Key takeaways

Where you plan to live in retirement is as important as when you plan to retire.

You should start planning for your retirement location up to 10 years before you retire.

Financial factors to consider include cost of living, taxes, housing and insurance costs.

Many people put a lot of thought and planning into when they will retire, whether it’s at a certain age or on a particular date. But it’s just as important to think about where you will live after you retire.

Determining where to live in retirement is a highly personal decision that’s different for every couple or individual. Several factors go into this decision, from lifestyle and family considerations to the tax and financial implications of living in a particular state. There are even more factors to consider if you’re thinking of retiring abroad.

Let’s take a look at choosing where to retire in the U.S.

Where to retire: Make a retirement bucket list

According to Rachelle Tubongbanua, senior vice president and managing director with U.S. Bank Private Wealth Management, couples and individuals should start by making a “bucket list” of all the things they think they’ll want to do in retirement. “This will go a long way toward helping you decide the best place to retire,” she says.

For example, if you enjoy the outdoors, you might want to live in an area with a mild year-round climate. If you plan to travel, you might choose an area that’s convenient to an international airport. And if you enjoy the arts, theater and music, you should probably focus on metropolitan areas with vibrant art and entertainment scenes.

“You might need to plan on much higher homeowner’s insurance premiums in states with a high risk of natural disasters like hurricanes and earthquakes.”

Rachelle Tubongbanua, senior vice president and managing director, U.S. Bank Private Wealth Management

“Sometimes I tell clients to consider college towns as places to retire,” says Tubongbanua. “These are usually lively communities with lots of things going on.”

Proximity to family and friends is often another important factor in choosing a retirement location, especially if you want to spend time with your adult children and grandchildren. Moving to a new city later in life without a support system can be isolating and negatively affect your physical and mental health.

Tubongbanua encourages clients to plan for the long term when thinking about where to live in retirement. “Your health will change throughout the course of your retirement,” she says. “As you age, you might not be able to do some of the things you can in your early retirement years, so factor this into your decision.”

Where to retire: Research the cost of living

Finances will play a big part in where you live during retirement, starting with the cost of living. This includes cost variations for things like housing, taxes, food, healthcare and other common expenses.

The cost of living in New York City is more than two times higher than national average, for example, while the cost of living in Dactur, Ill. is more than 20% below the national average, according to the 2024 Cost of Living Index.

“Your retirement income may be fixed, so you must plan carefully to make sure it’s enough to meet your living expenses throughout the course of your retirement,” says Tubongbanua. Do some research on the following cost of living factors in any area you’re considering living in during retirement.

Housing

The average cost of a home varies widely from one part of the country to another. If you can buy a home in an area for less money than where you live now, this could help stretch your retirement budget further. On the other hand, if a home in another area or state is going to cost more than where you live now, it could put a strain on your retirement budget, so you’ll need to plan for that.

Taxes

It’s critical to look at the tax situation in any area you’re considering moving to, because pension and Social Security income is taxed differently in different states. States also differ widely in terms of sales, property, estate and inheritance taxes. Florida, Georgia and Nevada are generally considered among the most tax-friendly states for retirees, while California, Connecticut and Vermont are generally considered among the least tax-friendly states for retirees.

Insurance

Insurance costs may be vastly different from one part of the country to another. This includes homeowners, health and car insurance. “You might need to plan on much higher homeowner’s insurance premiums in states with a high risk of natural disasters like hurricanes and earthquakes,” says Tubongbanua. The same goes for car insurance premiums in big cities, where traffic accidents are more likely.

Everyday living expenses

You’ll likely pay more for things like groceries, gasoline, utilities, restaurants and entertainment in some areas of the country than others. “Some clients I talk to haven’t thought about how much variations in these prices will affect their retirement budget,” says Tubongbanua. “So do some research to understand how these prices might differ from what you’re used to.”

