Key takeaways

The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 revised existing rules around retirement saving, including raising the age of required minimum distributions (RMDs) and eliminating age limits for traditional IRA contributions.

Congress passed a follow-up package in 2022, the SECURE 2.0 Act, changing rules that could affect how you save and withdraw money from your retirement accounts.

You should review your employer-sponsored retirement plan to see how the changes could affect you, and consult a financial professional for further guidance.

The SECURE 2.0 Act was signed into law in late 2022, delivering dozens of new retirement-related provisions. These changes build on the original SECURE Act of 2019, which altered the rules around how you can save and withdraw money from your retirement accounts.

The SECURE 2.0 Act offers comprehensive changes to address the retirement income gap for individuals, and there are very few people who won’t be affected. These changes could empower you to reach your savings goals and provide more flexibility when you retire.

On this page

A lack of retirement preparedness

The lack of retirement preparedness among Americans has drawn the attention of Washington policymakers in recent years.

According to one study, by 2050, the U.S. will face a $137 trillion retirement income gap (the difference between what savers should have and what they’ve actually saved). If projections hold, retirees in six major economies (including the U.S.) would outlive their savings by an average of eight to 20 years.1

The provisions of the SECURE 2.0 Act, which aim to address this income gap, will be phased in over the next decade. Following is a rundown of these provisions, their effective dates and how they could affect your retirement planning.

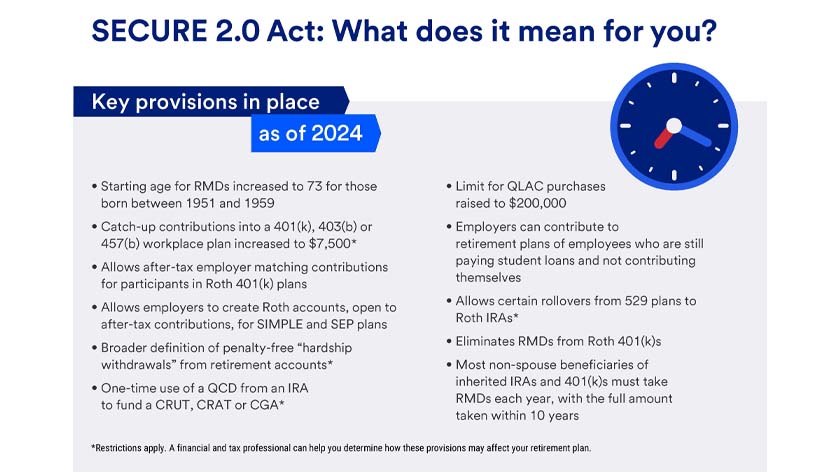

SECURE 2.0 Act provisions in effect through 2024

The SECURE 2.0 Act raises the starting age for RMDs.

The threshold age that determines when you must begin taking required minimum distributions (RMDs) from traditional IRAs and employer sponsored retirement plans has increased from 72 to 73.

What this means is that you now can choose to delay taking your first RMD until April 1 of the year after the year in which you turn 73. From that point on, you must take your RMDs each year by December 31. In addition, the penalty for failing to take RMDs on a timely basis has been lowered from 50% to 25%.

It’s important to note that delaying RMDs means the amount of withdrawals required in later years may be larger, which could move you into a higher tax bracket. And since your RMD amount is calculated by dividing your account balance on December 31 of the prior year by your life expectancy, a year with strong market performance may also move you into a higher tax bracket.

You can minimize the tax impact of this provision in a couple of ways:

- Donating an RMD, in any amount up to $105,000 for 2024, from a traditional IRA directly to a qualified charitable organization. This is known as a qualified charitable distribution (QCD) and it’s available to individuals 70 ½ years of age or older. QCDs are often an overlooked planning opportunity for individuals to manage gifts and reduce taxes.

- Building a tax-diversified portfolio that includes taxable (traditional brokerage accounts) and tax-free (Roth) accounts, which are exempt from RMDs.

The SECURE 2.0 Act increases employer-sponsored retirement plan catch-up contributions.

Catch-up contributions allow people age 50 and older to set aside additional dollars beyond the standard maximum contributions to employer-sponsored retirement plans.

Effective in 2023 and 2024, the maximum additional catch-up contribution to an employer plan increased from $6,500 to $7,500 per year and remains at $7,500 for 2025 for those 50-59.

The SECURE 2.0 Act makes changes to employer-sponsored Roth 401(k) plans.

If you have a Roth 401(k) plan through your employer, and if the employer plan is updated to allow it, you can choose to have your employer’s matching contributions directed to your Roth 401(k) account. These contributions are considered taxable income in the year of the contribution, but future growth or withdrawals are tax free.

