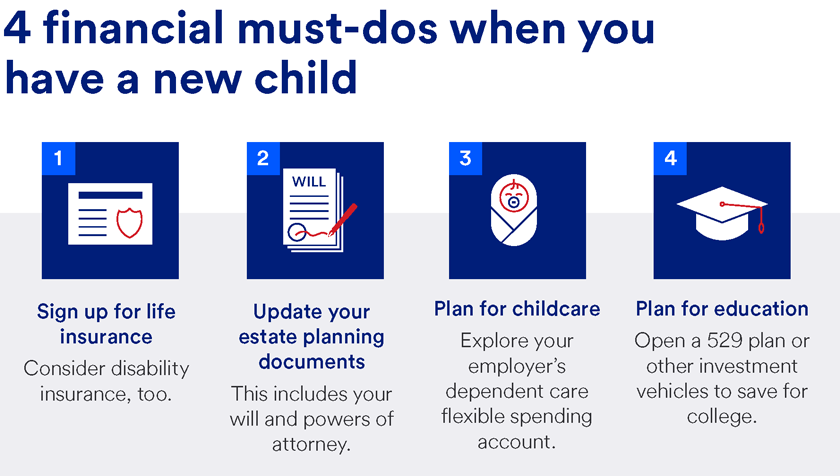

Establishing essential documents such as a will or trust, powers of attorney and insurance policies ensures your child’s future is secure should something happen to you or your partner.

Planning for education is even more important as college tuition skyrockets. Opening a 529 plan can give you a head start on covering the costs.

When you welcome a child into your home, you’ve probably already considered the short-term and long-term essentials, like baby gear and childcare arrangements. But there’s another critically important aspect to expanding your family: financial planning.

In 2017, the U.S. Department of Agriculture estimated that raising a child born in 2015 from birth through high school would cost $233,610 for a middle-income, two-parent household.1 In 2022, adjusting for higher inflation, the Brookings Institution estimated the cost to be closer to $310,605 from birth to age 17.2 Housing, food, and childcare costs are typically the largest expenses initially, with higher education added as another major expense in the future.

How to financially prepare for a baby

Planning for expenses related to a new child can help ensure that you’re prepared for immediate expenses and more. Here are a few tasks to take care of before your new child arrives.

- Establish or increase your emergency fund. Having money set aside in a savings or money market account means your family would have some breathing room if you experienced a job loss or a large, unexpected expense, such as a home repair or medical bill. Experts typically recommend keeping an emergency fund of three to six months’ worth of total household income, but with children in the mix, you might want to aim for six to nine months or more.

- Understand your parental leave coverage. Bonding time can be beneficial, but you also want to make sure your finances won’t take a hit that they can’t handle. Speak to your HR department about your options, which could be a combination of the company’s parental leave offering, short-term disability, FMLA-protected unpaid leave, sick time and/or vacation time.

- Check if your employer offers FSA/HSA and dependent care accounts. Childcare is expensive, but a dependent care flexible spending account (DCFSA) will lessen the blow by allowing you to contribute pre-tax dollars toward care. Similarly, healthcare flexible spending account (FSA) or health savings account (HSA) contributions are tax-advantaged, lessening your taxable income.

Financial planning for new parents task #1: Consider health, life and disability insurance options for your family

One of the first tasks you should do as a new parent is to get health insurance for your child. You can add them to your health insurance plan or, if you don’t have insurance, you can enroll in a Marketplace plan through a Special Enrollment Period. Requirements vary depending on your plan and/or your state, but you typically need to add your new child or apply for coverage within 30 to 60 days.3

Another way to protect your child’s wellbeing is to have life insurance for you and your partner or spouse, if you have one. Life insurance is a financial planning tool that acts as a safety net if a parent — especially the breadwinner — passes away unexpectedly.

There are two main types of life insurance:

- Whole, or permanent, life insurance provides death benefit protection for your family and allows you to access the potential cash value that may accumulate inside the policy. The cash value can be used for additional financial needs, like college funding.

- Term life insurance is a more affordable option and provides coverage for a period of years, usually no more than 30, with a fixed premium each year.

Finally, consider disability insurance. If you or your partner became unable to work due to an accident, illness or injury, it would have a big effect on your family income. Disability insurance would cover a portion of the income loss, helping your family stay on an even keel during what may be a difficult time.

Financial planning for new parents task #2: Establish estate planning documents

One important task is to review your beneficiary designations on any retirement accounts, such as a 401(k) or an IRA. The beneficiaries you list on these accounts supersede any designations in your will and trusts, so it’s important to update them as your life changes.

Next, review your estate planning documents to ensure your beneficiaries are up to date. Your new child should be included, as should your current partner or spouse and any children from previous marriages.

Here are the key estate planning documents you should create or update when you become a parent:

- A will: If you don’t have a will yet, it’s important that you create one as soon as you can, as it establishes guardianship for your children. If you die, your will ensures that your children will be cared for in the way you determine is in their best interest. (Tip: When choosing a guardian, be sure to specify both a first choice and a back-up choice.)

- Healthcare power of attorney: This allows you to specify who will make decisions about your healthcare if you’re incapacitated. For instance, in what situation would you want, or not want, ventilator support or any other life-extending treatments? A healthcare power of attorney also specifies who can receive information about you and your healthcare needs.

- Financial power of attorney: This document allows you to designate your spouse, partner or another individual to act on your behalf in financial matters if you became incapacitated. A financial power of attorney establishes a safeguard for your children if you’re not able to care for them for an extended period.

- A trust: A trust is a legal contract, drafted by an attorney, with a named trustee who ensures your assets are managed according to your wishes both during your lifetime and after your death. Talk with an estate planning attorney to see if a trust is right for your situation.

These documents will have a major impact on your family if you die or are incapacitated, so it’s a good idea to consult with an experienced estate planning attorney who can help you create a plan designed to establish the legacy you want. If an estate planning attorney isn’t an option for you right now, there are estate planning software programs that can help you create and maintain these documents.

Financial planning for new parents task #3: Plan for childcare

While childcare costs are highly dependent on where you live, 59% of U.S. families were expecting to spend at least $15,000 in 2023.4

Childcare will therefore be a significant expense in the early years if both parents work outside the home. Expenses could include including daycare, preschool, summer camps, and before- and after-school care. Check to see if your employer offers a DCFSA, which allows you to deduct a certain amount per year from your pre-tax salary for use on eligible childcare expenses.

Financial planning for new parents task #4: Plan for education

Get a head start on saving for college by opening a 529 Education Savings Plan for your child and setting up regular deposits. If you’re considering private school, a 529 plan can also be used for K-12 private school tuition.

In addition to a 529 plan, you can establish a Coverdell education saving account, a Uniform Gifts to Minor Account or even a Roth IRA for educational purposes. Consulting with an experienced financial professional can help you decide which savings vehicles are right for you.

The benefits of financial planning for new parents

By taking care of family financial planning as soon as you can after a child joins your family, you can focus on enjoying and bonding with your child. The four steps above can help you establish a more secure financial future for you and your family.

Thoughtful planning can make a significant difference in how you manage your money. Learn how our approach to financial planning can help put you in control of your finances.

Tags:

Explore more

Sandwich generation financial planning tips

Financial tips on how to keep working toward your financial goals while supporting your children and aging parents.

Our goals-focused approach puts you first.

We can help you identify and prioritize your financial goals and design a plan to work toward them, making adjustments as your needs evolve.