Key takeaways

There are pros and cons to retiring overseas. Some countries offer Americans a lower cost of living and a change of pace, but culture shock and distance from support networks can be challenging.

Financial considerations to keep in mind include residency requirements, how you’ll pay for healthcare and buying vs. renting a home.

If you decide to retire abroad, it’s smart to work with a financial advisor and a tax expert who specializes in overseas taxation.

One of the biggest decisions you must make before retiring is where you will live. You might decide to stay right where you are, or maybe you want to move to a different part of the country to be closer to kids and grandkids or live a different lifestyle.

But what if you want to live outside the U.S. after you retire? About 450,000 people living outside the U.S. received Social Security payments in 2021, up from 307,000 people in 2008. That number could be higher, however, as not all retirees living abroad receive Social Security payments.

The pandemic saw an increase in overseas retirements, as it motivated many people who had dreamed of retiring overseas to live out their dreams.

Pros and cons of retiring abroad

There are potential benefits, as well as challenges, to retiring oversees, says Rachelle Tubongbanua, senior vice president and managing director, U.S. Bank Private Wealth Management.

“Many retirees want a change of pace or scenery, along with new experiences, and retiring abroad can provide this,” she says.

Among the pros of retiring abroad is a lower cost of living, including lower healthcare expenses and financial incentives, to U.S. expats who move there. These include Portugal, Costa Rica and Panama. The latter’s Pensionado program is one of the most popular among overseas retirees.

But retiring abroad can present some people with culture shock, especially if they haven’t spent much time in their new country.

“Many retirees want a change of pace or scenery, along with new experiences, and retiring abroad can provide this.”

Rachelle Tubongbanua, senior vice president and managing director, U.S. Bank Private Wealth Management

“There’s a big difference between visiting a country on vacation and moving there,” says Tubongbanua. Language barriers and being away from their family and support system are other challenges overseas retirees often face, along with political and economic instability in some parts of the world.

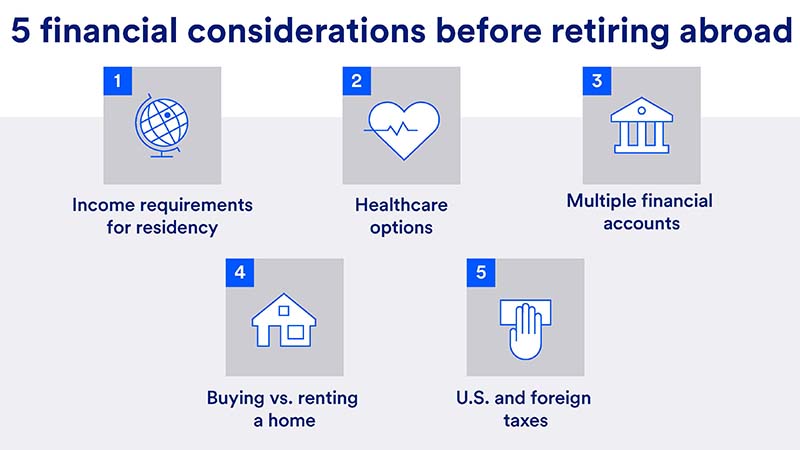

Five considerations for retiring abroad

Here are five things to think about and plan for if you’re considering retiring overseas.

1. Residency requirements.

Every nation has its own residency requirements, but many countries have been relaxing theirs to attract more expats. For example, Belize offers residency to U.S. citizens who are 45 years of age or older and have retirement income of at least $2,000 per month, while Panama only requires a valid U.S. passport and retirement income of $1,000 per month. Portugal, Italy, Greece, France and Spain offer generous retirement visas with modest income requirements.

2. Healthcare options.

Medicare generally doesn’t cover medical care delivered outside the U.S., so it’s critical to figure out how you’ll pay for healthcare if you retire abroad. One option is to simply pay out of pocket for medical expenses, especially if costs are relatively low where you move. You could also purchase a hospital insurance plan that covers all healthcare provided at a specific hospital, or an international policy that offers broader coverage, including access to more doctors and hospitals.

Tubongbanua says you can qualify for government-sponsored healthcare in countries that offer it once you have established residency there. “This is one thing that’s attracting many retirees to Europe right now,” she says. “However, I encourage clients to retain Medicare in case they ever move back to the U.S. or want to come back here for a major procedure.”

3. Financial accounts.

Tubongbanua recommends maintaining bank accounts both in the U.S. and the country where you retire. “This way, you can have Social Security and other retirement distributions direct deposited into your U.S. bank account and use your local account to pay your bills,” she says. Keep in mind that some countries require expats to open a local bank account to establish residency. Also, the Foreign Account Tax Compliance Act (FATCA) requires foreign banks to report assets held by certain U.S. citizens to the IRS.

4. Buying vs. renting a home.

It’s usually wise to rent instead of buy a home when first moving to a new country so you can get a feel for the new area before making a long-term commitment. Also, overseas real estate tends to be more expensive and more difficult to buy. That’s why Tubongbanua stresses working with a local expert if you plan to purchase a home overseas. “Home ownership is very different in most other countries than it is here,” she says.

5. Navigating taxes.

As long as you retain your U.S. citizenship, you must pay federal taxes (and perhaps taxes to your former state) even if you retire overseas. The Foreign Earned Income Exclusion helps prevent double taxation by allowing U.S. expats to exclude wages and salaries (up to a certain threshold) earned overseas from U.S. taxes. The exclusion doesn’t apply to Social Security, pension or retirement investment income.

Tubongbanua notes that some countries tax withdrawals from Roth accounts, though the U.S. government doesn’t tax them if you’re over age 59½ and have owned the account for at least five years. “This can get complicated, so it’s important to work with a tax expert who specializes in overseas taxation,” she says. American Citizens Abroad offers an online Expat Tax Services Directory to help Americans who retire overseas.

Approach retiring abroad like you would any major financial decision

Retiring overseas is a big decision that requires lots of careful thought and planning—but the rewards can be great. “Make sure you have your eyes wide open and perform all your research and due diligence before making a move like this,” says Tubongbanua.

Working with a financial advisor can help you untangle any financial challenges to retiring abroad, allowing you to enjoy your post-work years in the location of your dreams.

Learn how our approach to financial planning can help you plan and prepare for the retirement you want.

Tags:

Explore more

How to plan for retirement

You probably have big dreams for retirement. That’s why comprehensive retirement income planning – for the short, medium and long term – is so important.

Your vision for retirement starts with a clear plan.

Our planning services and professional guidance can help you work toward a more secure and fulfilling retirement.