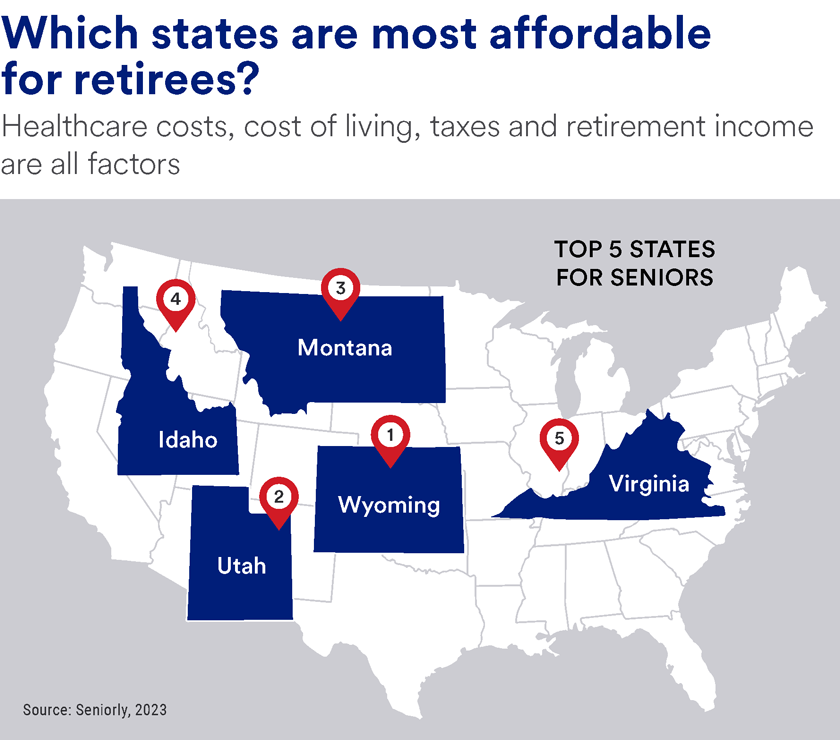

Best places to retire by state

Seniorly analyzed eight financial metrics (cost of living index score, average retirement income, housing costs, utility costs, senior poverty rate, average annual Medicare spend per beneficiary, average annual cost for home health aide, and tax-friendliness for retirees) to determine the most affordable states for retirees.

Here are the top 5:

1. Wyoming

- Average retirement income: $34,287

- Average annual Medicare spending per beneficiary: $10,274

- Tax-friendliness for retirees: Most tax friendly

2. Utah

- Average retirement income: $32,732

- Average annual Medicare spending per beneficiary: $10,664

- Tax-friendliness for retirees: Mixed

3. Montana

- Average retirement income: $32,585

- Average annual Medicare spending per beneficiary: $9,338

- Tax-friendliness for retirees: Mixed

4. Idaho

- Average retirement income: $28,981

- Average annual Medicare spending per beneficiary: $9.948

- Tax-friendliness for retirees: Most tax friendly

5. Virginia

- Average retirement income: $37,634

- Average annual Medicare spending per beneficiary: $10,622

- Tax-friendliness for retirees: Tax friendly

Where to retire: Plan your retirement location far in advance

Tubongbanua recommends that clients start thinking about where they might want to live up to 10 years before their planned retirement date. “Then, between three and five years before retirement, start narrowing down possible areas and spending time there to get to know them,” she says. Some of her clients have bought vacation or second homes in areas they’re considering to get a feel for what it would be like to live there.

Determining where to retire in can be complicated. Learn how we can help put you on the path to the retirement you’re dreaming of.

Tags:

Explore more

Retiring abroad: Financial factors to consider

Retiring abroad can bring plenty of benefits, but you also need to consider differences in healthcare, homeownership and taxation before you make the move.

Your vision for retirement starts with a clear plan.

Our planning services and professional guidance can help you work toward a more secure and fulfilling retirement.