Key takeaways

There are two main categories of life insurance: term, which provides coverage for a specific timeframe, and permanent, which is meant to last for a longer period of time.

Permanent life insurance comes in different forms, including whole, universal, current assumption universal, index universal or variable universal.

Weighing the cash value, cost, and coverage duration may be helpful in determining the right type of life insurance policy for you.

Purchasing a life insurance policy can give you peace of mind that your loved ones will be protected when you die—but it’s not always a straightforward decision. There are a number of factors to consider when choosing a policy, including how much life insurance you will need and what you want to cover.

Understanding the different types of life insurance and what makes them unique can help make the process a little easier.

Term vs. permanent life insurance: What’s the difference?

To start, life insurance falls into two overarching categories: term and permanent. (Within permanent life insurance, there are several sub-categories to explore, too—more on those below.) Your first step will be to decide whether a term or permanent policy type is right for you.

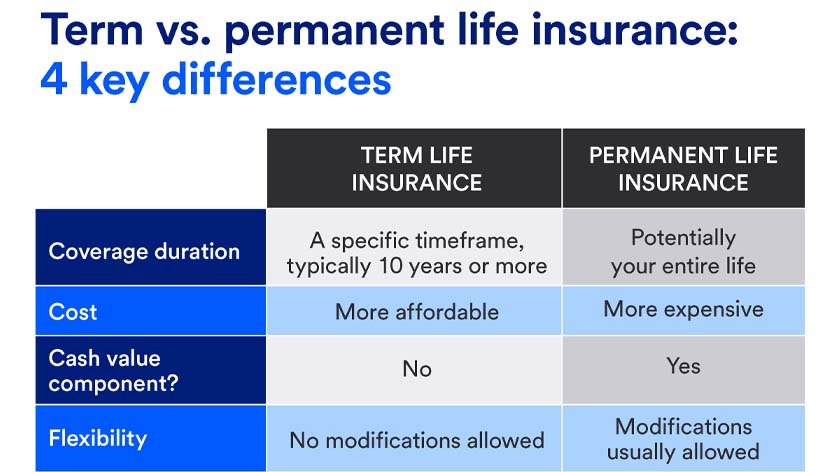

Here are the main differences between term and permanent life insurance policies:

- Coverage duration. Term life insurance provides coverage for a specific timeframe, such as 10 or 20 years. Permanent life insurance is meant to last for a longer timeframe—sometimes, your entire life.

- Cost. Because of the difference in coverage, term life insurance is usually the more affordable option; permanent life insurance tends to be more expensive.

- Cash value Term life insurance policies don’t offer a cash value component, meaning you can’t borrow against them or withdraw cash if needed. Permanent life insurance policies do offer a cash value component, with the premiums you pay accumulating in a cash value account that grows over time.

- Investment options. Because of their associated cash value, you can leverage permanent life insurance policies as an investment tool. For example, if you accumulate enough cash value, you may add these funds to your portfolio of investments to boost your retirement income. How you can use this cash value an investment tool—and how much control you have over those investments—varies slightly by different types of permanent life insurance (addressed below).

- Flexibility. Term life insurance policies can’t be changed after they’re issued, while permanent policies usually let you make modifications. Common changes people might want to make after purchasing a life insurance policy include updating the death benefit or adjusting premium amounts.

When is term life insurance the right option?

Sometimes, a term life insurance policy may be the best fit, particularly for people who are solely focused on income replacement in the event of their death. You might find that term life insurance makes sense for you if:

- You are under the age of 50. If your primary goal is to provide a source of income for your family that would be lost upon your death, and you’re under the age of 50, you might opt for a shorter-term policy to last throughout retirement age.

- You have a specific need for coverage. If you want to ensure a specific debt, like a mortgage, is paid off, you may opt for a term life insurance policy.

- You want to ensure business continuity. Business owners sometimes opt for term life insurance policies in the event that a key employee or executive dies.

When selecting your term, you’ll want to consider the length and amount of your outstanding debts, number and age of dependents, and any anticipated future expenses, including end-of-life costs.

For example, a 28-year-old parent with young children and a 30-year mortgage might opt for a term policy of 30 years. A 45-year-old parent with children in their teens and 10 years or less left on their mortgage may find a 10-year policy sufficient to cover their financial commitments.

When is permanent life insurance the right option?

Permanent life insurance is designed to meet more specific needs than just income replacement. And since insurers are obligated to pay out death benefits to beneficiaries, these types of policies are generally more expensive than term life policies.

Specific circumstances where permanent life insurance may be the right fit include:

- Providing liquidity for an estate. If estate taxes are a concern, permanent life insurance can be used to essentially replace the proceeds from the estate that would be lost to taxes and fulfill the financial expectations of your heirs.

