Key takeaways

Bonds’ steady income stream can help balance out equity fluctuations during periods of market volatility.

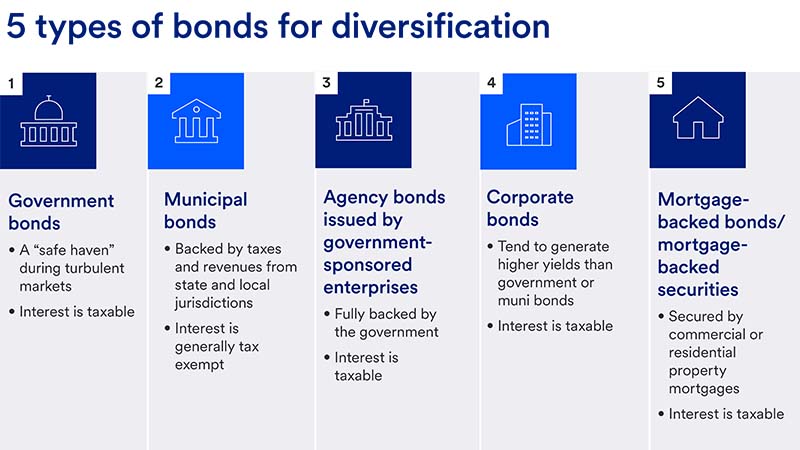

Different types of bonds, including government bonds, municipal bonds, agency bonds, corporate bonds and mortgage-backed securities, have different characteristics.

Focusing primarily on high-quality bonds can be an effective way to build a diversified portfolio.

An effectively diversified portfolio includes an appropriate mix of equities, bonds and cash. For most investors, bonds play three critical roles. They contribute to a portfolio’s total return; generate a stream of income (if that’s an investor’s objective); and provide portfolio stability during periods of market volatility. Bonds as an asset class have not historically kept pace with stock market returns, but they do typically experience less short-term price volatility.

Bonds as an asset class have not historically kept pace with stock market returns, but they do typically experience less short-term price volatility.

Here’s an overview of how to invest in bonds and a look at the different types of high-quality bonds.

For most investors, bonds play three critical roles. They contribute to a portfolio’s total return; generate a stream of income (if that’s an investor’s objective); and provide portfolio stability during periods of market volatility.

Bond risk and performance in an uncertain economy

“Bond diversification benefits are important,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “For example, in most environments, if the economy slows, interest rates tend to fall, which boosts bond prices.” That often helps “smooth the ride” for investors by mitigating some of the volatility inherent in owning equities, which typically face pricing pressure in periods of slowing economic growth.

This isn’t always the case, though. For example, a rising interest rate environment often results in lower bond prices. This is a rare circumstance when bond performance doesn’t help offset a negative turn in the stock market. “In most periods, we’ll see a somewhat opposite correlation between bonds and stocks,” says Haworth.

One rule of thumb is that a diversified portfolio should contain 60% in equities and 40% in fixed income investments. Keep in mind this is a broad guideline, and the specific mix in your portfolio should be based on your own objectives, investment time horizon and risk tolerance.

How to assess bond quality

When using bonds to diversify a portfolio, know that not all bonds are equal. “Some investors think that if they load up on high-yield bonds [which have lower credit quality but generate greater income streams], they’re diversified, but that’s not the case," says Haworth.

While high-yield bonds can add value to a portfolio, they’re often nearly as volatile as stocks, and therefore may offer less diversification value to offset equity market volatility.

Instead, high-quality bonds, including Treasury bonds and corporate debt securities, can more effectively diversify a portfolio. Bond issuers from this category of fixed-income investments are likely to see the value of their issues hold up better during times of economic uncertainty, when stocks are most susceptible to downturns.

“Quality is a measure of the likelihood of default by a bond issuer, which can include missing interest payments to bondholders or failing to repay principal when bonds reach maturity,” says Haworth.

Bond quality is measured by the issuers’ bond ratings, which are assessed by independent ratings agencies. Investment-grade bonds (those with a lower risk of default) have ratings of or above BAA (on the ratings scale used by Moody’s) or BBB (on the scale used by Standard & Poor’s or Fitch).

Types of bonds to consider for diversification

Just as there are different types of equities, there are different types of bonds, each with its own characteristics. Haworth suggests choosing from the following lower-risk options to help you diversify an equity portfolio.

What are government bonds?

Government bonds are issued by stable governments from developing economies with the powers of taxation, including the U.S., Germany, Japan and Canada. U.S. government bonds are called Treasury bonds (T-bonds).

Many turn to U.S. government securities in times of economic distress, viewing these bonds as a “safe haven.” U.S. Treasury bonds, for example, have never been subject to default. Because its taxing authority backs bond obligations, the federal government is considered the most reliable bond issuer. Treasury bond interest is taxable.

How to buy government bonds

The TreasuryDirect website, which is run by the U.S. government, is the only place you can electronically buy and redeem Treasury bonds. You can also buy these bonds in bulk through a broker or a bank or as part of an exchange-traded fund (ETF) or mutual fund.

What are municipal bonds?

Also called “muni” or “tax-exempt” bonds,” these are backed by taxes and revenues from state and local jurisdictions. Many well-funded entities have ample assets and taxing authority to back general obligation (GO) bonds. Revenue bonds issued by providers of essential services such as water and sewer facilities can be another stable option in the municipal bond category.

Yields on muni bonds are typically lower than yields on comparable Treasury or corporate bonds, because the interest paid is generally exempt from federal income taxation, and in some cases, from state taxation.

How to buy municipal bonds

You can buy individual municipal bonds through a brokerage firm or bank or invest in a pool of municipal bonds via a mutual fund or ETF. As you assess your options, you want to compare the tax-equivalent yield generated by municipal bonds compared with other types of bonds.

What are GSE-issued agency bonds?

Government-sponsored enterprises such as Fannie Mae and Freddie Mac provide credit and other financial services to the public. These bonds are now fully backed by the U.S. government, so they carry credit quality similar to U.S. Treasury debt. The interest these bonds pay is taxable.

How to buy government-backed agency bonds

You can buy individual agency bonds through a broker or bank, or you can invest in a pool of such bonds via a mutual fund or ETF.

What are corporate bonds?

To find highly rated, high-quality corporate bonds, look for well-established companies with diversified product offerings and a long track record of financial stability and success. These bonds tend to generate higher yields than government or municipal bonds, and the interest paid is considered taxable income.

How to buy corporate bonds

You can buy individual corporate bonds through a brokerage firm, bank or bond trader, or invest in a pool of corporate bonds via a mutual fund or ETF.

What are mortgage-backed security bonds?

Also known as mortgage-backed securities (MBS), these bonds are secured by commercial or residential property mortgages and can be a good choice to achieve bond portfolio diversification. These bonds, with higher-quality ratings, tend to benefit from their focus on borrowers with an ability to make timely mortgage payments.

How to buy mortgage-backed securities

You can buy individual MBS through a brokerage firm, bank or bond trader, or invest in a pool of MBS via a mutual fund or ETF.

Other considerations in building a bond portfolio

Consider conducting a risk assessment before determining how to invest in bonds for diversification. For example, if your goal is to generate higher yields, you must be willing to accept more risk.

Before investing in bonds or any other asset class, review your portfolio strategy with a financial professional. Consider your investment time horizon, financial goals and desired level of risk. And remember that your long-term goals shouldn’t change just because the market is dealing with short-term volatility. As always, investing is a long-term game.

Learn about our approach to investment management.