Key takeaways

Short-term investments can be converted to cash in less than three years, making them useful for saving for financial goals on a shorter timeline.

They range from money market accounts, which can be accessed at any time, to certificates of deposit, which generally mature within three to five years.

A comprehensive investment strategy should include both short-term and long-term investments.

When it comes to time horizon, most investments fall into one of two broad categories: short-term or long-term investments. Each type can play an important role in a diversified investment portfolio, depending on your goals and investing timeframe.

What are short-term investments?

Short-term investments are those that can easily be converted to cash in less than three years without penalty or risk of loss, according to Rob Haworth, senior investment strategy director with U.S. Bank Asset Management.

Conversely, long-term investments are usually held in vehicles such as 401(k)s, IRAs and 529 education savings plans to meet long-term goals such as retirement and saving for college.

Short-term investments seek to strike the right balance between risk and reward. When saving money for near-term goals, you generally want to earn the highest yield while taking on the lowest risk possible.

Short-term investments seek to strike the right balance between risk and reward. When saving money for near-term goals, you generally want to earn the highest yield while taking on the lowest risk possible.

“So, the first step is to determine how soon you’re going to need the money,” says Haworth. “Based on this, you can choose the best short-term investment vehicle for your goals.”

Choosing the right short-term investing option

There are several financial goals usually considered to be short-term in nature.

- Building an emergency savings fund. It’s generally recommended that you keep between three and six months’ worth of living expenses in a short-term investment that offers maximum liquidity so it can easily be withdrawn if you need to pay for unexpected expenses, such as home or car repairs or medical bills, or in case of a job loss.

- Buying a car or other durable goods, such as furniture or appliances. Paying cash for items like these, or at least making a large cash payment up front, instead of financing them can be a smart financial move, potentially saving hundreds or thousands of dollars in interest. “The same thing goes for home remodeling and home improvement projects,” says Haworth.

- Saving for a down payment on a home. The larger your down payment, the smaller mortgage you’ll have to take out, which can save tens of thousands of dollars in interest payments over the life of the loan.

Good short-term investments for your timeframe

Here are short-term investment options to consider, based on your investing timeframe.

Timeframe: Less than one year

- Savings accounts, money market accounts and high-yield savings accounts: These offer the lowest potential yield but also the highest liquidity and safety. Funds held by FDIC-insured financial institutions are protected up to $250,000 per depositor against loss due to the institution’s failure.

- Marketable debt securities: Also referred to as short-term paper, these include U.S. Treasury bills and commercial paper. Treasury bills are issued by the U.S. Treasury Department and backed by the full faith and credit of the federal government, with maturities (investment terms) up to one year. Commercial paper is debt that corporations issue to finance short-term liabilities such as payroll and accounts receivable, with terms of less than 270 days.

Timeframe: One to three years

- Short-term bond funds: Bonds are loans made to the government or businesses. They pay fixed rates of return and are generally riskier than savings and money market accounts but safer than stocks. Government bonds, such as municipal bonds, tend to be less risky than corporate bonds, which could default if the company goes bankrupt. Bond funds can be purchased using an online brokerage account.

- Certificates of deposit (CDs): CDs pay a fixed interest rate over a specific period, generally from three to 60 months. The longer the term, the higher the interest rate. CDs issued by FDIC-insured financial institutions are protected up to $250,000 per depositor against loss due to the institution’s failure. Keep in mind that CDs offer the least liquidity of short-term investments. If you need to withdraw funds before the end of the term, you may have to pay a penalty. “Be sure you won’t need the money before the CD matures,” says Haworth.

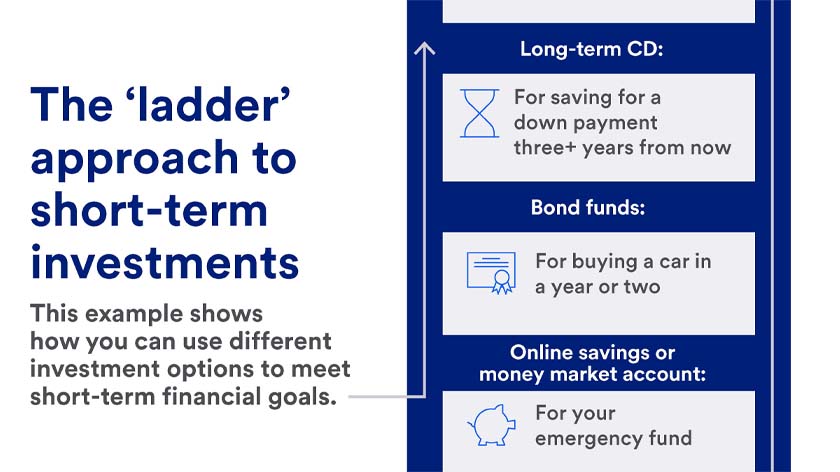

Ladder your short-term investments

Haworth recommends laddering short-term investments to maximize your return. “You probably won’t need all the money at one time, so you can spread your short-term savings out among different investment vehicles with different maturities and returns to earn higher yield,” he says. Here’s one example of laddering:

- Invest a portion of your short-term savings in an online savings or money market account so you have maximum liquidity to meet emergency needs.

- Invest another portion of your short-term savings in bond funds to fund a purchase sometime in the next one to two years.

- Invest the final portion of your short-term savings in a long-term CD to put toward a down payment on a home in three+ years.

A laddering strategy staggers your investments’ maturity dates (the ladder “rungs”) and may help reduce interest rate risk.

Help building your short-term investment strategy

Choosing the right short-term investments requires creating a comprehensive investing strategy that incorporates both short- and long-term investing.

Learn how we can help you design a financial plan that that helps you work toward your short- and long-term goals.

Tags:

Explore more

Understanding how a diversification strategy can help your investment portfolio

Diversification is a key part of risk management, with the goal to enhance and preserve your investment portfolio’s value.

Personalized investing guidance aligned with your goals.

Let us help you craft a portfolio that reflects your goals, time-horizon and values.