- Funding the buyout of a business partner upon their death. Life insurance is often used as a key component of a buy-sell agreement between business partners.

- Meeting potential future costs for long-term care. With permanent life insurance, you can add on something called a long-term care rider (LTC rider) which allows a portion of the death benefit to pay for long-term care services, if needed. If you don’t end up using the LTC benefits, your beneficiaries will receive the full death benefit.

- Financially supporting a disabled dependent upon your death. If you have children or other dependents who may not be able to financially support themselves, permanent life insurance can help ensure they are cared for financially after your death.

Different types of permanent life insurance and their investment potential

If a permanent life insurance policy is the right option for your situation, you have a few more decisions to make. Within this category are sub-categories: whole, current assumption universal, indexed universal and variable universal.

These types of life insurance policies can be designed to have cash value, meaning that a portion of the premiums you pay go into a cash value account. This cash value is something you may leverage as an investment tool, by either placing them in investment vehicles of your choice or having the insurance company select them for you.

Whole life insurance

As its name implies, whole life insurance is a specific type of permanent life insurance meant to last your whole life. As long as you pay your premiums, it’s considered a set-it-and-forget-it method of life insurance. (However, whole life insurance policies can be modified or changed if you wish, unlike term policies.)

Of the different types of permanent life insurance, whole life is considered the most conservative and least flexible. This is because you don’t have the ability to choose your investments — the insurance company selects the investments that will be made with your cash value. Your premiums are also fixed. The fixed premiums of whole life insurance may not offer the same potential for high returns as other options, but they do provide predictability that your premiums won’t rise unexpectedly.

This reliability may be seen as a benefit, seeing as the cash value of these policies grows at a guaranteed interest rate year-after-year, and the death benefit is not subject to fluctuation. You can also withdraw that cash value and borrow against it if you need, though this may reduce the death benefit.

Universal life insurance policies

Like a whole life policy, universal policies (also known as an adjustable policies) can provide lifetime protection. Universal policies differ, however, in that they may have flexible premium payments and may or may not build cash value. They also come with a guaranteed minimum interest rate, offering the potential for higher returns. While the flexibility and higher return potential of universal life insurance is appealing, keep in mind that these policies do require diligent management to prevent any lapses in coverage.

It's also important to note that different types of universal policies vary when it comes to how their cash value accumulates.

Current assumption universal life insurance

With current assumption universal life insurance, the insurance carrier sets an interest rate annually, with a minimum guaranteed rate. Your cash value earns interest at this rate—either monthly or annually—and the rate can change yearly on your policy’s anniversary. Your death benefit will also be paid as long as your cash value remains enough to cover the policy’s monthly expenses.

Indexed universal life insurance

With indexed universal life insurance, cash value earns interest based on the performance of a specific index—such as the Nasdaq 100 or S&P 500. Interest is typically subject to a floor of 0% and a ceiling (cap) or participation rate. Even though the interest may fluctuate, these policies do come with a minimum guaranteed interest rate, which limits your losses. The timing of interest credits can also vary depending on your selected strategy.

Variable universal life insurance

Variable universal life insurance is a type of universal insurance where your premiums are invested in stock and bond market portfolios of your choice. Policyholders decide how to invest their cash value from a range of options, from mutual fund-like sub-accounts and index funds to ETFs. This offers the potential to generate competitive returns that may dramatically affect the cash value accumulated in the account.

Variable universal life may be a good option if you’re looking to provide a death benefit and potentially contribute to your investment portfolio. Increasing cash values can be used to partially offset premium payments. You can also take partial withdrawals of the cash value or borrow against it.

A variable universal life insurance policy offers an opportunity to boost the cash value beyond what’s available in other types of permanent policies. Keep in mind, however, that a variable life insurance policy requires hands-on management because of the impact that investment performance has on the policy’s coverage features. You’ll want to assess your risk tolerance and investment time horizon to determine an appropriate investment strategy.

Choosing the life insurance that’s right for you

While understanding the different types and purposes of life insurance can help in your decision-making, determining the right approach to life insurance is often best accomplished with a financial advisor. Since life insurance is just one aspect of a comprehensive financial plan, you want to make sure your purchase decision is aligned with your most important financial goals.

Learn more about the role life insurance can play in your financial plan.

Tags:

Explore more

Why is insurance important in financial planning?

Just like your financial goals, insurance policies are as unique as you are.

Insurance coverage for what matters most.

Insurance protection from U.S. Bancorp Investments can help you, your family or your business feel more prepared, no matter what lies ahead.