In addition, employers can now elect to add after-tax Roth contributions to accounts for SIMPLE IRA and SEP IRA retirement plans. Like Roth IRAs, starting in 2024, Roth 401(k)s are no longer subject to RMDs.

The SECURE 2.0 Act allows more penalty-free early withdrawals.

There’s generally a 10% tax penalty if you take distributions from a retirement account before you turn 59 ½. The SECURE 2.0 Act expands the circumstances where penalty-free “hardship” withdrawals could occur if the employer elects to provide them in the plan. The 10% penalty will be waived for:

- Individuals certified by a physician as having a terminal illness or condition that can reasonably result in death in 84 months or less (withdrawals of any amount).

- Individuals in federally declared natural disaster areas (withdrawals up to $22,000).

- Domestic abuse victims within the past 12 months (withdrawals up to the lesser of $10,000 or 50% of the vested balance of the account). All or a portion must be repaid within three years.

- Individuals facing financial emergencies (one withdrawal per year up to $1,000 is allowed). Certain criteria must be met before they can make subsequent withdrawals.

The SECURE 2.0 Act introduces new rules for QCDs.

As stated previously, individuals who are 70 1/2 and older can direct over $100,000 in distributions per year from a traditional IRA to a QCD. The contribution limit is indexed for inflation annually.

You also have a one-time opportunity to also use a QCD of up to $50,000 from an IRA to fund a charitable remainder unitrust (CRUT), charitable remainder annuity trust (CRAT) or a charitable gift annuity (CGA). As in a regular QCD distribution, there is no tax deduction for making this gift; however, the distribution will count against the RMD for that year.

The SECURE 2.0 Act brings in new limits for qualified longevity annuity contracts (QLACs).

The maximum amount that you can use to purchase QLACs is now $200,000 (up from $145,000). In addition, the “25% of account balance” limitation is eliminated.

The SECURE 2.0 Act allows employers to make retirement plan contributions for employees with student loan debts.

Employers can elect to make contributions to retirement plans on behalf of employees who are still repaying student loans, even if those employees do not make retirement plan contributions themselves. Employer contributions can match the amounts of student loan debt repaid by the employee in a given year.

This provision creates an excellent opportunity for employers to offer an incentive to attract and retain employees. It could prove to be an effective way to kick-start a retirement savings plan for younger workers who are burdened with student loans.

The SECURE 2.0 Act allows rollovers of 529 plan balances to Roth IRAs.

You can now roll up to $35,000 of leftover funds in a 529 education savings plan into a Roth IRA over the course of several years due to the annual contribution limit to a Roth IRA. Balances above $35,000 can be taken as a non-qualified distribution, but the earnings portion of the distribution is subject to income tax and a 10% penalty.

This provision reduces the fear of overfunding a 529 plan by allowing excess funds to be used for other needs without penalty. The $35,000 threshold is a lifetime limit subject to a few restrictions:

- The 529 account must have been in place for at least 15 years.

- Funds in an amount up to the maximum annual Roth IRA contribution limit must be transferred directly into a Roth IRA for the same individual who was the beneficiary of the 529 plan.

- Any 529 plan contributions made in the previous five years, and any earnings attributed to those contributions, are not eligible to be rolled into a Roth IRA.

- The amount transferred into a Roth IRA each year must be within annual Roth IRA contribution limits.

The SECURE 2.0 Act updates rules for withdrawals from inherited IRAs and 401(k)s.

The 2019 SECURE Act mandated the full withdrawal of inherited IRAs and 401(k)s within 10 years of the account holder’s death for most non-spouse beneficiaries. Before this, non-spouse beneficiaries could generally stretch withdrawals over their lifetime according to IRS life expectancy tables.

An ambiguity in the law led many to believe that non-spouse beneficiaries only had to withdraw the entire account balance by the 10th year. But in 2022, the IRS issued proposed regulations requiring that RMDs be taken each year during the 10-year period. Final regulations issued in 2024 confirm this, which means non-spouse beneficiaries cannot wait until the 10th year to withdraw the full account balance.

Due to the ambiguity of the law, the IRS will not assess penalties on non-spouse beneficiaries who did not take RMDs between 2021 and 2024, or require them to make up these missed RMDs.

