Why use U.S. Bank online Bill Pay?

Save money.

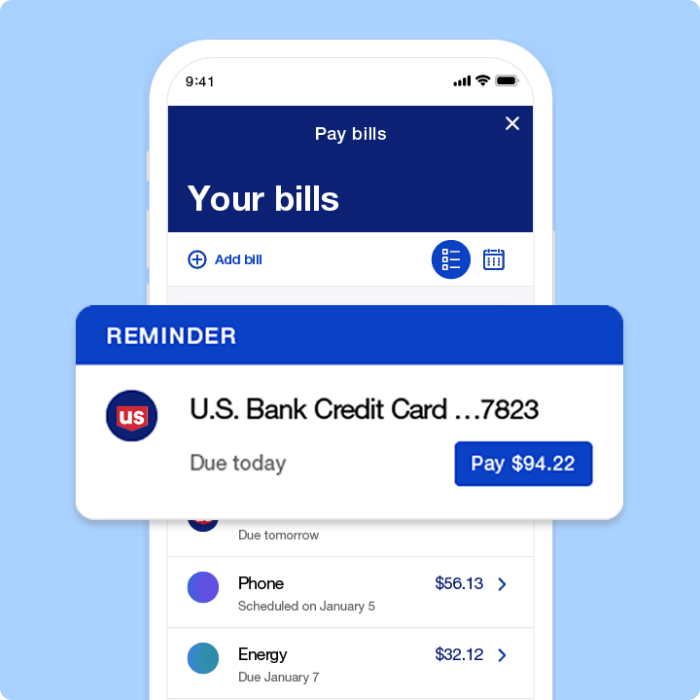

Avoid incurring late fees. Bill Pay makes it easy to see and manage due dates.

Save time.

Manage all your U.S. Bank payments and external bills through one app.

Gain insights.

Track your bills and monitor trends. Bill Pay gives you quick access to your payment history.

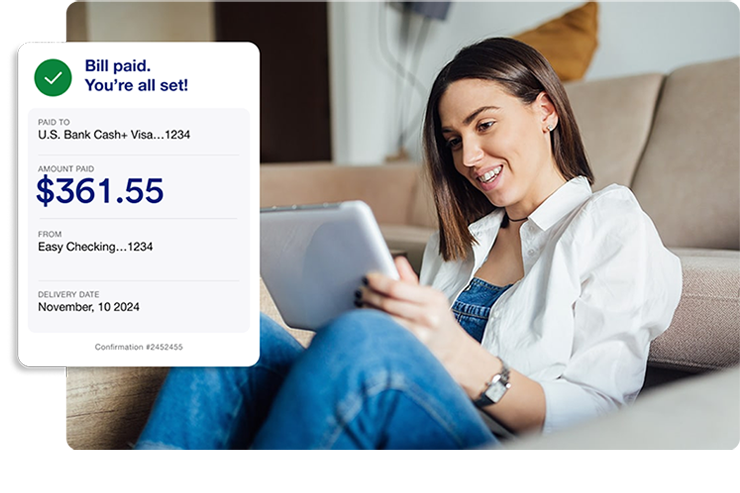

Feel confident.

Know your payments will be securely delivered by the payment date you select.

Get started with Bill Pay.

Set up takes just a few short minutes. We’ll find the bills you’re already paying. Adding new ones is a snap. Let us show you how.

Frequently asked questions

General Questions

When you pay your bills from your account in mobile and online banking, we send the payments directly to your billers. Most payments are made electronically because that’s how most billers are set up to receive them. For billers that don’t accept electronic payments, we send a paper check via U.S. Mail.1

You can pay almost any biller with a U.S. mailing address. For billers that don’t accept electronic payments, including people, we send a paper check.1

We send electronic payments to billers that accept them. For companies that don't accept electronic payments, we send a paper check by U.S. Mail, which takes more time to deliver and process.

You can determine which type of payment will be sent based on the available payment dates displayed in the scheduling calendar when you set it up. If your first available payment date in the scheduling calendar is:

- Two business days away or sooner – the payment will be sent electronically.

- Five business days – the payment will be sent via paper check.

No. There is no limit to the number of bills that can be paid with Bill Pay.

No, currently it is not possible to pay bills using a credit card in U.S. Bank Bill Pay.

Features & Benefits

Bill Pay is free when you use the standard delivery option. If you need to send a payment faster, you can use expedited delivery2 for a fee of $14.95 to send it on the same day or overnight (for most billers).

Yes. You can set automatic payments for weekly, bi-weekly, monthly, quarterly, bi-annually and annually. Additionally, you can set them to recur indefinitely, and you may change the terms of the autopay at any time.

No. After a payment is set up, the biller will receive a payment just like they would from you. Be sure to double-check that you’ve entered the correct account number and a current address.

Electronic bills

Digital bills are electronic versions of your paper bills and are available from hundreds of companies. If you choose to receive digital bills, they are sent securely to your account in online and mobile banking instead of through the mail.