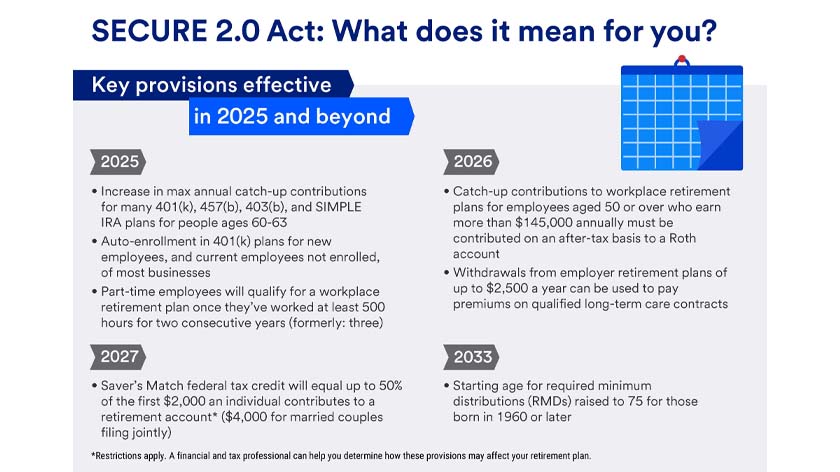

SECURE 2.0 Act provisions effective beginning in 2025 and beyond

The SECURE 2.0 Act increases 401(k) and SIMPLE IRA catch-up contributions for people age 60-63.

Starting in 2025, the maximum additional catch-up contribution will increase from $7,500 to $11,250 for individuals who are between the ages of 60 and 63. This amount will be indexed for inflation annually after 2025. For SIMPLE IRAs, the catch-up contribution limit will increase from $3,500 to $5,250 in 2025 for individuals between the ages of 60 and 63.

The SECURE 2.0 Act enacts auto enrollment in 401(k) plans.

Starting in 2025, new employees will be automatically enrolled in 401(k) plans as soon as they become eligible. Also, existing employees will be automatically enrolled if they’re not participating in a plan. Employees who don’t wish to participate in the plan will have to choose to opt out.

Auto enrollment will be required of most major employers. Businesses with 10 or fewer workers and those in operation for less than three years will be excluded from the mandate.

The amount automatically deferred each year will range from 3% to 10% of each employee’s pretax earnings. After the first year, this will increase by 1% annually until it reaches 10% to 15% of pretax earnings.

The SECURE 2.0 Act relaxes 401(k) plan participation criteria for part-time employees.

Starting in 2025, part-time employees will qualify to participate in a retirement plan once they’ve worked at least 500 hours for two consecutive years. Under existing law, part-time workers must meet the 500-hour threshold for three consecutive years.

The SECURE 2.0 Act mandates Roth catch-up contributions for high earners.

Beginning in 2026, catch-up contributions to employer retirement plans for employees aged 50 or over who earn more than $145,000 annually must be contributed on an after-tax basis to a Roth account.

The SECURE 2.0 Act allows penalty-free withdrawals to pay long-term care premiums.

Also beginning in 2026, withdrawals of up to $2,500 per year from an employer-sponsored retirement plan can be used to pay premiums on qualified long-term care contracts.

The SECURE 2.0 Act establishes a Saver’s Match.

The current “Saver’s Credit” program allows those meeting lower income thresholds to claim a tax credit for contributions made to an employer retirement plan or IRA. This credit will be replaced by a “Saver’s Match” beginning in 2027.

The match will equal up to 50% of the first $2,000 contributed by an individual to a retirement account each year, or up to $1,000 (or $2,000 for married couples filing jointly). This will be a federal matching contribution deposited into the saver’s traditional retirement account.

The SECURE 2.0 Act raises the starting age for RMDs.

In 2033, the threshold age that determines when individuals must begin taking RMDs from traditional IRAs and employer sponsored retirement plans will increase from 73 to 75.

Consider the effect of SECURE 2.0 Act on your own retirement plan

The SECURE 2.0 Act will change the rules around retirement savings and retirement plan distributions over the next few years. However, these provisions can be complex, so you may want to connect with a financial professional to understand how it affects your retirement situation.

Review the details of your employer-sponsored retirement plan to see if your employer has elected to add any of the optional provisions of the SECURE 2.0 Act. If any apply to your situation, a financial professional can help you review your current strategy and discuss which adjustments may be most beneficial. You may also wish to consult with your tax advisor to understand the potential tax ramifications of any decisions you make.

Learn how we can help you plan for retirement.

Tags:

Explore more

IRA and 401(k) withdrawal rules

Qualified retirement plans like IRAs and 401(k)s benefit from tax breaks, but you must follow the withdrawal rules to make sure you aren’t penalized instead.

Your vision for retirement starts with a clear plan.

Our planning services and professional guidance can help you work toward a more secure and fulfilling retirement.