In the U.S. Bank Mobile App:

- After you set up a biller, select that biller from the Pay bills dashboard.

- On the Bill details page, select the Digital bills option (displayed only if digital bills are available for the biller) and follow instructions to set up.

In online banking:

- After you set up a biller, select that biller from the Pay bills dashboard.

- Choose the Digital bills option in the right sidebar and follow the instructions to set up.

In the U.S. Bank Mobile App:

If a digital bill is due, you’ll see the amount due and due date displayed below the biller on the Pay bills dashboard. You can also select this bill from the Your bills page to view the biller in Bill details. Here, you’ll also be able to see if you have a digital bill due.

In online banking:

If a digital bill is due, you’ll see the amount due and due date displayed next to the biller on the Your bills page. You can also select this bill from the Your bills page to view the biller details on the right-hand side. Here, you’ll also be able to see if you have a digital bill due.

Bill Pay timing

We recommend setting up payments at least five days before the due date to allow enough time for the biller to process and post the payment to your account.

There are two options for delivery:

- Standard delivery: Standard delivery is available for all billers, and payments can usually be made within 1 to 2 business days for electronic delivery, or 5 to 6 business days for a paper check. There is no charge for standard delivery. The calendar will automatically display the earliest standard delivery payment date available. You can choose that date or schedule another. The date must be a business day.

- Expedited delivery: For most billers, we offer expedited delivery 2 for a fee of $14.95. With expedited delivery, your payment will be made on the same day or overnight, depending on when you submit it and the biller’s cutoff time. If express delivery is available, you’ll find this option when choosing a payment date in the calendar.

This can happen occasionally when a payment is made by a paper check. The paper check is placed in the mail up to five business days prior to the payment date to ensure it’s delivered and processed on time. Some billers process the check as soon as they receive it, which results in an earlier payment. If you incur any fees due to a payment that clears earlier than you planned, please contact us at 800-987-7237.

Most scheduled payments are sent electronically, and funds are withdrawn from your account on the payment date you select. If we send a check, the money is usually withdrawn when the biller cashes the check. If you incur any fees due to a payment that clears earlier than you planned, please contact us at 800-987-7237.

Most types of payments are guaranteed. Exceptions include payments for taxes, court orders, stocks, investments and bonds. All others are guaranteed. We guarantee the payments are accurate and delivered by the payment date you select, assuming: your accounts are sufficiently funded, all payment information is entered correctly, and the payment is scheduled to arrive by its due date.

For standard delivery payments, we recommend that you log in at least five business days before your bill is due to schedule your payment. (This does not mean you need to pay your bill ahead of its due date, only that you should set up the payment enough in advance to arrive by the due date.)

Here's why:

- For billers that require payment by paper check, we need up to five business days’ notice to process and mail the check.

- You can be sure the due date you choose is available by setting up your payment in advance.

Note: Some billers process paper checks as soon as they receive them, which can result in an earlier bill payment than you requested. If you incur any fees due to a bill payment that is processed earlier than you requested, please contact us at 800-987-7237.

Canceling, changing or questions about payments

In the U.S. Bank Mobile App:

- Select Pay bills & transfer from the quick-action menu at the bottom of your Accounts dashboard, then select Pay a bill.

- On the Your bills screen, find the biller whose payment you wish to cancel or change and select it.

- On the Bill details screen, select the upcoming payment you wish to cancel or change.

- Make your desired changes on the Edit payment screen, then select Save.

In online banking:

- Select Bill payments at the top of the page, then Pay bills & U.S. Bank accounts.

- On the Your bills screen, find the biller whose payment you wish to cancel or change under SCHEDULED in the right column and select it.

- Make your desired changes on the Edit payment page, then select Save.

In the U.S. Bank Mobile App:

- Select Pay bills & transfer from the quick-action menu at the bottom of your Accounts dashboard, then select Pay a bill.

- On the Your bills screen, find the biller whose payment you wish to cancel or change and select it.

- On the Edit payment screen, select the Edit autopay link.

- Make your desired changes on the Edit autopay screen, then select Save.

In online banking:

- Select Bill payments at the top of the page, then Pay bills & U.S. Bank accounts.

- On the Your bills page, find the biller whose payment you wish to cancel or change under SCHEDULED in the right column and select it.

- On the Edit payment page, select the Edit autopay link.

- On the Edit autopayment page, you can edit just the next payment in the series or the entire series. Make your desired changes, then select Save.

If you have a question about a payment you made or believe there has been an error:

In the U.S. Bank Mobile App:

- Select Pay bills & transfer from the quick-action menu at the bottom of your Accounts dashboard, then select Pay a bill.

- On the Your bills screen, find the biller whose payment is in question and select it to view additional details.

In online banking:

- Select Bill payments at the top of the page, then Pay bills & U.S. Bank accounts.

- On the Your bills page, select the Activity tab.

- Find the payment in question in the right column and select it to view additional details.

Call U.S. Bank 24-Hour Banking at 800-USBANKS (872-2657).